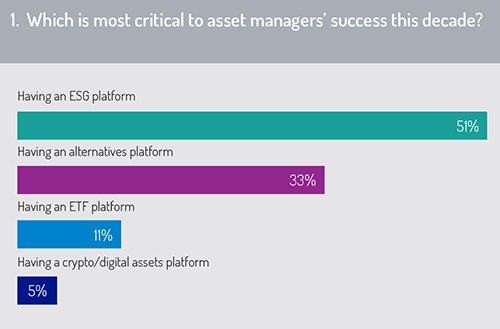

One of the easiest predictions to make about the asset management market in the next decade is that Environmental, Social, and Governance (ESG) funds will be a critical feature. According to our survey (see figure 1), having an ESG platform was cited as critical to asset managers’ success by just over half (51%) of respondents.

In the wake of the recent COP 26 global conference on climate change and the transition to Net Zero carbon emissions, it is easy to see why ESG funds are so critical. “Increasingly, investors are pushing for ESG or sustainable products and it’s not just ‘millennial’ retail investors,” says Sanjiv Sawhney, global head of Custody and Fund Services at Citi. “Institutional investors and pension funds are also demanding more sustainable solutions.”

But it is not just environmental factors driving the growth of sustainable and responsible investing. There is a greater focus on stewardship among institutional investors and pension funds.

There are some regulatory drivers too. The Sustainable Funds Disclosure Regulation, part of the EU’s action plan on responsible investment, is due to come into force next year. It is designed to prevent greenwashing by requiring fund promoters to sign up to Articles 6, 8, and 9 if they want to market their funds to European investors.

There are some regulatory drivers too. The Sustainable Funds Disclosure Regulation, part of the EU’s action plan on responsible investment, is due to come into force next year. It is designed to prevent greenwashing by requiring fund promoters to sign up to Articles 6, 8, and 9 if they want to market their funds to European investors.

Similarly, the Shareholders Rights Directive has been brought in to support shareholder activism by ensuring investors are able to have a say in the running of the companies they invest in.

The impact of climate change goes beyond just ESG funds. Asset managers of all stripes are incorporating sustainable criteria into their investment process, regardless of whether they are pursuing an ESG strategy. This raises the question of whether ESG funds will be a separate category at the end of the decade, or will all funds become ESG funds on some level?

Alts still in favour

A third (33%) of our survey respondents selected an alternatives platform as critical, highlighting both the enduring appeal of alternative investment as well as the rise of real assets such as real estate, infrastructure, private debt and other more esoteric asset classes.

This rise has been driven by the low interest rate and low yield environment that has persisted since the financial crisis. The same economic conditions may persist well into the next decade, given that fiscal stimulus may be needed to manage the economic impact of the pandemic and almost two years of disruption to the business environment.

Passives’ popularity persists

Exchange-traded funds (ETFs) still remain popular with investors thanks to their low cost and efficient structure. Exchange-traded products have also proved to be an effective way to access new asset classes, offering exposure to emerging assets but also providing protection against volatility or liquidity risks. Perhaps the most surprising finding from the survey is that just 5% of respondents believe that digital or crypto assets will be critical to their success.

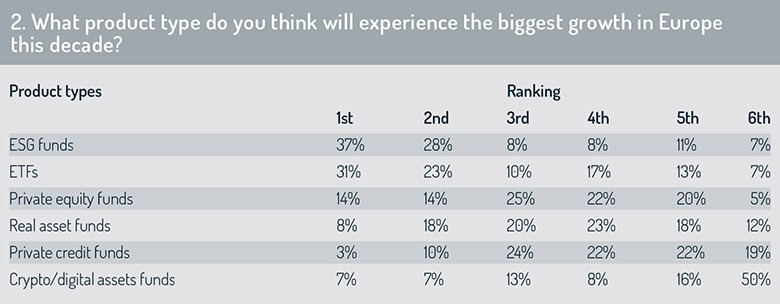

These findings are further supported by the responses seen in figure 2. Respondents were asked to rank six product types in terms of how much growth they are expected to experience in the next decade. More than a third (37%) selected ESG funds as their first choice.

A similar number (31%) cited ETFs, which suggests that the rise of passive funds is unlikely to dissipate any time soon. Furthermore, it may be that ESG-themed ETFs will experience considerable growth. This is already fertile ground for fund managers.

According to Deutsche Boerse, ETFs focused on ESG factors experienced huge growth in the first half of 2021. Monthly turnover averaged nearly €3 billion, trebling the volume of a year previously. Meanwhile, the exchange’s electronic trading platform Xetra stated that ESG ETFs account for as much as 16% of ETF trading turnover, up from 6% a year ago.

