Global Tactical Asset Allocation became more important to investors – particularly in the UK – in the unusual Q2 market environment, finds CAMRADATA.

The first half of 2022 presented institutional investors with an unusual market and economic environment, with generally both equity and fixed income markets experiencing sharp declines. Given the unique nature of the current market environment, many investors have been unsure about what to do with their portfolios. It is therefore perhaps not surprising that the institutional investor usage in Camradata Live increased in the second quarter of 2022 in comparison to the first quarter.

This is demonstrated by the increase in asset manager searches, asset class searches and performance exports. The database users are mainly consultants, insurance firms and pension schemes.

Global Tactical Asset Allocation is the seventh-most researched asset class by institutional investors in Q2 in comparison to being the 11th most researched asset class in Q1. In terms of geographical focus, the research activity is higher for this asset class from UK institutional investors when compared to other countries.

Tactical asset allocation is a multi-asset investment approach that generally encompasses a range of top-down macro-investment strategies. The key objective for this asset class is to deliver excess returns through asset allocation such as asset class, country or sector level rather than through individual security selection.

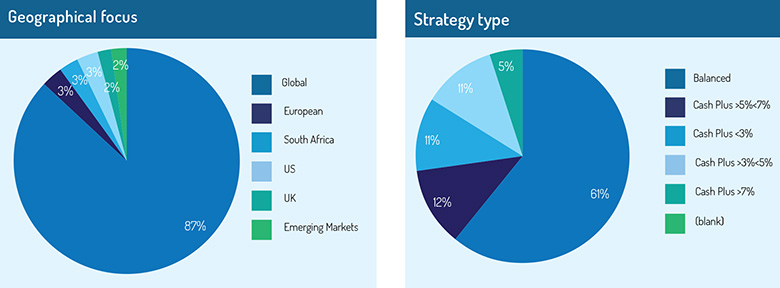

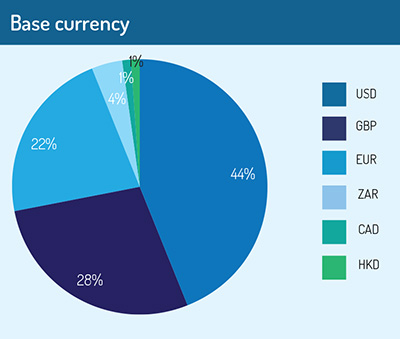

There are more than 120 vehicles with the style of tactical asset allocation. The geographical focus is predominantly global, but there are also some vehicles that focus specifically on emerging markets, European, global, UK and US as well as South Africa. The performance returns of Global Tactical Asset Allocation in USD for one year ranged from 44.83% to -20.19%.

The peer group analysis shown here states the performance and risk taken in absolute and relative terms. In relative terms, for the three-year period to June 30, 2022, 15 of these vehicles have performed above the benchmark return and all vehicles took more risk than the benchmark to achieve this. Whereas for the one-year period to June 30, 2022, ten of these vehicles have performed above the benchmark return and again all vehicles took more risk to achieve this.

The peer group analysis shown here states the performance and risk taken in absolute and relative terms. In relative terms, for the three-year period to June 30, 2022, 15 of these vehicles have performed above the benchmark return and all vehicles took more risk than the benchmark to achieve this. Whereas for the one-year period to June 30, 2022, ten of these vehicles have performed above the benchmark return and again all vehicles took more risk to achieve this.

Camradata’s proprietary IQ tool shows the top 20 best-performing managers for an asset class. The best-performing manager in the Global Tactical Asset Allocation (USD) universe for the three years to June 30, 2022 was IM Global Partner with its product SEI Liquid Alternative Composite (gross of fees). This vehicle achieved an excess return of 7.76% over the benchmark whilst taking excess risk of 7.86% to achieve it.

The current uncertainty in the market is caused by many factors, a significant one currently being the rate of inflation. Central banks will continue to focus on bringing down the rate of inflation, attempting to navigate a slowdown in economic growth and avoid a recession.

Medium-term market pricing continues to suggest an expectation that inflation will eventually fall back, though markets are pricing in an increased risk that this is at the cost of a contraction in output.

The economic side-effects of the war in Ukraine, and the supply chain scars caused by Covid-19, provide additional complexity and uncertainty in the calibration of monetary policy. Perhaps, therefore, now is not the time for changes, but institutional investors should stay invested and maintain a disciplined investing approach to remain aligned with their targeted allocation.

*All figures are as of June 30, 2022, unless otherwise stated.

© 2022 funds europe