Exclusive Funds Europe/Caceis research among 250 asset owners and professionals reveals how ETFs have become an essential part of asset allocators’ toolkits. As well as being a low-cost way to track indices, our survey finds ETFs also being used for other purposes.

Since they launched in the early 1990s, exchange-traded funds (ETFs) have revolutionised the asset management industry. Their low fees, simple structure, greater transparency, highly liquid characteristics and ease of trading have made them firm favourites with investors of all stripes over the years.

Having gained much popularity initially for being able to track indices cheaply, these products have evolved over the years to offer investors a wide range of asset classes and strategies to choose from. Whether factor-based, thematic, leveraged or, more recently, actively managed, investors can find strategies that can fit into almost any portfolio.

Funds Europe research, in partnership with CACEIS, the asset servicer, finds ETFs remain an important tool for asset allocators. The findings are from the first part of a report entitled ‘Reshaping Investment: Tokenisation, ETFs and Sustainability’, based on survey results to be serialised in Funds Europe and published in full later this year.

Funds Europe research, in partnership with CACEIS, the asset servicer, finds ETFs remain an important tool for asset allocators. The findings are from the first part of a report entitled ‘Reshaping Investment: Tokenisation, ETFs and Sustainability’, based on survey results to be serialised in Funds Europe and published in full later this year.

“Cheap index tracking might be reductive, but it is still one of the biggest reasons that asset owners like these products. However, the popularity of ETFs for transition management shows how sophisticated and adept they have become at wielding these products.”

We asked more than 250 asset owners, investment consultants, family offices and sovereign wealth funds from all over Europe to give their opinions on how they are approaching three key areas shaping the future of asset allocation: digital assets and tokenisation; ESG and sustainability; and ETFs.