So, while ESG will be the asset class or investment theme of choice, ETFs will be the investment vehicle of choice. Passive or index-based products may also provide the means for crypto and digital assets to become more popular with institutional investors by offering access to the increase in value, via an index, but avoiding direct exposure to the asset itself. As US regulators have granted approval for crypto ETFs on Wall Street, this market may yet take off.

The Domicile Question: no Brexit bounce as Lux and Dublin dominate

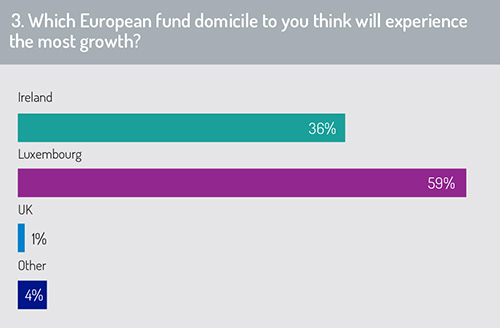

The UK is not likely to dominate the European funds market with a new range of Brexit-inspired, UK-domiciled funds. Instead, the current cross-border centres of Luxembourg and Dublin are set to increase their market share as investors stick to the tried-and-tested success of Ucits funds.

When asked to name the fund domiciles that will experience the most growth over the next decade (figure 3), Luxembourg and Ireland were named by 60% and 36% respectively. The UK, on the other hand, was named by just 1% of respondents. Brexit has been a controversial issue in the funds world. The idea that it may lead more managers to set up UK-specific funds does not appear to be borne out by our survey.

When asked to name the fund domiciles that will experience the most growth over the next decade (figure 3), Luxembourg and Ireland were named by 60% and 36% respectively. The UK, on the other hand, was named by just 1% of respondents. Brexit has been a controversial issue in the funds world. The idea that it may lead more managers to set up UK-specific funds does not appear to be borne out by our survey.

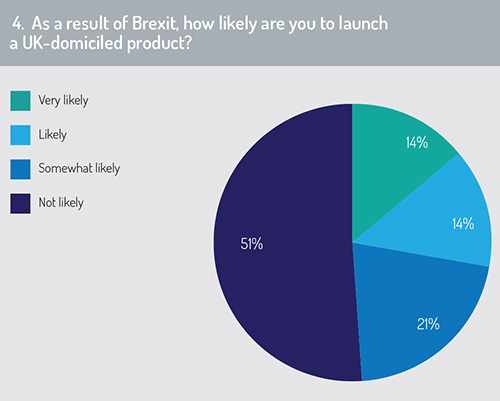

More than half (51%) of firms will not launch a UK-specific product as a result of Brexit (figure 4), putting paid to the prospect of a so-called ‘Brexit bounce’. While the UK avoided a financial cliff-edge that might have followed a no-deal exit from the European Union in January 2021, it has also not seen a ‘Brexit bounce’. And our respondents do not envisage a sudden flurry of UK-specific products.

There are still some critical political issues that need to be resolved in order to make a fair assessment of the UK financial services market’s prospects. The ongoing negotiations around the Northern Ireland protocol have led to uncertainty. In more financial services-specific terms, the question of passporting or equivalence between the UK and the EU remains unresolved. However, for funds, the way forward is a little more clear, which may help to explain the lack of enthusiasm for UK-domiciled products. “The UK is working on an offshore fund regime that will create a fund passport for Ucits funds,” says Larissa Sototskaya, head of Luxembourg Custody and Fund Services at Citi.

“This will allow, more or less, the status quo to remain for firms selling Ucits into the UK and reduces the need to create UK-specific products.” At some point, the UK will have to reach a deal with the EU as regards accessing the European Economic Area. It also remains to be seen if the UK will continue to abide by well-established regulations like MiFID II and Solvency II, or take the risk of implementing UK-specific rules.

“This will allow, more or less, the status quo to remain for firms selling Ucits into the UK and reduces the need to create UK-specific products.” At some point, the UK will have to reach a deal with the EU as regards accessing the European Economic Area. It also remains to be seen if the UK will continue to abide by well-established regulations like MiFID II and Solvency II, or take the risk of implementing UK-specific rules.

For the time being, investors are able to access the European market through the current Ucits framework, and this is more appealing than setting up a UK-specific product. Aside from the regulatory uncertainty, such a product would have to build its brand. Given the divisiveness of Brexit, this may be challenging, especially if the vehicles are to have any appeal beyond the UK’s borders.

© 2021 funds europe