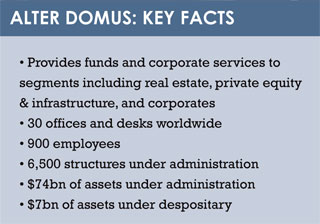

Fund administration firm Alter Domus held its inaugural client conference to explain how fund professionals are adapting to a changing world.

Requests for more regulatory and industry updates from clients prompted Alter Domus, the fund administration firm, to hold its first client forum in April.

Laurent Vanderweyen, the firm’s chief executive, said the London conference was triggered by a client satisfaction survey in 2015, which identified a need for customers, such as fund management firms, to hear more about key trends affecting their businesses.

Laurent Vanderweyen, the firm’s chief executive, said the London conference was triggered by a client satisfaction survey in 2015, which identified a need for customers, such as fund management firms, to hear more about key trends affecting their businesses.

Consequently, Alter Domus, which was founded in 2003, drew up an agenda that covered business operating models, and how the roles of industry professionals are changing. Over 120 people participated in the morning conference, hearing news and views from their industry peers and from Alter Domus’s own experts.

Robert Brimeyer, the firm’s chief operating officer, took part in a panel entitled ‘Optimal operating models in a changing world’, which considered facts such as balancing substance with efficiency in outsourcing, and addressing the challenges of new asset classes and jurisdictions.

Other panel participants included Jamie Lyon, the chief financial officer and COO of LaSalle Europe, and Larry Christensen, Chief Financial Officer of Heitman.

Karen Sands finance director of Hermes GPE and Kevin Early, finance director of Ares Management, were amongst those that took part in the second of the two morning panels that looked at the changing role of the CFO,COO and legal counsel.

Ric Lewis, the chief executive of Tristan Capital Partners, an international real estate investment management firm, was the keynote interviewee, who talked about how he used outsourcing so that Tristan would keep its character as a boutique, despite the level of asset growth.

For Lewis, the concept of a boutique firm does not equate with the size of assets it manages; instead it describes a business’s corporate culture.

The event was held at Café Royal on Regent Street.

Mr Vanderweyen said that over the course of a morning session, followed by lunch, participants had the opportunity to exchange best practices and discuss the important and relevant issues that they face today.

He said that other topics clients had wanted to hear about, and which were covered, included the leveraging of new technology and the changing role of fund boards in the new regulatory environment for alternative funds in Europe.

In his closing remarks, Mr Vanderweyen said: “A large part of our success in recent years has been in offering what we like to refer to as our ‘Vertically Integrated’ solution – essentially providing our clients with the benefits of a single provider,

from fund through holding structure, down to local entities across the multiple jurisdictions we operate in.

“We are proud of our track record of growth, starting in Luxembourg with 60 staff in 2003, to 18 offices across four continents and over 900 professionals today. This could not have been achieved without your confidence and support over the years, and as our valued clients we thank you for this.”

©2016 funds europe