Sustainable finance presents challenges for both the demand and supply side of the market but financial market infrastructure providers like Euroclear can help pave the way for industry participants to collaborate and break through structural rigidities.

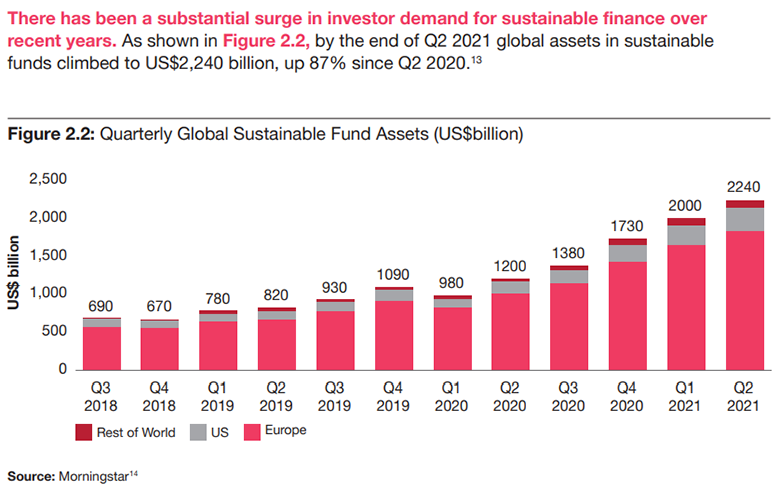

Sustainability is now a top priority for many businesses, particularly as consumers increasingly look for partners that are investing in sustainability practices. Across the international financial markets, the development of green finance has also continued to accelerate over the past decade.

Green finance encompasses a wide range of financial instruments that meet environmental, social and governance (ESG) criteria. Asset managers have become increasingly invested in ESG capabilities and understand that embedding ESG into investment decisions can allow them to identify investment risks and add qualitive aspects to the investment process.

“Investors are placing the value in their return on stakeholder capitalism, and they measure return on investment not only in monetary terms but also on the wider social and environmental impact of an investment. This marks a profound shift in how one thinks about long-term investing. Investment is becoming broader and increasingly incorporates ESG factors,” says Anthony Harper, head of sustainable finance, ETFs and asset managers, Euroclear.

Harper explains that this shift in approach means that the industry is now working together collaboratively between the people who have assets to invest and those who have projects or businesses that require capital.

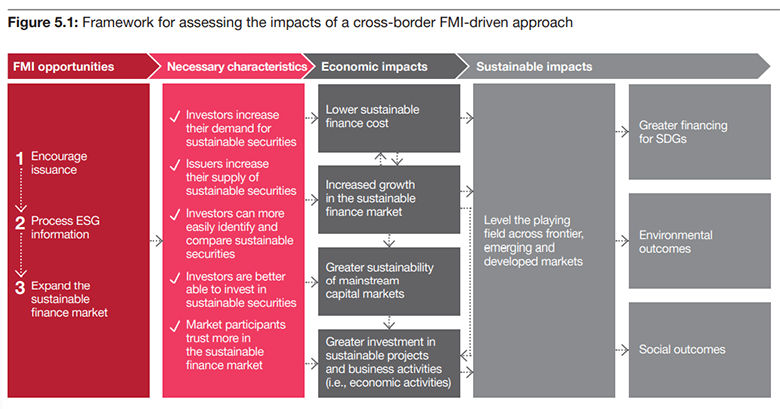

Financial market infrastructures (FMIs), like Euroclear, hold a trusted position in the global financial market. FMIs include central counterparties, central securities depositories, payment systems, securities exchanges, securities settlement systems and trade repositories. FMIs play a key role in encouraging a coordinated effort across financial market participants to support the sustainable finance market, so that it can reach its full potential.

Sustainable finance enables financing to achieve sustainable environmental and social outcomes. However, this also means that sustainable finance is more complicated than mainstream finance.

Challenges

The supply and demand sides of the market face key challenges in scaling sustainable finance due to its complicated nature.

The investor side, for example, struggles to gauge the requirements for a trustworthy issuance capable of attracting international investment. This can lead to limited supply of sustainable securities. Issuers must increase their supply of sustainable securities to scale a successful sustainable finance market.

