Fund manager Mickaël Tricot speaks about the results of the second Amundi/Funds Europe emerging markets survey, which focuses on valuations, growth and volatility.

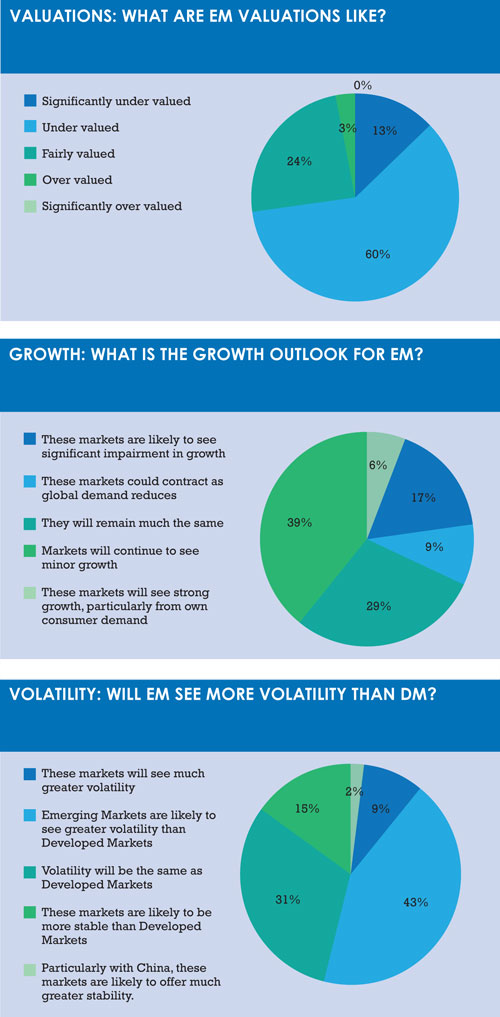

The fact that 60% of respondents to our survey said emerging market assets were undervalued probably reflects the greater interest now shown in these regions. Yet about a quarter of respondents saw the assets as already fairly valued.

Which group is right?

As far as equities are concerned, Mickaël Tricot, fund manager of Amundi’s Emerging Equity Focus Strategy, considers himself in the former camp, albeit only just.

“I agree that emerging market equities are undervalued – but not significantly,” he says. “Whether you view emerging market equities as undervalued or fairly valued depends on whether you base your valuation on price-to-earnings (PE), or on price-to-book.”

Tricot’s approach considers PE ratios, which at 14 times earnings means the PE is above the long-term average, making the stocks look expensive. But using the low return-on-equity for emerging market stocks – which he says is 11%, compared to a ten-year average of 15% – means the PE is closer to nine times earnings.

“Those saying ‘fair value’ are probably looking at price-to-book and thinking corporate profit margins will not recover much. Others, like us, are looking at the return on equity and adjusting the PE to forwards-looking, rather than backwards. On that basis, emerging market equities are relatively attractive.”

From a less technical angle, Tricot’s case for emerging markets hinges a good deal on corporate profits. He does not agree with the notion that profit margins “will not recover much” and thinks many investors – perhaps moving back to the asset class because US growth looks less attractive – do not have the full picture. They are chasing relative returns and not seeing emerging markets in the light of more absolute terms, he says. For Tricot, something deeper is going on and it gets right to the point of corporate profitability.

BETTER PROFIT MARGINS

Emerging market firms increased their debt levels between 2002-10, cutting capital expenditure to manage repayments. The overall level of debt in the MSCI Emerging Market index is now lower than in 2014 and free cash flows are stable.

“Declining credit growth and the cut in capital expenditure that we’ve seen in the last three or four years will lead to better profit margins in the next three or four years,” Tricot says. At some point, corporates will either invest or increase dividends, he adds.

“Companies that have survived through difficult times will be stronger in the next upturn of the cycle.” And once margins improve, investors will see an even stronger case for emerging market equities, he says

GROWTH OUTLOOK

Some 29% of our 85 respondents – drawn entirely from the funds industry – expected emerging markets to see minor growth. More (39%) expected strong growth. Tricot is in the former camp. “I agree that emerging markets will see minor growth – but this is already an improvement on the last four or five years.”

