Investment into private markets has surged over the past decade, with many institutional investors and private wealth clients responding to a low interest rate, low fixed income yield environment by increasing allocations to private markets.

A recent research paper by PwC predicts that assets under management in private market strategies are likely to grow between US$4.2 trillion and US$5.5 trillion in the period to 2025, boosting aggregate AuM in the sector to between US$13.7 trillion and US$15.0 trillion. PwC forecasts that private markets will represent more than 10% of global AuM by 2025 in its base-case scenario.1

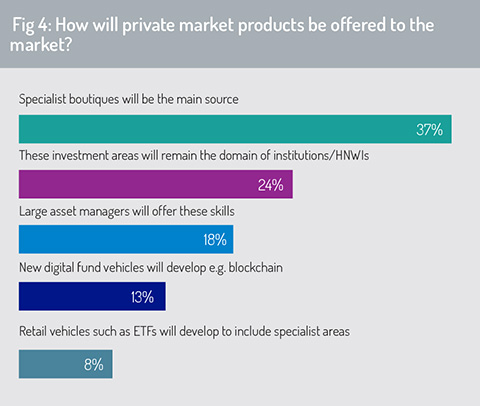

Against this backdrop, this Funds Europe survey finds that specialist investment boutiques (cited by 37% of respondents) will be the primary route through which investors access private market assets (fig 4). This was more than double the percentage of those who believed that these specialist products will be sourced from large asset management houses.

Against this backdrop, this Funds Europe survey finds that specialist investment boutiques (cited by 37% of respondents) will be the primary route through which investors access private market assets (fig 4). This was more than double the percentage of those who believed that these specialist products will be sourced from large asset management houses.

Over time, specialist fund managers may look to new issuance models, particularly tokenised issuance of fund units on blockchain (13%). This offers benefits in terms of improved liquidity, potentially making illiquid assets available to a wider community of investors and allowing these to be traded more cheaply and easily in the secondary market. When they are ‘tokenised’, assets can also be ‘fractionalised’ – traded in smaller denominations – thereby reducing the minimum investment.

The overarching message from these survey results is that there is a position for both specialist boutiques and larger asset management houses in supporting investors’ appetite for private market products. However, fund managers will need to pick their optimal position. Boutique investment houses need to target strategies and products where they have market-leading skills and can deliver outperformance.

Asset managers seeking to establish scale in the private markets area will need to identify how they can grow most effectively, whether through acquisition, through building their capability internally, and/or through entering into strategic partnerships and alliances. These choices each shape how the firm meets its requirement for talent, for technology and how it expands its sales pipeline.

Intuitively, we anticipate that asset managers may look to position themselves towards either end of this barbell – as specialist boutiques or through creating scale. Firms that lack specialisation or scale may struggle to compete in the medium term.

Respondents were asked to rank opportunities in private markets asset classes, rating these opportunities from ‘very strong’ (4) to ‘weak’ (1). These were then listed in order on the basis of weighted mean, calculated from these survey responses (fig 5).

The survey finds that, in respondents’ view, real estate funds will offer the most attractive opportunities for growth in the coming 12 months (weighted-mean score = 2.54). Private credit (2.25), private equity (2.03) and infrastructure (1.92) featured next, ranked in order of importance.

The survey finds that, in respondents’ view, real estate funds will offer the most attractive opportunities for growth in the coming 12 months (weighted-mean score = 2.54). Private credit (2.25), private equity (2.03) and infrastructure (1.92) featured next, ranked in order of importance.

Real estate specialist CBRE observes that 2020 has been a year of convulsive change. For commercial real estate, many of the conventional measures of market activity, such as investment turnover and leasing demand, contracted sharply during 2020. But values have remained surprisingly resilient in other areas, bolstered particularly by huge fiscal and monetary interventions by governments and central banks.

