Funds Europe pulls out some of Ireland’s key fund figures.

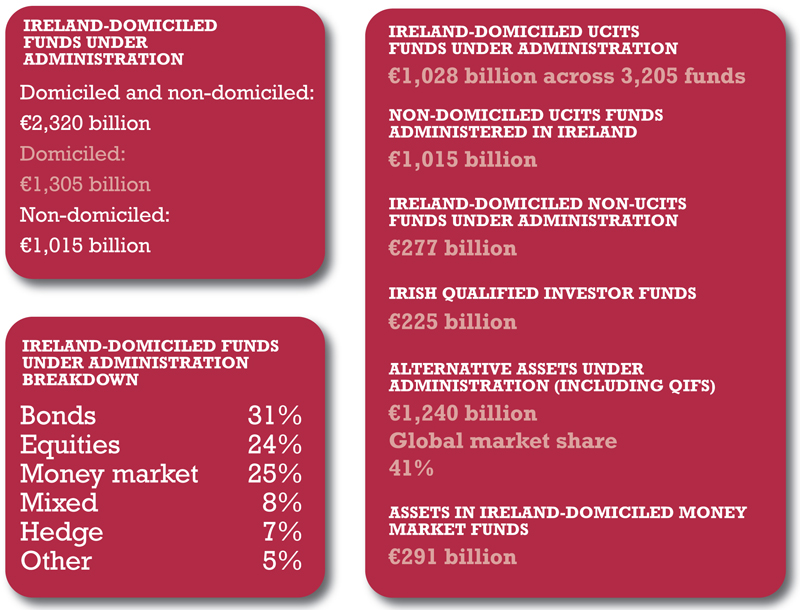

A notable point about Ireland’s funds industry as it races towards the new regime for regulated alternative funds is that the number of Qualified Investor Funds rose significantly after the Alternative Investment Fund Managers Directive was proposed. There were 1,115 funds in 2008 and 1,732 funds at the end of March 2013. Assets in the same period went from €94 billion to €225 billion.

Growth in the number of Ucits funds has also been faster than anywhere else in recent years.

In 2012 assets of Ireland-domiciled investment funds passed the €1 trillion mark for the first time – up 40% from the end of 2009. Total assets under administration passed the €2 trillion mark for the first time. All figures at March 2013.

©2013 funds europe