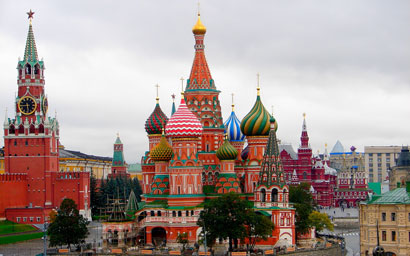

The election of Donald Trump is still impacting fund flows with emerging markets seeing redemptions – apart from emerging Europe markets owing to increased sentiment towards Russia.

Europe, Middle East and Africa equity was the only major group to see inflows “thanks to the improved sentiment towards Russia” as relations between Russia and the US are expected to increase including the repeal of economic sanctions, said EPFR Global, which tracks fund flows.

Russia equity funds recorded their biggest inflow since the first quarter of 2015 and global emerging market (GEM) equity funds’ exposure to Russia is at a 27-month high.

EPFR said redemptions from emerging markets equity funds were “within striking distance” of $8 billion (€7.6 billion) during the third week of November.

Retail investors accounted for a third of the outflows and institutional investors the rest.

The GEM equity funds category lost the most in cash terms and Latin America equity saw the largest in terms redemptions in terms of percentage of their assets under management.

But GEM fund allocations for Brazil were increasing and at the highest level since the end of 2014. EPFR said this was not down to reforms in the country, but due to the “lingering recession that has chopped over 7% off Brazil’s GDP and an inflation rate still north of the central bank’s target ceiling”.

EPFR’s headline finding for the third week of November was that investors continued, though at a slower pace, to put money into fund groups that expected to benefit from the reflationary policies that Trump promised. Investors are rotating out of funds with fixed income and emerging markets mandates into US equity and sector funds.

©2016 funds europe