Domestic demand is widely seen as a driver for economic growth in these markets, but Tricot is at odds with this view.

“You cannot isolate that portion of the economy from what is happening elsewhere in the world, where growth is weak,” he says.

“Emerging market growth will probably stay positive but it cannot be independent from what is happening in the rest of the world.”

A number of respondents would agree, as 17% said emerging markets could contract as global demand reduces.

Tricot agrees with the 42% who said emerging markets will see greater volatility than developed markets. A major reason is that most sources of capital for emerging markets are in Europe and the US, so volatility is related to European and US asset managers’ own risk tolerances.

“Dedicated emerging market investors have always wanted to see the pool of domestic emerging market investors increase. This was the case with Chile, which had a high number of domestic investors. When markets have more domestic money, they are more stable,” says Tricot.

At the same time, he says Federal Reserve interest rate moves have less impact on emerging market volatility nowadays. In the 1980s and 1990s, Fed rate hikes caused currency crises because emerging market currencies, being pegged to the dollar, appreciated and high external debts meant governments had to sell reserves to support their currencies.

“We are still dealing with that risk aversion when the US increases rates. But what is better now is that, since the 2013 ‘tapering’ of the Fed’s quantitative easing programme, though there can still be large portfolio outflows, emerging market currencies have depreciated.Currencies are no longer pegged and so central banks in emerging markets do not have to sell reserves. That’s an important structural change.”

The rebound in profit margins that Tricot forecasts, and greater awareness of economic resilience, could make emerging markets a stronger return story. “I’m confident that over the next few years any rate hikes by the Fed will have a less detrimental effect for emerging equities,” he says.

Disclaimer: In the European Union, this document is only for the attention of “Professional” investors as defined in Directive 2004/39/EC dated 21 April 2004 on markets in financial instruments (“MIFID”), to investment services providers and any other professional of the financial industry, and as the case may be in each local regulations and, as far as the offering in Switzerland is concerned, a “Qualified Investor” within the meaning of the provisions of the Swiss Collective Investment Schemes Act of 23 June 2006 (CISA), the Swiss Collective Investment Schemes Ordinance of 22 November 2006 (CISO) and the FINMA’s Circular 08/8 on Public Advertising under the Collective Investment Schemes legislation of 20 November 2008. In no event may this material be distributed in the European Union to non “Professional” investors as defined in the MIFID or in each local regulation, or in Switzerland to investors who do not comply with the definition of “qualified investors” as defined in the applicable legislation and regulation. This document is not intended for citizens or residents of the United States of America or to any «U.S. Person» , as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. This document neither constitutes an offer to buy nor a solicitation to sell a product, and shall not be considered as an unlawful solicitation or an investment advice. Amundi accepts no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi can in no way be held responsible for any decision or investment made on the basis of information contained in this material. The information contained in this document is disclosed to you on a confidential basis and shall not be copied, reproduced, modified, translated or distributed without the prior written approval of Amundi, to any third person or entity in any country or jurisdiction which would subject Amundi or any of “the Funds”, to any registration requirements within these jurisdictions or where it might be considered as unlawful. Accordingly, this material is for distribution solely in jurisdictions where permitted and to persons who may receive it without breaching applicable legal or regulatory requirements. The information contained in this document is deemed accurate as at August 2016. Data, opinions and estimates may be changed without notice. You have the right to receive information about the personal information we hold on you. You can obtain a copy of the information we hold on you by sending an email to [email protected]. If you are concerned that any of the information we hold on you is incorrect, please contact us at [email protected] Document issued by Amundi, a société anonyme with a share capital of €596,262,615 – Portfolio manager regulated by the AMF under number GP04000036 – Head office: 90 boulevard Pasteur – 75015 Paris – France – 437 574 452 RCS Paris www.amundi.com

©2016 funds europe