As the world emerges from a devastating pandemic, technology will play a critical role in determining the shape of the funds industry.

The Covid-19 pandemic that began its spread across the globe more than a year ago will have a profound effect on our society – and beyond that, on the technology we use every day, according to leading figures in business and finance.

“What we have witnessed over the past year,” says Microsoft CEO Satya Nadella, “is the dawn of a second wave of digital transformation sweeping every company and every industry. Building their own digital capability is the new currency driving every organisation’s resilience and growth.”

For BlackRock chief executive Larry Fink, one striking aspect of the pandemic was its highly uneven impact. In his annual ‘Dear CEO’ letter to companies in which BlackRock invests, he wrote that Covid-19 had sparked the most severe global economic contraction since the Great Depression and the sharpest fall-off in equity markets since 1987.

“While some industries, particularly those that depend on people congregating in person, have suffered, others have flourished,” he continued. “And although the stock market recovery bodes well for growth as the pandemic subsides, the current situation remains one of economic devastation.”i

Speaking as Covid-19 tightened its hold on Europe in March 2020, Peter Harrison, group chief executive of Schroders, reflected on his approach to the black swan events that every chief executive fears. “The pressing question is currently, ‘How resilient is my business?’, ‘How do we maintain service levels?’ and, most importantly, ‘How do we keep staff safe?’” he said.

For Harrison, technology lies at the heart of the solution. Indeed, several years before the pandemic, Schroders’ management team identified it as fundamental to establishing true cross-business collaboration and business resilience, he said.

For Harrison, technology lies at the heart of the solution. Indeed, several years before the pandemic, Schroders’ management team identified it as fundamental to establishing true cross-business collaboration and business resilience, he said.

Unhindered flexible working was the aim. As Harrison noted: “This wasn’t simply about working from home. This was [an enabling factor] to allow staff to mix with other teams.”

According to cloud computing provider Amazon Web Services (AWS), the pandemic has changed how people interact, receive information and get help. Much of what used to happen in person has shifted online. “Many of our customers are using machine learning (ML) technology to facilitate that transition, from new remote cloud contact centres, to chatbots, to more personalised engagements online. Scale and speed are important – whether it’s processing grant applications or limiting call wait times for customers. Machine learning tools such as Amazon Lex and Connect are just a few of the solutions helping to power this change with speed, scale and accuracy,” it states.

For these large cloud computing providers, or ‘hyperscalers’, the pandemic has crowned a dynamic period of business expansion. At the end of December 2020, Microsoft announced a 17% annualised rise in revenue to US$43.1 billion, with net income up 33% to US$15.5 billion.

Commercial cloud services have been a primary driver, with the Microsoft Azure cloud platform reporting 48% revenue growth and aggregate cloud computing revenue up 34% year-on-year to US$16.7 billion.

Technology strategy

As we’ve reported above, Schroders CEO Peter Harrison believes technology lies at the heart of the asset management industry’s responses to Covid-19. What’s more, he thinks technology will be fundamental to its business recovery after the pandemic recedes.

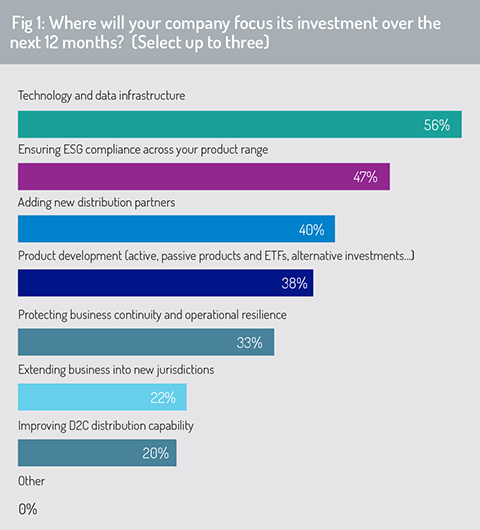

This message aligns with the thoughts of our survey respondents (fig 1). When asked where their company will focus its investment over the coming 12 months, the largest group opted for technology and data infrastructure (56%). Respondent companies will also prioritise efforts to ensure ESG (environmental, social and governance) compliance across their product range (47%). Perhaps unsurprisingly, measures to drive business expansion by extending distribution coverage (40%) and investing in product development (38%) were also high priorities.