For the real estate sector, closures and capacity restrictions in the retail and hospitality sectors have created inevitable challenges. However, new demand has also emerged over this period. The logistics sector offers opportunities as the UK and western European economies bounce back after Covid-19, backed by greater implementation of sales and leaseback strategies. Although the commercial office sector will restructure with the move to out-of-office working, CBRE reports that Grade A offices appear to be trading at a premium. Data centres are another niche sector that has benefited from the rise in home working and the transition to digital. (CMRE, 2021 EMEA Real Estate Market Outlook, pages 3-9)2

Preqin, a provider of data and analysis for alternative investments, indicates that there was a flight towards larger real-estate providers as the pandemic took hold. Real estate megafunds attracted 75% of the aggregated capital raised in Q2 2020, a rise from 59% in Q2 2019. In the face of market volatility generated by the pandemic, Preqin finds that there has been strong correlation between AuM growth and the brand strength of leading private markets fund managers, with the market share of strongly branded names increasing substantially over this period.3

This may be reinforced by the ability of larger asset management groups to apply technology to deliver competitive advantage. In private credit strategies, for example, analytics and AI are being applied to profile potential borrowers and evaluate credit risk. In private equity, the ability to apply alternative data sets, to manage big data and to apply advances in analytics is enhancing opportunities for some managers to identify value in private equity transactions and to provide ex-ante analysis of how key value drivers will perform under different investment conditions.

ESG standards

Almost a quarter of a century after the Kyoto Protocol, which established a practical framework for implementing the United Nations Framework Convention on Climate Change, the financial industry’s progress in meeting commitments to environmental, social and governance principles has at times been disappointingly slow.

But climate change is moving to the forefront of the regulatory and policy agenda in Europe. In the UK, this will be prominent as the UK government hosts the COP26 UN Climate Change Summit in Glasgow – and may be used by the country’s policymakers to reinforce its appeal as an investment destination after Brexit. Across the Atlantic, the Biden administration has shown initial signals that it intends to reintegrate the US into global environmental policy initiatives.

The Task Force on Climate-related Financial Disclosures (TCFD) has set out recommendations for helping businesses to disclose climate-related financial information, guiding governance around climate-related risks and opportunities, strategy, risk management and the use of metrics and targets. Established by the Financial Stability Board in December 2015, with more than 30 global members, its recommendations apply to a broad range of financial organisations, including institutional investors, asset management companies and banks. Its aim is to encourage voluntary, climate-related financial disclosures that are useful to investors, lenders and insurance underwriters in understanding material climate-related risks.

The TCFD is explicit about the key role to be played by beneficial owners and fund managers in promoting this initiative. It states: “Large asset owners and asset managers sit at the top of the investment chain and, therefore, have an important role to play in influencing the organisations in which they invest to provide better climate-related financial disclosures”.4

The TCFD is explicit about the key role to be played by beneficial owners and fund managers in promoting this initiative. It states: “Large asset owners and asset managers sit at the top of the investment chain and, therefore, have an important role to play in influencing the organisations in which they invest to provide better climate-related financial disclosures”.4

As a component of the European Commission’s Sustainable Finance Action Plan, the Sustainable Finance Disclosure Regulation (SFDR) requires fund managers, financial advisers, and some other categories of regulated firms with activities in the EU to disclose information to investors on the ESG implications of their investment strategies.

European regulators published their final report on the draft regulatory technical standards (RTS) for SFDR on February 4, 2021. EU member states were required to implement key provisions of the regulation (i.e. Level 1) by March 10, requiring financial institutions to provide reporting on their sustainability activities at both legal entity (i.e. company) and product levels. However, some Level 2 provisions have been delayed subject to consultation on the draft RTS.

The UK has elected not to follow the SFDR or the EU’s taxonomy on ESG funds. Consequently, any firms intending to market their ESG funds in the UK and EU will need to comply with more than one set of disclosure requirements.

The UK has elected not to follow the SFDR or the EU’s taxonomy on ESG funds. Consequently, any firms intending to market their ESG funds in the UK and EU will need to comply with more than one set of disclosure requirements.

