Survey results have indicated that asset management companies are expected to increase the number of services that they outsource over the coming two years, taking advantage of the investment that large asset servicing companies have made in their global operating models to support asset managers’ investment activities across a full range of asset classes and global locations. To enable this process, asset managers are seeking seamless interconnection between functions along the investment value chain, including integration of middle- and back-office services that may be outsourced.

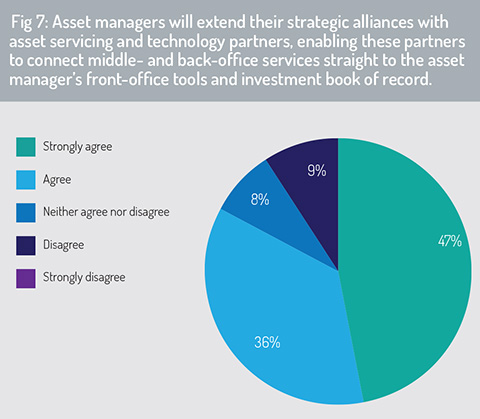

In all, 83% of survey respondents believe that asset managers will extend strategic alliances with asset servicing and technology partners (fig 7), enabling these partners to connect mid- and back-office services straight through to the asset managers’ front office tools and investment book of record (IBOR).

These types of initiatives are evident across the industry, through partnership and acquisition, with large global asset servicers exploring mechanisms to deliver third-party operational services directly into their clients’ common front-to-back applications.

These types of initiatives are evident across the industry, through partnership and acquisition, with large global asset servicers exploring mechanisms to deliver third-party operational services directly into their clients’ common front-to-back applications.

For example, asset servicing companies have also been working with front-office systems vendors to reinforce linkages between their middle-office technology and the order management and execution management tools available on the market.

A single data model is central to achieving this optimised front-to-back approach. The target is to operate a common data architecture that supports the data requirements of all modules across this front-to-back model. Although individual modules may have bespoke data requirements, this is fed from a standardised data model wherever possible.

Artificial intelligence and machine learning

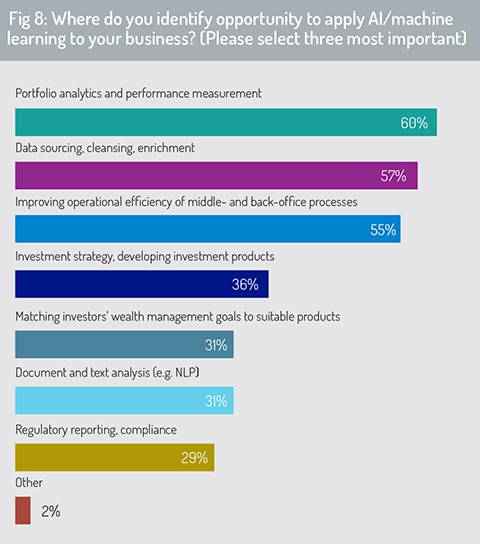

AI and ML are being applied by asset management and asset servicing companies to support an expanding range of functions across the investment lifecycle. This includes applications in portfolio modelling and investment decision-making, in trade execution and transaction cost analysis, in collateral and liquidity risk management, and across a broad range of functions designed to minimise operational risk and cost (fig 8).

A priority in applying AI, respondents tell us, is the ability to augment human expertise into AI models (fig 9). Augmented intelligence typically refers to the use of information technology and AI techniques to supplement and deepen human capabilities – to reinforce human intelligence, rather than simulate or replace it.

Building on this point, respondents indicate that the AI model must be easily adaptable to the requirements of product and business teams – enabling these personnel to make refinements through information dashboards or through ‘low code, no code’ inputs. This enables changes from staff that do not have full coding skills – allowing the company to shorten the gap between defining a business use case and implementing changes to the model.

Building on this point, respondents indicate that the AI model must be easily adaptable to the requirements of product and business teams – enabling these personnel to make refinements through information dashboards or through ‘low code, no code’ inputs. This enables changes from staff that do not have full coding skills – allowing the company to shorten the gap between defining a business use case and implementing changes to the model.

Alongside this principal of ‘adaptability’, the survey finds that AI modelling must be ‘explainable’. Google’s AI Platform team define ‘explainable AI (XAI)’ as a set of tools and frameworks to understand and interpret predictions made by machine learning models. This can debug and improve model performance and help others understand the model’s behaviour. This can also generate feature attributions (identifying how much an explanatory variable in the model contributed to the predicted result) and visually investigate model behaviour utilising scenario analysis (or ‘What if’) tools.

“Initially a large amount of the automation applied to financial operations was grounded in automating standardised, repetitive tasks,” says Temenos Multifonds’ product director, Sern Tham. “For security prices falling outside of a specified threshold, for example, these would be identified as a possible exception and flagged for investigation.

“However, during volatile periods, the number of possible exceptions may rise sharply and we have applied XAI to help manage this challenge – particularly to reduce the number of false positives. This has delivered greater efficiency to exception management, reducing false positives and therefore eliminating the need for manual investigation.”

“However, during volatile periods, the number of possible exceptions may rise sharply and we have applied XAI to help manage this challenge – particularly to reduce the number of false positives. This has delivered greater efficiency to exception management, reducing false positives and therefore eliminating the need for manual investigation.”

However, says Tham, a prerequisite for AI to be applied to a business use case is that the model’s findings must be explainable to financial regulators and to the client – and there must be a clear digital audit trail in place to support why the model has predicted a specific outcome.

Similarly, Brown Brothers Harriman (BBH) has applied AI to NAV (net asset value) calculation and certification, utilising a supervised learning model to identify securities that are incorrectly valued and which may potentially lead to a NAV error. BBH indicates that this Anomaly NAV Tracking System (ANTS) has been important in reducing false positives in NAV error detection. On backtesting ANTS against its legacy model, BBH identified a 77% reduction in pricing exceptions that needed to be investigated further (see BBH’s Kevin Welch in the expert comment section).

© 2021 funds europe