Selling higher revenue products and increasing geographical reach is important for many asset managers’ profitability. Nick Fitzpatrick asks if Europe’s Ucits III funds can help

Henderson Global Investors, the UK-listed asset manager, is hoping its annual results will be as pleasing to shareholders this year as they were last year, notwithstanding the credit crunch. This time last year, the company, which had £61.6 billion (e91.6bn) of assets under management as at 30 June 2007, was preparing to report a 30% increase in its profit before tax, while earnings per share had doubled. These strong results were reflected in its share price, which by year-end had rocketed higher than any other UK-listed manager.

Partly responsible for these robust figures was Henderson’s strategy to increase sales of higher margin products – those such as hedge funds, which collect a percentage of performance as part of their fee structure. Henderson was one of the first mainstream managers to manufacture hedge funds around ten years ago. The dividend for this clearly paid off in 2006, but only after a restructuring exercise that helped the company turn around its investment performance did the income from performance-related fees follow through.

Hedge funds aside, this year it will be interesting to try and glean how funds created under the Ucits III regulation – which typically contain a performance fee – are also feeding the profits of asset managers such as Henderson.

Managers started to roll out Ucits III products in earnest over 2006 and 2007, and they usually bolted on a performance-related fee to each fund that made use of the full Ucits III powers to imitate hedge funds by using certain derivatives. Managers, particularly those without the ability to set up bona fide hedge funds, may look to Ucits III as a way of increasing revenues through performance fees.

Asked if the Ucits III powers help Henderson in its strategy of increasing revenues from higher-fee products, Kate O’Neil, director of Henderson’s European distribution team, says: “Ucits III helps us develop higher revenue products in the sense that we benefit from our increasing investment performance.

“We have performance fees on as many of our products as we can. We were one of the first investment managers to embrace all of Ucits III, which gives us better freedom to deliver better returns.”

Hedge fund-like fees

Ucits III extended the amount of instruments that fund managers could invest in, principally to derivatives. Although Ucits III does not permit the most fundamental of hedge fund strategies – that of short selling stock (though Ireland has taken measures to allow this) – Ucits has permitted, through the use of derivatives, the creation of products that could produce higher risk-adjusted returns, similar to what the ideal hedge fund is capable of.

But increasing fee income from Ucits III products will be a success only if third-party distributors accept them, which in turn will depend a lot on performance. Charging hedge fund-like fees for products that are not actually hedge funds is a strategy that is viewed by some distribution agents with scepticism. In August last year, for example, Margaret Dobak, a product specialist at Citi Private Bank, told Funds Europe: “I would be concerned if Ucits III fees went to the level of hedge funds because Ucits III funds do have certain constraints that pure hedge funds do not have. A 20% performance fee, for example, I think will need to be tested by the market.”

Although performance is crucial, to fully convince distributors that mainstream investment managers can offer a viable alternative to hedge funds, they will have to demonstrate good risk-adjusted performance. According to Alexis de Mones, global product specialist at ABN Amro Asset Management, some distributors are concerned about the greater flexibility given to asset managers through derivatives. This would seem to mean that mainstream fund managers, hitherto supposedly inexperienced at investing in derivatives, need to demonstrate that they really do know how to use these instruments as well as their hedge fund cousins.

Product specialists like O’Neil and Mones say Ucits III will lead to better risk-adjusted returns, but to convince distributors that fund managers possess the ability to produce them, managers also have to demonstrate that their risk management is robust. O’Neil believes last year’s events in the sub-prime market will lead to a greater understanding of these issues. She says: “The summer of 2007 and the last quarter found out which managers were doing their appropriate Ucits III risk management and which were not. I hope that the events of 2007 will lead to a real understanding of risk-adjusted returns.”

BlackRock spent two years educating intermediaries about the new Ucits III powers it planned to employ, said Tony Stenning, the firm’s managing director for UK retail. “The BlackRock long-short UK Absolute Alpha Fund has become the number-one IFA [independent financial advisor] fund since it went to daily dealing in July. It is taking in £2.5m-£4m a day in net inflows. It returned around 10.6% last year, which was above the FTSE. That came from alpha, not beta.” Stenning also says the fund is cautious in its approach, likening it to a bond with equity-like returns.