French appetite

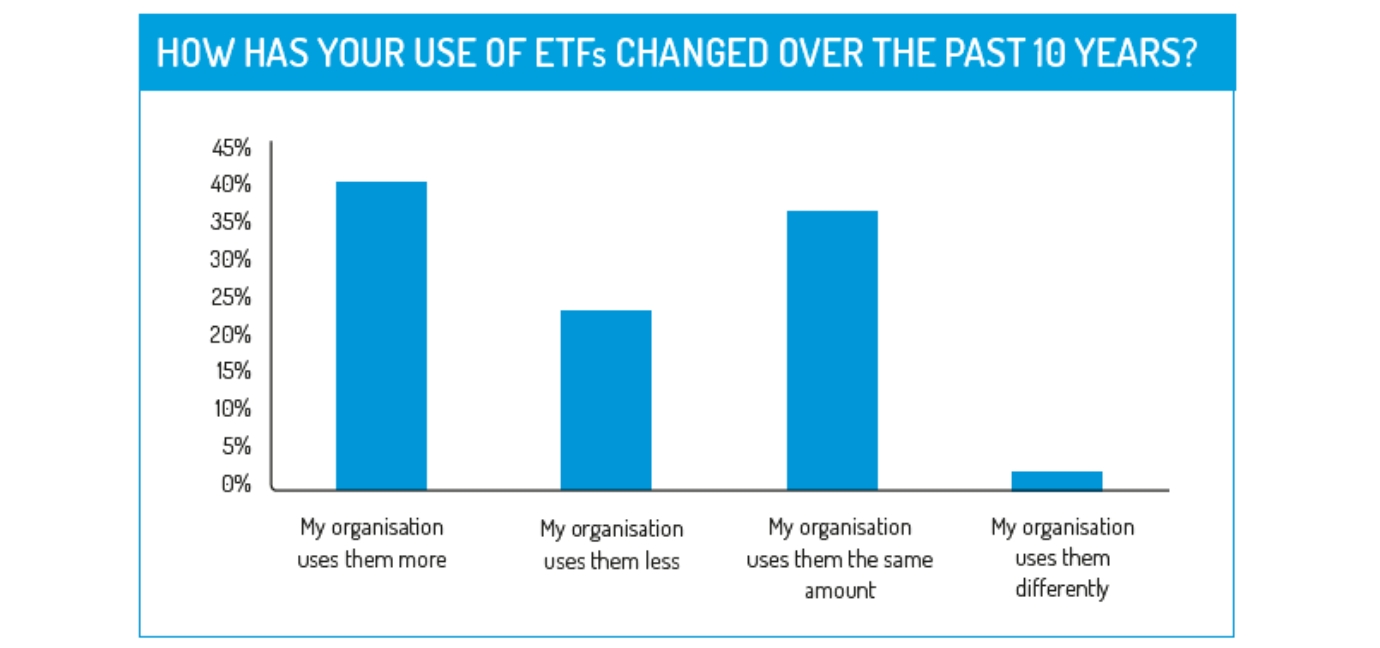

Compared with ten years ago, 39.6% of respondents said they now make more use of ETFs in their portfolios, while 35.4% continue to use the same amount. Not everybody uses them just as much, however, with 23.1% reducing the volume of ETFs in the portfolio over the past decade.The survey found the greatest increase in enthusiasm among French respondents, with 60.4% of this cohort expanding their use of ETFs compared with a decade ago. Approximately half of German and UK respondents also now use ETFs more than did ten years ago.

There has been a wide range of reasons for the changing use of ETFs over the past decade. Many respondents highlighted ETFs’ transparency and low costs as key reasons for including them in their portfolios.

There has been a wide range of reasons for the changing use of ETFs over the past decade. Many respondents highlighted ETFs’ transparency and low costs as key reasons for including them in their portfolios.

“ETFs’ ability to provide greater diversification and help reduce risk is well understood by respondents.”

Some respondents said ETFs have helped them to reduce risk in their investment portfolios by increasing the diversity and liquidity of their holdings, which has been particularly important during volatile market conditions. Additionally, the growing range of assets and strategies mean respondents have also been able to construct portfolios from a variety of ETFs.

