Politics remain in focus as we head towards the end of the year, with various issues that have weighed on investor sentiment remaining unresolved: the US–China trade war, the European Commission’s response to the Italian government’s budget deficit plans, Brexit negotiations and the impact of the US mid-term election results.

Despite concerns related to trade tariffs, the US economy continues to go from strength to strength, with the labour market tightening and wage pressures beginning to build. Fed Chair Powell has welcomed these developments, which have given the board confidence to continue on their gradual rate-hiking path. The market has followed the Fed’s lead, and is well priced for a December hike, as well as factoring in a little more than two hikes for next year, which is just one below the Fed itself. Importantly in our view, the latest rate sell-off and repricing was driven by the strong growth numbers, rather than fears of inflation. Our inflation view is similar to that of the Fed in that we do not see any significant inflationary pressures building up. This stance is supported by anchored inflation expectations and the long-term drivers of low productivity, technological change and demographics. As a result, and given the repricing that has now passed, our bias would be to add back to interest rate duration once rate markets settle.

In the eurozone, the ECB has stuck to its commitment of leaving rates unchanged through the summer of 2019. We do not anticipate any hawkish turns in the near term given the growing risks to the outlook from developments in Italy, the impact of trade, and the growth data which has dropped from the highs at the beginning of the year. On Italy itself, uncertainty and volatile price action has left us on the sidelines for the time being, as we wait for more clarity from the European Commission on its planned actions before looking to add back to risk. Whilst spreads have widened, the coalition’s lack of governing experience and track record leaves us cautious, as does the ECB’s reduced support to bond markets compared to previous years. Similarly in the UK, we await more detail on the likelihood of a deal, and if it materialises, its contents, before looking to add back to risk there.

Overall, our bias would be to add back to both interest rate duration and credit exposure from here. The fundamental macro backdrop remains supportive for risk markets in our opinion, given the robustness of global growth, which is being driven by the US, while inflation remains subdued. Furthermore despite fears related to trade wars, we are yet to see a significant slowdown in the data. The Chinese authorities appear to be reacting to any negative impact from the tariffs through more stimulus measures, which should stabilise growth somewhat. In addition, following the October equity-led sell-off, we see positioning as much clearer and valuations as more supportive of risk assets. In the near term, however, a lack of clarity may emerge on how some of the risks described will unfold. This, coupled with a seemingly less liquid and deep market as central banks gradually remove accommodation, does warrant caution and a focus on optimising a portfolio’s liquidity profile.

Turning to strategies, absolute-return strategies as an alternative in the low-yielding and volatile environment remain a key focus of our asset allocation. Such strategies enable investors to optimise their exposure to fixed income markets while keeping volatility in check.

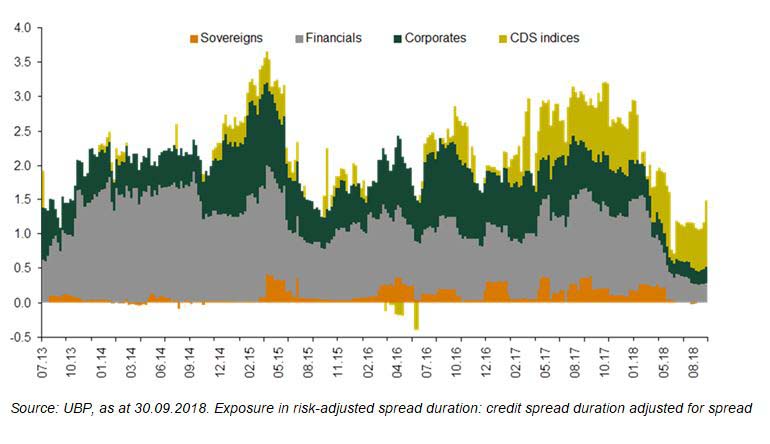

The Global & Absolute Return Fixed Income team manages a low-volatility absolute-return strategy with an objective of overnight cash +2% and limited volatility. This strategy is managed with a macroeconomic and top-down driven process of allocating to the sub-segments of the global fixed income universe. The allocation process is implemented within a strong risk control framework. Active management of the portfolio’s overall credit and interest rate exposure defines how the strategy is managed (see Figure 1) and how the value-added is generated (see Figure 2).

The portfolio allocation to credit is actively managed with changes in terms of risk-reduction of ca. 65% historically in 2015 and in 2017. This year, the risk-reduction was initiated on 7 February, with a key development since then being the increase in the percentage of CDS indices relative to the overall credit exposure (in yellow in Figure 1) from 30% to nearly 70%. The team implements CDS indices as a tool to maximise the liquidity of the portfolio and for relative value reasons.

Figure 1: Active management of the overall credit exposure and of the asset allocation of UBP’s low-volatility strategy in risk-adjusted spread duration

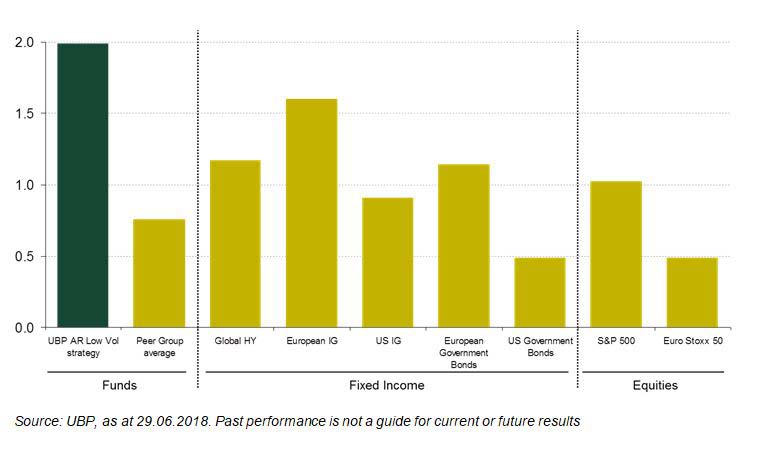

UBP’s low-volatility absolute-return strategy has demonstrated a higher Sharpe ratio than a peer group of flexible bond funds, the key segment in fixed income and also equities. First, the strategy is best in class in terms of optimised risk/reward in fixed income markets with a Sharpe ratio of 2. Second, the strategy exhibits higher Sharpe ratios than the fixed income segments it can invest in, which demonstrates that proactive asset allocation across those segments is adding value. Third, the strategy is a good diversifier to an equity allocation within a broader asset allocation.

Figure 2: Leading Sharpe ratios since June 2013

UBP is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority and is authorised in the United Kingdom by the Prudential Regulation Authority. UBP is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority.

By Mohamed Kazmi, Portfolio Manager & Macro Strategist with UBP Global & Absolute Return Fixed Income team

©2018 funds europe