Utilising risk parameters

Mones, at ABN Amro, says time will tell if managers can deliver better risk-adjusted returns. But he adds: “Ucits III has given the incentive for asset managers to upgrade their risk management tools substantially.

“Our take on Ucits III is not that it has increased risk in portfolios, but that it utilises existing risk bands in a more efficient manner.” To put it another way, says Mones, investment managers can now, thanks to Ucits III, reach the barrier of their risk parameters rather than undershoot them as in the past.

Henderson was busier than most last year when it came to product development that made full use of the Ucits III powers. The manager re-launched its Horizon Pan-European Equity Alpha-Plus Fund under the Ucits III banner. This fund already existed within Henderson’s traditional product suite, but employing Ucits III-authorised derivatives transformed the fund into a multi-asset-class offering managed by David Elms, a Henderson hedge fund manager. Henderson also launched a China fund in December, along with a global financials fund and a property securities fund. Last year Henderson also rolled out an absolute return fixed-income fund.

There is a perception that the demands of Ucits III risk management present a difficult hurdle for smaller asset managers to cross, consigning them to marketing lower-margin traditional products. But this is not so, according to Steve Cook, a business advisor at consultancy firm Morse. He points to the case of Perennial Investment Partners, an Australian boutique manager that has launched a Dublin-based Ucits-compliant fund range, including Asian and Japanese equities.

“Its investment proposition is world class and has been accepted as being so by a number of asset consultants,” said Cook. “A small fund manager is by definition a specialist and there are fund managers around who are quite capable of doing derivative overlays. If you are a specialist fund manager with a core set of funds with sophisticated derivatives, you might regard the risk management as part of your core activities and not even want to outsource it.”

The investment in appropriate risk management may well be worth the effort if it means accessing higher fees later down the line. Producing higher fee products has been front and centre of many asset management minds for

some time now. But so has diversifying income revenues geographically. The broader Ucits regulation helps here too – it is

also helping asset managers tap into revenues from foreign markets beyond just Europe itself. Perennial has a significant Asian client base, for example (although Australian investors can be fiscally punished by investing offshore).

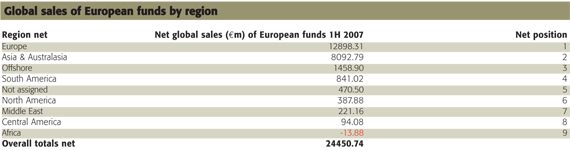

The table above indicates the success of European fund sales beyond Europe, although the data reflects mainly Ucits funds, non-Ucits funds are also included.

It is still difficult to ascertain how Ucits sales beyond Europe are impacting the bottom line of asset management, but managers such as Henderson are finding increasing appetites for the product as far away as Asia and South America. The Investment Management Association, a UK trade body, has noted that in 2003 global cross-border firms in Europe sourced 32% of their net fund sales from Asia, Latin American and other global markets.

Geographical reach

Increasing revenues geographically is another strategy for Henderson and, again, the firm is able to

use the broader Ucits regulation to do this. Last year, Henderson introduced its Horizon Pan-European Equity Alpha-Plus Fund to Singapore, for example. One of Henderson’s Luxembourg Sicav funds is distributed through 18 countries in total including Hong Kong, Singapore and Taiwan, through global distributors like Merrill Lynch, UBS and Citi. In 2007 the firm was also looking at the Japanese retail market and at Korea.

“Ucits has become a global brand,” says Adam Fairhead, global head of product development at HSBC Investments. But he notes that there are still some barriers to the international market, such as in Hong Kong where funds must comply with the Hong Kong Code.

“Hong Kong has its own code but by its generosity it has imported other funds too. Nevertheless, the opportunity space is significantly narrowed.”

© fe February 2008