Manuela Sperandeo, iShares Head of Specialist Sales EMEA, tells Funds Europe how investors can leverage smart beta strategies to target numerous outcomes.

With the popularity of smart beta products growing, it is no surprise that investors are increasingly curious with regards to the potential application of these strategies within a portfolio. Factor investing is a well-known concept that has had a presence in academic literature from the 1930s. Today, factor investing has been made accessible by smart beta ETFs; these products offer a low-cost way to access investment screens investors have been using for decades.

Introducing factors

Ever since the first stocks and bonds were traded, investors have tried to understand what drives returns. Over time, clear and persistent drivers of investment return emerged. By the 1930s, academics and practitioners had started to systematically identify these drivers and they later took on the name ‘factors’. Factors are broad, persistent drivers of return enabling investors to pursue outcomes that might be different than ‘the market’.

Factor investing is a branch of asset management that aims to target broad, persistent drivers of return. In essence, it’s a new way of looking at what drives the risk and return of your portfolio. While investors have traditionally viewed a portfolio in terms of asset classes, factor investing looks at the underlying drivers of returns, across and within asset classes.

Smart beta?

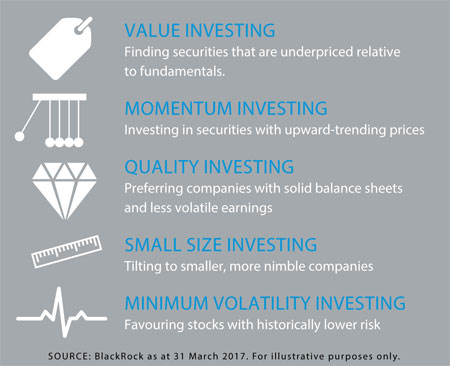

Factor investing seeks to identify and capture broad, persistent drivers of return. It is the formalisation of, for example, the idea of seeking inexpensive companies (value investing) or high-quality balance sheets (quality investing) – intuitive investment styles that have long been part of the active management toolkit.

Today, factor investing has been made accessible to the broader public via smart beta ETFs. These products offer a low-cost way to access investment screens, which investors have been using for decades. However, with increased technological advances and the proliferation of index investing, we are seeing a new wave of products come to the fore.

Factor tilting: can it work?

Because these factors tend to be driven by very different reasons, they tend to pay off at different times. The cyclicality of individual factors is unavoidable: bearing short-term underperformance is often a requisite for earning a long-term premium. For investors who wish to benefit from the potential results of factor investing, two paths are available: single-factor tilting to pursue incremental return over the short term, or implementing a broad multifactor allocation for the long term.

For those investors with special insights and views, tilting with single factors might be appropriate. In BlackRock’s 30+ years of experience in active management and research in factor investing, we have observed some key predictors that may contribute toward forward-looking performance of individual factors and publish these on a quarterly basis.

For those investors with special insights and views, tilting with single factors might be appropriate. In BlackRock’s 30+ years of experience in active management and research in factor investing, we have observed some key predictors that may contribute toward forward-looking performance of individual factors and publish these on a quarterly basis.

Factor diversification

For investors looking to outperform the market over time, multifactor strategies are optimised to seek to provide diversified exposure to several factors: quality, momentum, value and size.

Diversification means that when one strategy might underperform, like value during an economic recession, another strategy – like quality – might pay off. Factors tend to have low correlations with one another, so a multifactor strategy can potentially benefit in a number of market environments. Multifactor strategies can have sector, country, and risk characteristics which are similar to well-known equity benchmarks. As such, they can potentially work well as long-term core allocations.

Multifactor portfolios can further benefit from a rebalancing bonus: they are periodically rebalanced back to targeted factor weights, providing a simple and powerful mechanism that seeks to buy low and sell high. Importantly, the rebalancing process for smart beta strategies is automatic. This point is important because buying when prices are dropping through the floor can be a difficult task for any human being. Similarly, manually pressing the ‘sell’ button when prices continue rising can be challenging. A mandatory rebalancing policy forces investors to do both, which can help lock in realised gains and ensure portfolios remain well diversified.

A growing asset class

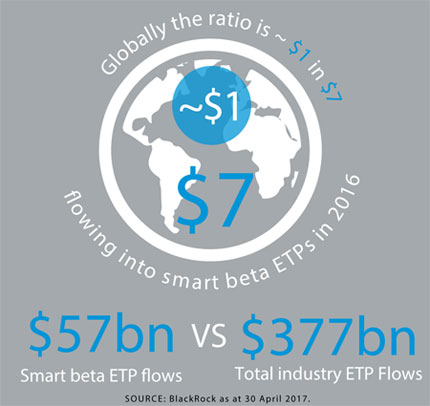

Global Smart beta assets reached a record high of $534 billion at the end of January 20171. The impressive growth observed in smart beta ETFs demonstrate that ETFs have been one of the preferred vehicles for accessing factor investing in a transparent and affordable way. Although institutional investors have been early adopters of factor investing, the growing availability of ETFs have created new ways for the broader investor types to access this type of investing.

1 Source: Bloomberg as at January 31, 2017

Disclaimer Regulatory Information BlackRock Advisors (UK) Limited, which is authorised and regulated by the Financial Conduct Authority (‘FCA’), having its registered office at 12 Throgmorton Avenue, London, EC2N 2DL, England, Tel +44 (0)20 7743 3000, has issued this document for access by Professional Clients only and no other person should rely upon the information contained within it. For your protection, calls are usually recorded. Restricted Investors This document is not, and under no circumstances is to be construed as an advertisement or any other step in furtherance of a public offering of shares in the United States or Canada. This document is not aimed at persons who are resident in the United States, Canada or any province or territory thereof, where the companies/securities are not authorised or registered for distribution and where no prospectus has been filed with any securities commission or regulatory authority. The companies/ securities may not be acquired or owned by, or acquired with the assets of, an ERISA Plan. Risk Warnings Investment in the products mentioned in this document may not be suitable for all investors. Past performance is not a guide to future performance and should not be the sole factor of consideration when selecting a product. The price of the investments may go up or down and the investor may not get back the amount invested. Your income is not fixed and may fluctuate. The value of investments involving exposure to foreign currencies can be affected by exchange rate movements. We remind you that the levels and bases of, and reliefs from, taxation can change. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. The data displayed provides summary information. Investment should be made on the basis of the relevant Prospectus which is available from the manager. In respect of the products mentioned this document is intended for information purposes only and does not constitute investment advice or an offer to sell or a solicitation of an offer to buy the securities described within. This document may not be distributed without authorisation from BlackRock Advisors (UK) Limited. © 2017 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK, SO WHAT DO I DO WITH MY MONEY and the stylized i logo are registered and unregistered trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. Issued in the Netherlands by the Amsterdam branch office of BlackRock Investment Management (UK) Limited: Amstelplein 1, 1096 HA Amsterdam, Tel: 020 – 549 5200.

©2017 funds europe