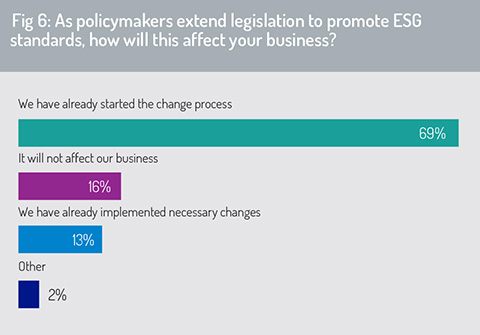

When we asked survey respondents how their business will be affected as policymakers extend legislation around ESG, almost 70% say that they have started the change process of integrating ESG standards into their investment strategies. A further 13% said that they have already implemented necessary changes under this ESG agenda (fig 6).

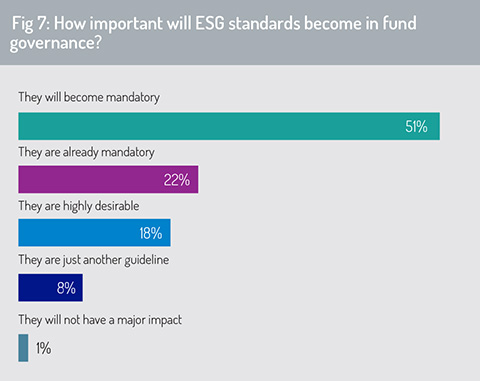

From fig 7, the majority (51%) of respondents believe that ESG standards will be (or already are) a mandatory component of investment fund governance. This substantially outweighs the 18% of respondents that believe that ESG standards are ‘highly desirable’ in the investment process, but will not be mandated by policymakers or financial authorities. Only 1% said that ESG standards will have no impact on fund governance.

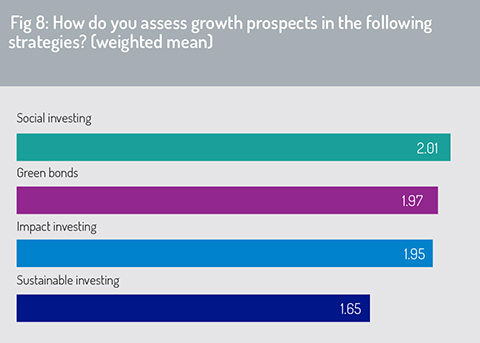

These trends, in respondents’ opinion, will translate into a significant rise in demand for social investing, green bonds and impact investing strategies (fig 8). Impact investing strategies are targeted to generate a positive, measurable social and environmental impact in addition to generating a financial return.

Social investment, according to the European Commission, is largely about investing in people. It refers to investment policies designed to strengthen people’s skills and capacities and to support them in participating fully in employment and social life. This may include investment in key policy areas such as education, healthcare and childcare, assistance with job searches and with rehabilitation.5

Social investment, according to the European Commission, is largely about investing in people. It refers to investment policies designed to strengthen people’s skills and capacities and to support them in participating fully in employment and social life. This may include investment in key policy areas such as education, healthcare and childcare, assistance with job searches and with rehabilitation.5

Green bonds are debt instruments issued to fund projects that promote a positive environmental or climate impact. The first green bond, the European Investment Bank’s (EIB’s) Climate Awareness Bond, was issued on the Luxembourg Stock Exchange in 2007. Currently, the EIB is the world’s largest issuer of green bonds.

1 – https://www.pwc.com/gx/en/news-room/press-releases/2021/prime-time-private-markets.html

2 – https://www.cbre.co.uk/research-and-reports/2021-EMEA-Real-Estate-Market-Outlook

3 – https://www.preqin.com/insights/research/blogs/capital-concentrates-but-private-real-estate-gps-see-opportunity

4 – Task Force on Climate-related Financial Disclosures, “Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures”, June 2017, page iii, https://assets.bbhub.io/company/sites/60/2020/10/FINAL-2017-TCFD-Report-11052018.pdf

5 – https://ec.europa.eu/social/main.jsp?catId=1044

© 2021 funds europe