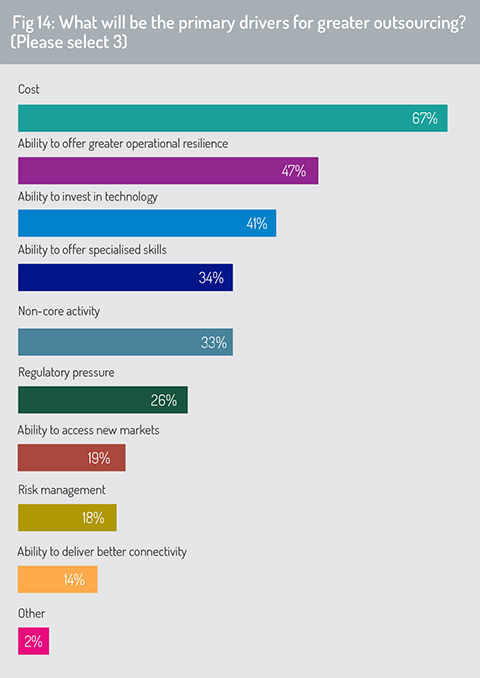

Building on this theme, the survey asked respondents to identify which factors will be the primary drivers of outsourcing across the asset management industry (fig 14).

The response was unequivocal. Cost pressures will be the dominant factor (67%). Companies will aim to reduce their headcount, technology and maintenance expenditure – and more generally to translate fixed into variable cost through outsourcing.

The response was unequivocal. Cost pressures will be the dominant factor (67%). Companies will aim to reduce their headcount, technology and maintenance expenditure – and more generally to translate fixed into variable cost through outsourcing.

Survey results indicate that, in the wake of the pandemic, companies are also seeking to establish a higher level of operational resilience by outsourcing services that they currently manage in-house (47%). Perhaps unsurprisingly, respondent firms will look to outsourcing partnerships to strengthen their technology capability and to access specialist skills that are not currently available internally.

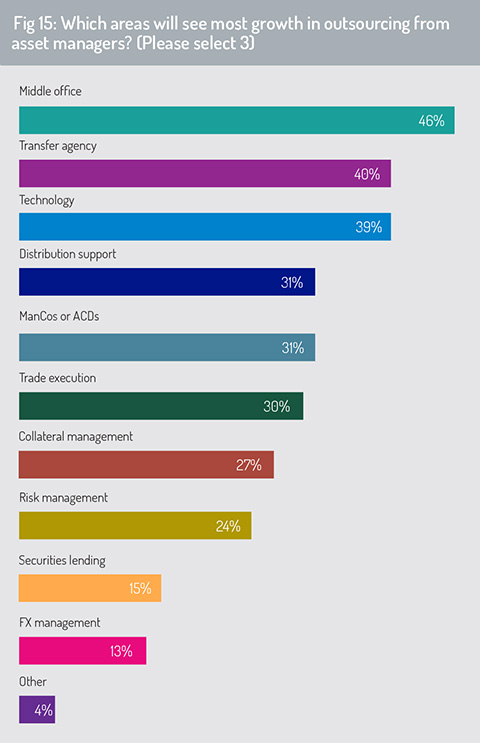

The strongest acceleration in service outsourcing, respondents tell us (fig 15), will take place for middle-office services (46%). While asset managers typically wish to retain key functions in-house that feed their competitive advantage, they may be willing to outsource ‘non-core’ support functions to a specialist third-party provider.

One example may be for investment firms still meeting their transfer agency requirements in-house to outsource this to an external specialist, either on a modular basis or as part of a bundled package from their asset servicing partner(s). The survey finds that buy-side firms may also outsource to meet their requirements for technology renewal and innovation.

One example may be for investment firms still meeting their transfer agency requirements in-house to outsource this to an external specialist, either on a modular basis or as part of a bundled package from their asset servicing partner(s). The survey finds that buy-side firms may also outsource to meet their requirements for technology renewal and innovation.

Digital transition

According to Schroders’ group chief executive, Peter Harrison, technology has been at the heart of his company’s response to Covid-19, facilitating collaboration across business units and safeguarding business resilience. Even before the pandemic, this asset management group has been working to establish an infrastructure for ‘unhindered flexible working’, helping teams to cross-fertilise ideas within the company and for portfolio managers, analysts and traders to achieve the same working experience, whether working in the office, at home, or from a disaster-recovery site.

