The UK is a tough market to enter, but Angelique Ruzicka speaks to asset managers that have found their way into the retail and institutional worlds. She also finds out where investors are looking to allocate funds

The UK practically invented 21st-century investment management, at least in Europe. A mixture of severe underfunding in the country’s pension schemes, and a subsequent influential government-backed review of institutional investment in 2001, paved the way for the UK to diversify away from its massive holdings of long-only domestic equities and into new asset classes, new strategies and a wider spread of geographies.

Virtually any type of investment started to pop up on the menus for UK investors, particularly pension schemes, and in turn this opened up a wide doorway through which foreign firms could gain entry. Pioneer Investments, for example, which is owned by Italy’s UniCredit bank, saw this opportunity and entered the market through the acquisition of a hedge fund.

Ken Livingstone, the mayor of London, says the city is the biggest fund management centre globally, managing almost half of Europe’s institutional equity capital worth $5.50 trillion (e3.74 trillion). In addition, around 56% of global foreign equity and 70% of Eurobonds are traded in London. According to the Investment Management Association (IMA), the local trade body, funds under management in UK-domiciled investment funds were £462.3bn (E614.2bn) in November 2007, a fall of 4% from October, but 16% higher than in November 2006.

Crowded and competitive

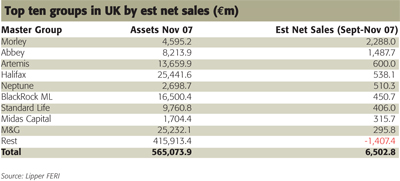

But how penetrable is the UK for foreign asset management companies? Unfortunately, gaining access to the UK and its retail and institutional investors is by no means an easy task. The UK has a reputation for being a tough place to enter; it’s crowded and competitive. As an illustration, the table on p14 shows that the majority of companies with the best fund sales over the last quarter (up to November 2007) were UK asset management firms. Only one foreign firm made it to the top ten: BlackRock ML from the US, which gained entry through acquisition.

Richard Wilson, UK retail marketing director of New Star, a UK asset manager, says: “If you look at the companies that sell in volume quite a lot of those are well established UK groups like Invesco Perpetual, Artemis, ourselves and Jupiter. Most people in the UK would recognise the brand in front of them from the UK and perhaps Fidelity as the top sellers. If you have good UK performance and you are a UK company then that helps.”

In addition to fighting the local competition, there is also the layer of third-party advisors to impress. In the UK, intermediaries are strongly established. Independent financial advisors (IFAs) act as gateways for many retail investors, while investment consultants act for institutions. Wilson says: “At the end of the ‘90s companies with good performance could sell direct but since the tech bubble burst we’ve had a big change in the distribution landscape. Life companies have become big distributors of asset managers in the UK and so lots of companies are keen to link with them. We also have wrap platforms and now the sophisticated direct investor is dealing through those or

fund supermarkets so the asset manager doesn’t actually have any direct contact with them anymore.”

New Star, a UK-listed manager with a retail and institutional business, was able to launch its UK business in 2001 at a time when confidence among consumers was low. “When we launched our UK retail business in July 2001 it was the worst possible time to build a fund management company but it shows that you can build critical mass and now we are one of the top providers,” says Wilson. “So it is possible for people who get the right mix and understand the UK market.”

Foreign players

There are a number of foreign players who have made their move to the UK a success too. Paul Price, international head of institutional business at Pioneer Investments, says: “I think what drew us to the UK on the institutional side was the significance of the assets under management in the market and also the openness of the market for new managers.”

In 2002, Pioneer Investments entered the UK through its acquisition of hedge fund group Momentum for $110m. “We entered by default with the acquisition of Momentum. This was a building block to our business in the UK going forward. So from that we built our long-only presence and continued to build out on client servicing and relationship managers,” says Price.