Transition management

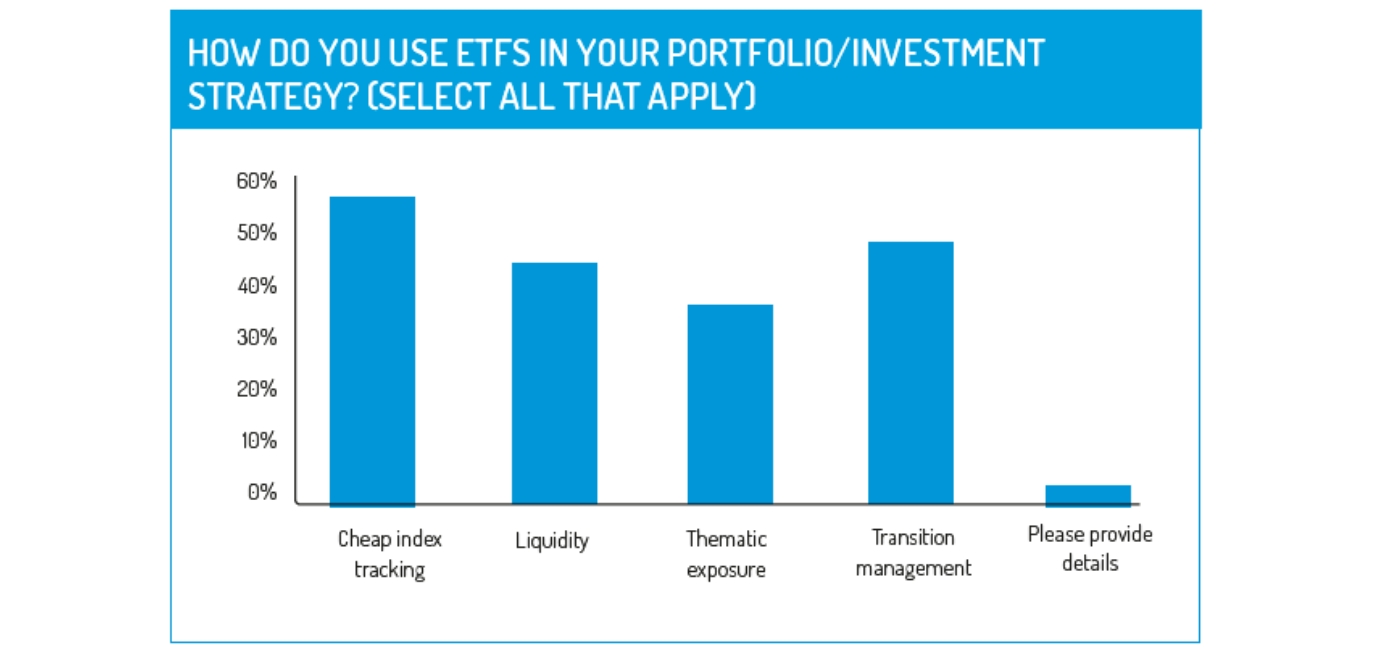

ETFs have traditionally been used for their ability to replicate the performance of indices, providing a cheap source of beta exposure; it remains a key feature of portfolios. But they are increasingly using ETFs in other ways too. Almost half (47.3%) of respondents have used ETFs as an aid for transition management, due to their tradability and scalability, facilitating the move to a new manager or strategy more easily. Liquidity is also a key reason for their inclusion in portfolios, highlighted by 44.2% of respondents.

There is clearly a split between respondents based in different European countries when it comes to their use of ETFs.

Dutch and Swiss respondents were the most enthusiastic users of ETFs for cheap index tracking and transition management. French and UK respondents were more likely to use ETFs for liquidity and thematic exposure. German respondents, meanwhile, reported using ETFs predominantly as cheap index trackers and for liquidity purposes.

Dutch and Swiss respondents were the most enthusiastic users of ETFs for cheap index tracking and transition management. French and UK respondents were more likely to use ETFs for liquidity and thematic exposure. German respondents, meanwhile, reported using ETFs predominantly as cheap index trackers and for liquidity purposes.

Swiss and Dutch respondents are heavy users of ETFs for passive exposure, with 44.7% and 42.9% respectively using ETFs for over half of their allocations. However, UK and German respondents were the lightest users of ETFs for passive exposure, opting to spread their allocation across other products.

“ETFs are part of investors’ investment strategy for various reasons,” said Gilles Dubos, senior expert in CACEIS’ ETF division. “Cheap index tracking might be reductive, but it is still one of the biggest reasons that asset owners like these products. However, the popularity of ETFs for transition management shows how sophisticated and adept they have become at wielding these products.”

“ETFs are part of investors’ investment strategy for various reasons,” said Gilles Dubos, senior expert in CACEIS’ ETF division. “Cheap index tracking might be reductive, but it is still one of the biggest reasons that asset owners like these products. However, the popularity of ETFs for transition management shows how sophisticated and adept they have become at wielding these products.”