“Issuers need to identify projects that are particularly suitable to those markets, which is not how they would normally think about raising finance. They also have to work out to how to go about issuing into this market with the additional data requirements, and then they have to gauge what investors want, which is changing all the time in this market”, explains Nick Forrest, UK economics consulting leader, PwC.

Additionally, underdeveloped market infrastructure in certain regions, along with prohibitive upfront issuance costs, create further challenges for the supply side. However, Forrest observes: “We have noticed steady demand for investors working out what kind of instruments they want.”

Increasing investor appetite for sustainable securities will also help to achieve a successful sustainable finance market. However, despite the increasing prominence of sustainable finance, lack of standardisation and unstructured information is creating challenges on the demand side. These information failures are preventing the buy side from making informed investment decisions.

Euroclear’s Harper notes: “When we think about ESG investing today, there is publicly available information from the issuers, but it’s in many different languages and formats, and is based on different regional intentions. As a result, someone needs to sift through vast amounts of sustainability information, which is extremely time and labor intensive.”

These companies would rather depend on someone to do that aggregation. Information failures are often caused by an overload of methodologies and taxonomies for ESG classification. This is further complicated by poor compatibility of ESG scores and issuer disclosure reporting.

“This marks a challenge for aggregation, and there are participants trying to solve that right now. A key part of making sustainable finance markets scalable and self-sustainable is ensuring that investors can easily identify, compare and select securities based on their ESG criteria,” Harper adds.

Collaboration is key

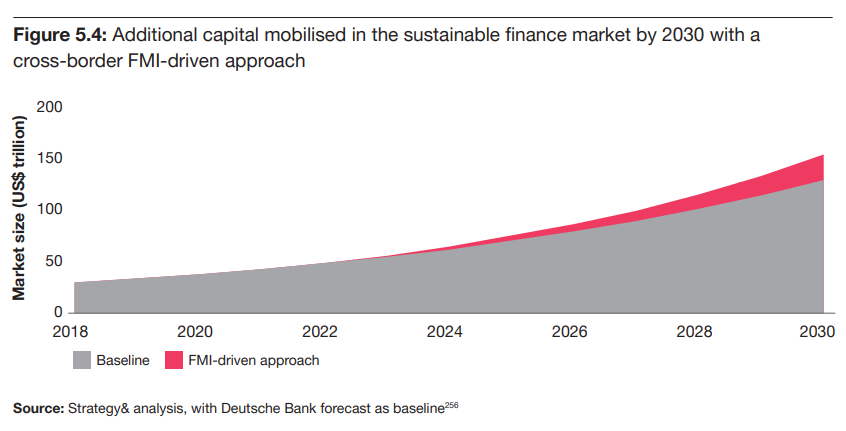

Euroclear’s recent report with PwC, Scaling the sustainable finance market: A cross-border financial market infrastructure-driven approach, identified that a cross-border, FMI-driven approach can help address challenges relating to sustainable finance and balance progress on sustainability globally.

Cross-border FMIs encourage the connection of issuers and investors across borders. This engagement is critical in overcoming issuer and investor challenges.

As well as collaboration, reducing costs associated with sustainable finance is important for neutralising expense and reducing the barriers to entry. Harper comments: “The fact that we are a collaborator and a global connector for the investment business means we are uniquely positioned to reduce costs, not just for the large industry players but also those in emerging economies, too.”

Historically, Euroclear has been able to bring the wider global issuer base into the capital markets. For example, Euroclearability allows international banks and global investors to seek diversification and yield in local markets globally. Four years ago, PwC conducted a report that showed Euroclearability can reduce sovereign borrowing costs by 28 basis points, while reducing corporate borrowing costs by 14 basis points by accessing a wider pool of global investors.

Meanwhile, PwC’s Forrest notes: “The danger with sustainable finance is that due to wider global issuers and capital markets getting pulled apart, it’s harder for emerging markets issuers to access the increased complexities of sustainable finance required by global investors.”

So, according to Forrest, bringing issuers and investors together and encapsulating similar benefits will allow a broader base of global issuers to tap into global capital markets, including sustainable finance.

Euroclear is currently paving the way for industry participants to collaborate to break through some of the structural rigidities and processing challenges relating to sustainable finance.

“While we do not have this exact solution yet, the intent is to design and operate an application to reduce costs for the issuers while increasing access for the investors. This is what an FMI is designed to do, so creating this solution is a very important thing to us,” concludes Harper.

© 2022 funds europe