The shift away from UK equities has opened the door for a number of specialist asset managers to carve out a place for themselves too. Pictet Funds, the fund distribution subsidiary of Swiss private bank Pictet & Cie launched its Luxembourg fund range into the UK last year. It has over 90 funds in its Luxembourg range with a host of different strategies including emerging markets, Japanese equities, local currency, emerging debt and a number of sector funds which include biotech, premium brands and clean energy. Paul Gaston, head of UK sales at Pictet Asset Management, says: “The timing of Pictet entering the UK market was quite significant. Internally we feel that the UK market has changed to the extent that Pictet would see more demand coming from the UK for the types of products that Pictet has to offer, particularly the sector funds and thematic funds.

“Traditionally UK investors have tended to look at investments in terms of geographical asset allocation. They would have 60% invested in UK equities, 20% in European equities and so on. But what we are increasingly seeing is more demand for thematic investing such as premium brands, clean energy or biotech and this is what Pictet specialises in.”

Market saturation

The market is saturated with UK equities and European equities, which are favoured by domestic investors. Price, of Pioneer, says: “The competition today is even more intense. This is because there are more managers entering the space and targeting product speciality. We are not in the UK equity space but if I was, I would feel a lot of heat at the moment.” Pictet’s Gaston agrees. “We don’t have a UK equity product to offer and this is good news, because we wouldn’t necessarily have the correct expertise to run that product, and it’s a very, very crowded space. There are some extremely well-run products there and we wouldn’t want to compete on those levels.

“But what we are offering stands out in performance and in product type. Life insurance companies who want to distinguish themselves from one another are keen to get this type of product on board.”

Price, of Pioneer, says: “The really hot subjects for us are global emerging markets and alternative funds and global equities. So they are the three frontrunners in terms of the UK market. On a secondary basis we have seen a lot of demand for Libor-plus strategies that we have launched in the UK.”

Further barriers offshore

There are higher barriers to promoting foreign products into the UK, though. Getting recognition for Luxembourg-domiciled funds is a primary problem.

Wilson, of New Star, says: “There are some groups who do have Luxembourg-based funds but they will launch a UK-

registered version because there is still some reluctance by intermediaries to invest in offshore-registered funds. In fact some of the platforms, such as FundsNetwork, don’t have offshore funds available on their supermarket.

So that is why overseas companies have had less of an impact as most have offshore-registered funds and probably won’t go through the hassle of doing a UK or European-registered version.”

But thanks to a change in legislation it is becoming easier for UK investors to put their money offshore. “If you go back three or four years ago very few people would actually do a search for Luxembourg funds, but that’s now changing,” says Gaston of Pictet. “There were also tax disadvantages if you invested in these offshore funds, but that’s gone now and it has created a more level playing field.”

Wilson believes that Luxembourg-registered funds will make an impact in the UK market in the future. “As groups start to promote and demand shelf space, it only takes one or two to be successful on one platform and other platforms will do it as well, because they are very competitive and don’t like being left behind.”

Future opportunities

The good news, however, is that catering to the UK should become easier over time. Retail and institutional investors are still opening up to new products.

“Longer term I think fund of funds will continue to grow. We could see hedge funds, certainly fund of hedge funds become more mainstream but that is still subject to what the regulators will allow,” says Wilson.

Changing legislation in the UK could create more opportunities for foreign asset management firms too. Although there is currently no compulsion for retailers to invest their savings at present, in 2006 the UK government set out plans for a national pension scheme, called Personal Accounts, into which people without a suitable company scheme will be enrolled automatically. Personal accounts are due to take affect from 2012.

Micro rule changes could also create more opportunity. “Changes to the individual savings account (ISA) rules taking affect from this year mean that investors will be able to transfer their cash ISAs into equity ISAs. It’s quite interesting as that means there is about £120bn in cash ISAs at the moment,” says Wilson.

As for institutional investors, Price says: “I think we are going to see a very radical shift. UK equities will continue to decline and I think allocations will go towards global equities. I think this should be balanced, though, with an allocation towards global emerging markets.

“In the past, global emerging funds were seen as an eclectic allocation, but I think going forward the sector will be seen as a core allocation simply because these are the markets and companies of tomorrow. I think we must be invested in these because pensions are about investing in the future.”

© fe February 2008