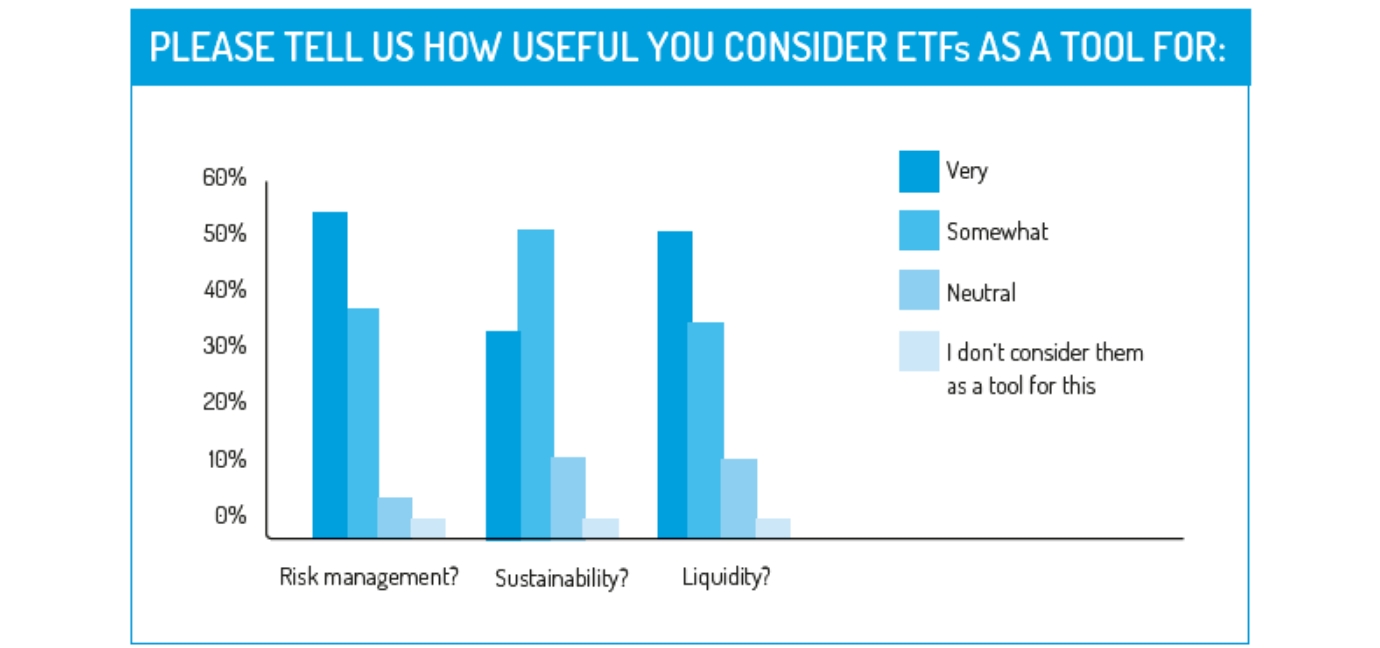

For respondents, the unique attributes of ETFs make them an effective tool for managing several aspects of their portfolios. An overwhelming majority (91.5%) of respondents said ETFs are an effective tool for risk management. Moreover, a high proportion of respondents said ETFs can be useful tools for helping to implement their sustainability strategies and manage liquidity.

Liquidity is a key feature of ETFs and one of the reasons for their rising popularity over the years. This aspect of ETFs has been brought into greater focus in recent years, following the pandemic-induced volatility in markets and the LDI crisis in the UK. Indeed, liquid instruments such as ETFs have helped pension funds weather some of the most challenging market conditions since the Global Financial Crisis.

“ETFs’ ability to provide greater diversification and help reduce risk is well understood by respondents,” said CACEIS’ Dubos. “These types of strategies, where you have exposure to an entire index, market or theme, provide a more secure investment vehicle than investing in one security.”

“Lower transaction costs”

Another reason for ETFs’ strong growth and enduring popularity has been the low costs associated with the structure.

Costs have been brought into greater focus in recent years, as pension trustees are being pushed to demonstrate how they deliver value for money. As such, more schemes are looking to ETFs to provide lower-cost exposure to markets, sectors and themes.

“These types of strategies, where you have exposure to an entire index, market or theme, provide a more secure investment vehicle than investing in one security.”

Respondents overwhelmingly (89.62%) said ETFs offer value for money, praising their lower costs in comparison with other types of investment products.

“ETFs bring greater transparency and lower fees,” said one respondent to our survey. “The transaction and holding costs of ETFs are usually low because they do not need to trade frequently and rebalance like other funds.”

© 2023 funds europe