The first of these points, highlighting the importance of investment in technology and data architecture, will be addressed throughout this report.

It is timely, however, to reflect on the high priority that respondents accord to ESG compliance and the role technology may play in achieving this objective. Questions around sustainability, diversity and social inclusion have become integral to strategic decision-making across institutional investor and asset management firms – and this focus is only likely to grow in the times ahead.

Conventional wisdom was that the crisis might divert attention from the climate change agenda. However, according to BlackRock’s Larry Fink, exactly the opposite has taken place and reallocation of capital has accelerated even faster than anticipated. “From January through November 2020, investors in mutual funds and ETFs invested US$288 billion globally in sustainable assets, a 96% increase over the whole of 2019,” he says.ii

Conventional wisdom was that the crisis might divert attention from the climate change agenda. However, according to BlackRock’s Larry Fink, exactly the opposite has taken place and reallocation of capital has accelerated even faster than anticipated. “From January through November 2020, investors in mutual funds and ETFs invested US$288 billion globally in sustainable assets, a 96% increase over the whole of 2019,” he says.ii

Essential to this transition has been the growing availability and affordability of sustainable investment options. “Not long ago, building a climate-aware portfolio was a painstaking process, available only to the largest investors,” says Fink. “But the creation of sustainable index investments has enabled a massive acceleration of capital towards companies better prepared to address climate risk. Better technology and data are enabling asset managers to offer customised index portfolios to a much broader group of people – another capability once reserved for the largest investors.”

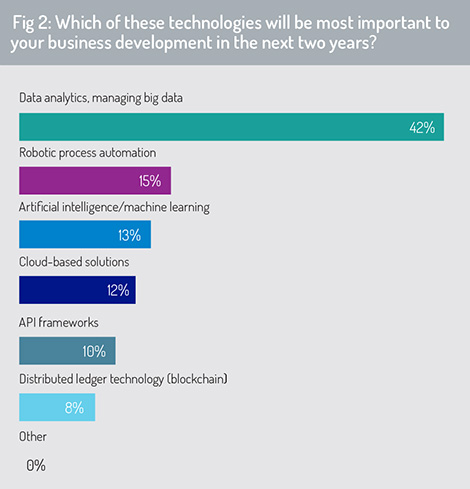

Reflecting on which technology disciplines will be most important to business development over the coming 24 months (fig 2), respondents put data analytics and the capacity to manage big data at the top of the list (42%). The ability to manage large data volumes and high data velocity is fundamental to a wide array of functions in the asset management industry – as an input to factor-based and quantitative investment strategies, for example, or for conducting analysis of customer buying preferences as a driver for its product development and distribution strategy.

A third fundamental requirement for managing big data – the ability to accommodate data variety – is becoming ever more important. Investment teams are drawing insights from a wide range of alternative and unstructured data sets to inform their investment strategies – and, beyond the investment decision, this expertise may be important, for example, when applying ESG screening to assets held in a portfolio or received as collateral in secured finance transactions.

Beyond this, control over data quality and the ability to manage large data volumes is fundamental to driving advances in robotic process automation (RPA) and innovation in machine learning.

Definitions of RPA vary, but a common one is that it is the use of software with machine learning capabilities to handle high-volume, repeatable tasks that previously were processed by human action. RPA is being applied by asset servicers and, to a degree, by asset managers to realise cost savings and efficiency gains across standardised, repeatable service functions that can be replicated by machine.

One example is in processing trade order flow and providing trade or settlement reporting to key parties in the transaction. Another is in error detection – in identifying data points that lie outside of specified tolerances and handling these robotically where possible, or escalating these to the operations or client service team when they cannot be resolved by the processing engine.

This approach is now being reinforced by more sophisticated artificial intelligence (typically supervised learning) techniques, as we will see later in this report.

© 2021 funds europe