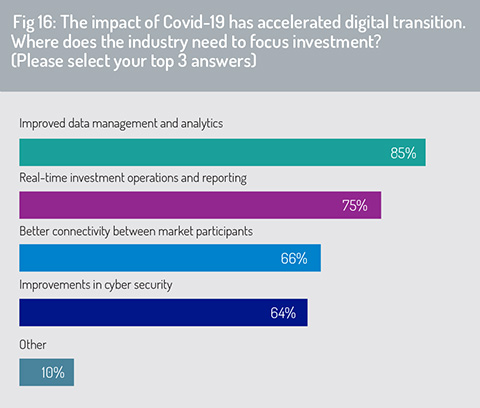

But where does the industry need to focus its attention to realise most gain from its investment in digital transition (fig 16)?

The need to invest in data management and analytics is the most pressing issue identified by respondents (85%). This is a wide-ranging category that embraces many priorities highlighted in this report. Additionally, respondents prioritised efforts to move to real-time (or near-real-time) investment operations and reporting (75%) and a need to improve connectivity between participants (66%). Improvements in cyber security (64%) ranked fourth in this list.

The ability to manage large data volumes and high data velocity is fundamental to a wide array of functions in the asset management industry – as an input to factor-based and quantitative investment strategies, for example, or for conducting analysis of customer buying preferences as a driver for its product development and distribution strategy.

The ability to manage large data volumes and high data velocity is fundamental to a wide array of functions in the asset management industry – as an input to factor-based and quantitative investment strategies, for example, or for conducting analysis of customer buying preferences as a driver for its product development and distribution strategy.

Another fundamental requirement in effective data management – the ability to accommodate data variety – is also becoming increasingly important. Investment teams are drawing insights from a wide range of alternative and unstructured data sets to inform their investment strategies. Beyond the investment decision, this expertise may be important, for example, when applying ESG screening to assets held in portfolio or received as collateral in secured finance transactions.

In the ‘Other’ category, respondents highlighted the importance of effective channels to support digital engagement with customers. In the context of remote working, a number of respondents prioritised standardisation of market practice around digital document signatures.

Several respondents also highlighted the potential benefits offered by blockchain in supporting centralised record-keeping, reconciliation and safekeeping across the investment value chain, including custody services.

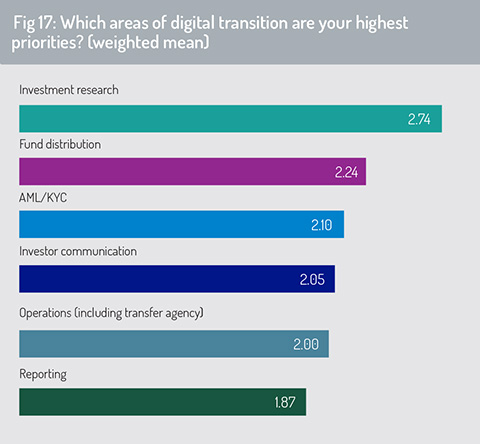

When asked which areas of digital transition are most important to respondents’ firms, the survey finds that the highest priority is in digitalisation of investment research (fig 17). Asset management firms are seeking access to new data sources to support their investment decision-making, including alternative data sets to support alpha generation and to enable their ESG strategies.

Second in the rankings is the need to improve digital transformation in fund distribution – including digital transmission of fund subscription/redemption instructions, the ability to bring greater automation to anti-money-laundering/know-your-client (AML/KYC) verification and improved automation of fee and commission payments.

Second in the rankings is the need to improve digital transformation in fund distribution – including digital transmission of fund subscription/redemption instructions, the ability to bring greater automation to anti-money-laundering/know-your-client (AML/KYC) verification and improved automation of fee and commission payments.

Alongside the sales component of the distribution function, key parties to the fund transaction may require a wider range of services including managing distributor agreements, rebate calculation and processing, support with compliance reporting, communicating data on distributor sales, and access to product information and fund documentation through a single point of access.

Many of these tasks have traditionally been manual and resource-intensive. The distribution and distribution support functions are now benefiting from investments to improve digital engagement, improving STP rates and lowering operational risk, as well as delivering a better client experience to the investor. This is vital to improve cost-efficiency and to meet the investment objectives of younger generations.

© 2021 funds europe