Faced with a new investment paradigm, investors must seek a means of accessing the wider world of private markets, argues Tom Douie, founding partner and CEO of PM Alpha.

We are at a long-term inflexion point in geopolitics, economic outlook and the resulting investment landscape. The ‘norms’ that have pervaded our lives, at least in the democratic West, and have informed our investment decisions (such as low/absent inflation, low negative interest rates and a geopolitical order clinging to an ageing super-cycle of ‘globalisation’) have come to an end. What replaces them is arguably a shift back to a more ‘normal’ capitalist system, ending the seemingly perennial calls of ‘lower for longer’ fairly abruptly on one hand, and an establishment of a new ‘bi-polar’ geopolitical world order that feels more like a sudden realisation of something that has been 20 years in the making.

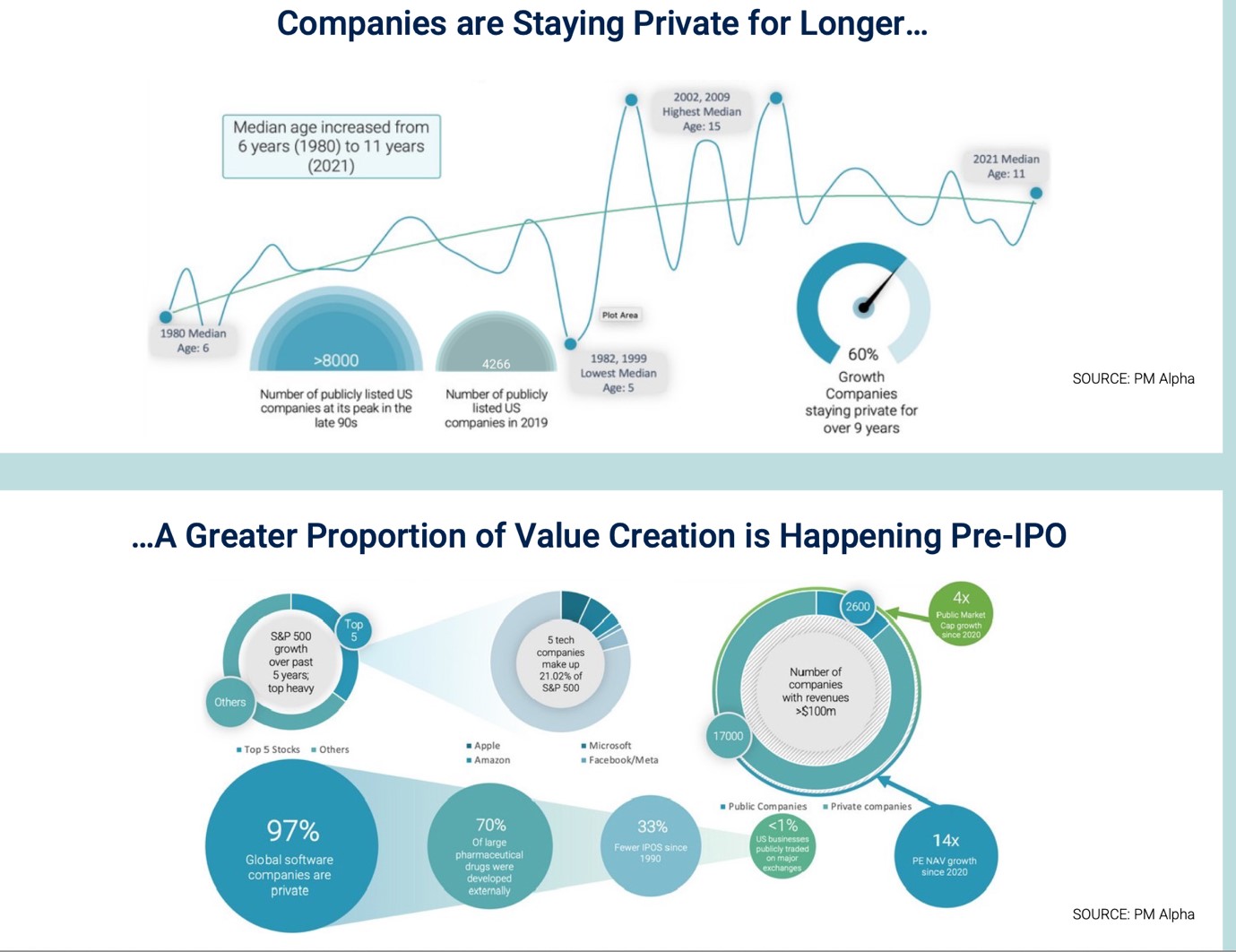

What does it mean for the savers and investors in our society? The central bank fuelled asset bubbles of the last 15 years are spent, and simply owning real estate, equity or corporate debt will be unlikely to provide the market returns enjoyed by investors for almost a generation. It has always struck me as odd that if investment returns are ultimately pegged to global economic growth, the pervasive means of providing exposure to that, the public debt and equity markets, represent such a small proportion of global economic activity. Furthermore, that representation has actually been falling over the last couple of decades, with the number of companies represented on world equity markets diminishing year over year.

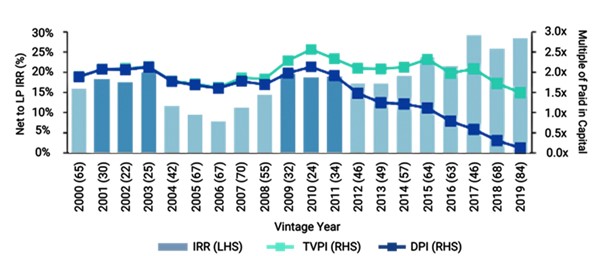

Faced with a new investment paradigm and an increasingly unsatisfactory means of addressing it, investors must seek a means of accessing the wider world of private markets. The good news is that not only are they broad and diverse enough to provide a means of addressing almost any investment exposure that an investor desires, but history shows that periods of higher volatility in public markets and economic recession are the best time to allocate to private market investment strategies.

