In today’s intensely climate-conscious culture, we may well see more vehicles managed under the Net Zero Carbon approach.

The Net Zero Asset Managers Initiative introduced in December 2020 includes global asset managers who are supporting the transition to net-zero greenhouse gas emissions by 2050.

Following this launch, CAMRADATA decided to research which asset managers have the capability and are currently managing funds under the Net Zero Carbon approach.

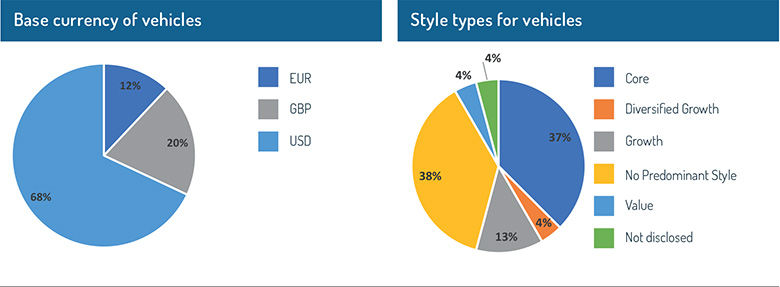

This research created a universe of 25 vehicles, managed by 16 asset managers (see the large table opposite). The base currencies of these vehicles included USD (68%), GBP (20%) and EUR (12%).

Asset classes varied across Equity, Multi Asset, Private Markets and Fixed Income. The geographical focus included Global, Emerging Markets, US, UK, European and European Inc. UK. Meanwhile, the style of these vehicles was Value (4%), No Predominant Style (38%), Core (37%), Growth (13%) and Diversified Growth (4%).

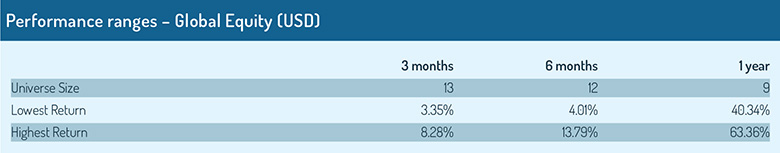

The majority of vehicles currently managed by the Net Zero Carbon approach are Global Equities (USD), equating to 13 vehicles, the analysis highlighted.

The performance range for the past three months for this asset class was 3.35% to 8.28%. See the table for six-month and one-year performance ranges.

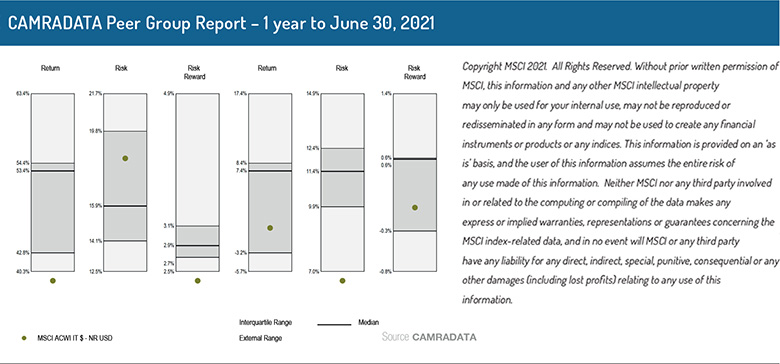

The peer group report compares the performance and risk of the Net Zero Carbon – Global Equities (USD) funds. The first three bars are based on absolute figures whereas the last three are based on relative figures. The last three show how the funds within the universe have performed in direct relation to a chosen benchmark.

For the one-year period to June 2021, six of these vehicles have performed above the benchmark return and all vehicles took more risk to achieve this in comparison to the benchmark. There was in fact one vehicle that achieved an additional 1.4% return for every 1% risk it was taking above the benchmark.

More to come

As part of this research, CAMRADATA also had conversations with many other asset managers, including Troy Asset Management, which is in the process of aligning its portfolios to meet this Net Zero Carbon goal.

As a result, we expect to see an increase in these types of vehicles being added into CAMRADATA Live in the foreseeable future, especially as the demand for them from asset owners grows and more asset managers commit to support the goal of net-zero emissions by 2050 or sooner.

*All figures are to June 30, 2021 unless otherwise stated.

© 2021 funds europe