Recession era vintages have shown resilience

As of June 30, 2022 – net to Limited Partners

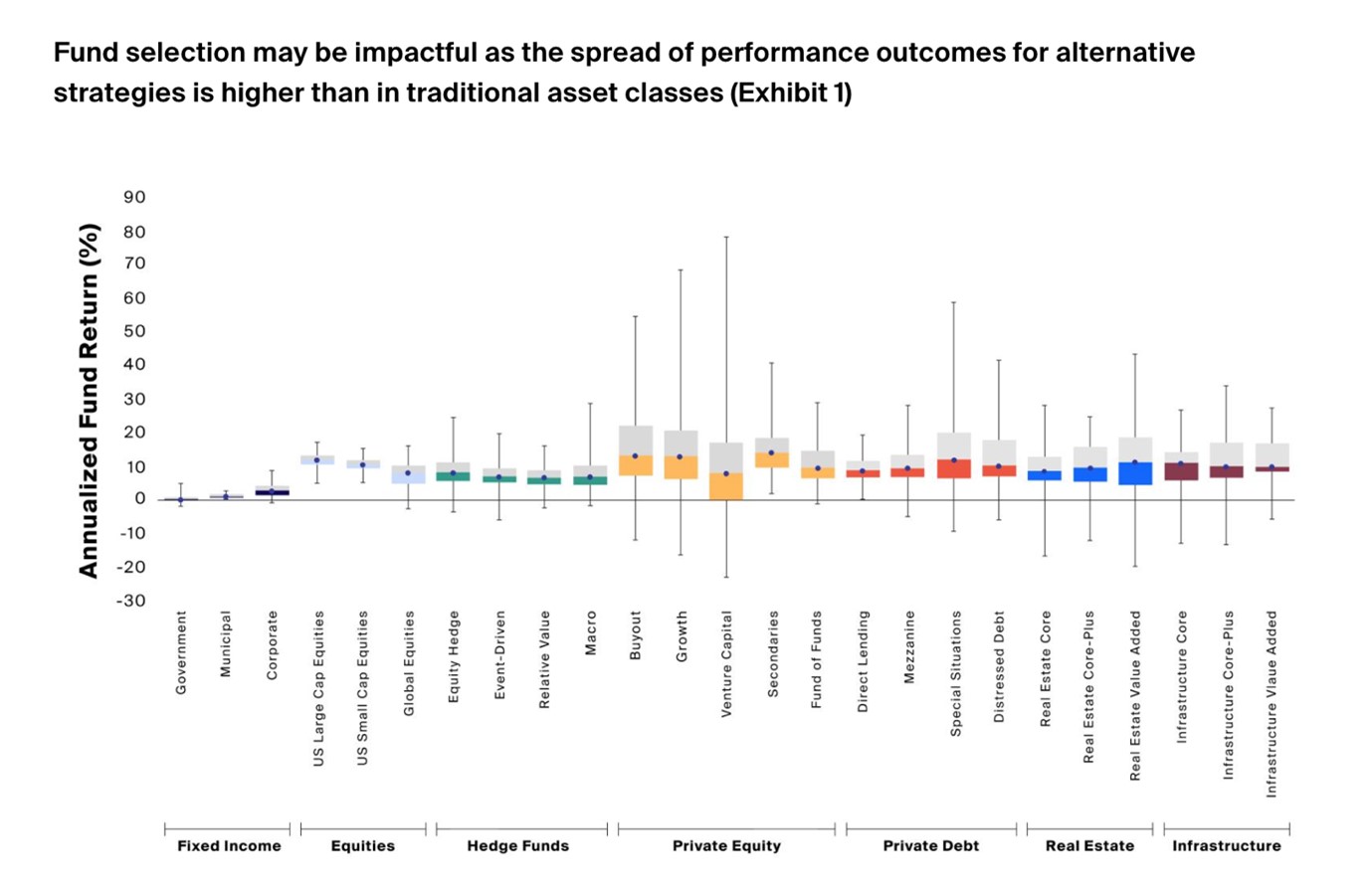

Unlike narrow equity and debt markets, a private markets investor can isolate almost any specific trend or theme, such as investing in the growing need for healthcare, focused on the US and benefit from today’s near-term dislocation in the debt-financing public markets. Or perhaps you want to invest in the infrastructure and technology that is both enabling and benefitting from the global thrust to realising sustainable development practices and ‘near-shoring’ of power generation and industrial production. Both preferences, and many others besides, are possible in a diversified manner, using specialists in investment fields, and the number of options for allocating capital provides a rich universe to pick from for the discerning investor in a market where picking the best demonstrably improves the quality of the investment outcome. Good luck picking a basket of equities able to pinpoint such specific investment exposures.

Dispersion of Managers

With so many investment options available, the choice of exposures and specialists to deliver them can be bewildering for the individual investor and the wealth managers and financial advisors that serve them alike. I believe simplicity is best and to start with the simple long-term ambitions for your investments – what needs to be achieved and identify the key drivers to those desired investment outcomes. Whilst these will likely overlap, there is a clarity that emerges from a framework derived from those decisions, whether investing to weather the storm, to generate an income and or protect against the eroding effects of inflation ends up as the top priority, for example. It is demonstrably next to impossible to time your investments, so stay the course and keep allocating regularly; private markets are characterised as ‘patient capital’, and when confidence in one’s choices feels the least comfortable, it’s conversely likely the best timing for those investments.

Access for non-institutional investors has long been problematic, but that is slowly changing as means of investing in private markets strategies are being revolutionised by fintech platforms and wealth management companies increasingly making the commitment to embrace the wider opportunity set it offers.

Finally, don’t be put off by negative headlines. The fact that institutions have been the driving force of capital inflows for two decades and are likely to continue doesn’t mean that the whole private markets ‘universe’ is awash with too much capital and so ‘too expensive’, just as individual wealth management monies begin their allocations. The market is so broad, and whilst leveraged buyouts and speculative venture capital has been a rewarding space to be allocated to in the past, the current market environment of distressed and dislocated assets available in the private secondary market may provide the appropriate allocations for today. These are different, timely expressions of an investment view – the breadth of opportunity and operators means that you can still hold true to the investment drivers you identified and the long-term secular investment themes that should provide the bulk of the returns needed to meet your investment ambitions.

© 2023 funds europe