Nicholas Pratt describes how fund management firms are taking more interest in the networks of their global custodians.

Sub-custodian banks – those often local, sometimes global banks that form the worldwide branch networks for global custodians and their asset manager clients – are under scrutiny as asset managers take an interest in network strength.

Much of this stems from regulations such as Ucits V and the Alternative Investment Fund Managers Directive (AIFMD) that have put asset safety high up the agenda.

The custodian’s management of the sub-custody network is a core element to consider, especially to ensure that networks are built on sound criteria that are regularly checked, market by market, says Nicolas Xanthopoulos, chief executive of Alpha Lux, a wealth and asset management consultancy.

Because asset safety is so important, Matthew Bax, head of global custody in Europe, Middle East and Africa at JP Morgan, says fund firms want to know global custodians understand the entire risks within their sub-custody chains and have the financial strength to support those risks.

This makes sub-custodian selection and monitoring, contingency planning and ring-fencing of assets, among other factors, all important in assessments, he says.

But as accepting as global custodians are of the need for greater due diligence, there is a cost involved. Greater scrutiny takes time and money, although both of these could be reduced if the industry introduced more standardisation into what is a somewhat unstructured service provision, says Mathilde Guérin, global head of sub-custody network management at Societe Generale Securities Services.

Due diligence and monitoring processes lack standardisation, says Guérin. But it is something that the industry is trying to address. The Association for Financial Markets in Europe (Afme) has started a working group to produce a standardised questionnaire for due diligence that can answer at least 80% of common question, says Guérin.

“Fund managers have not been involved so far but we do expect to use it as the basis for our due diligence from the beginning of 2017,” he adds.

A sub-custodian with 100 clients will most likely have to answer 100 different questionnaires, all asking the same questions but in slightly different ways.

NETWORK REDUCTION

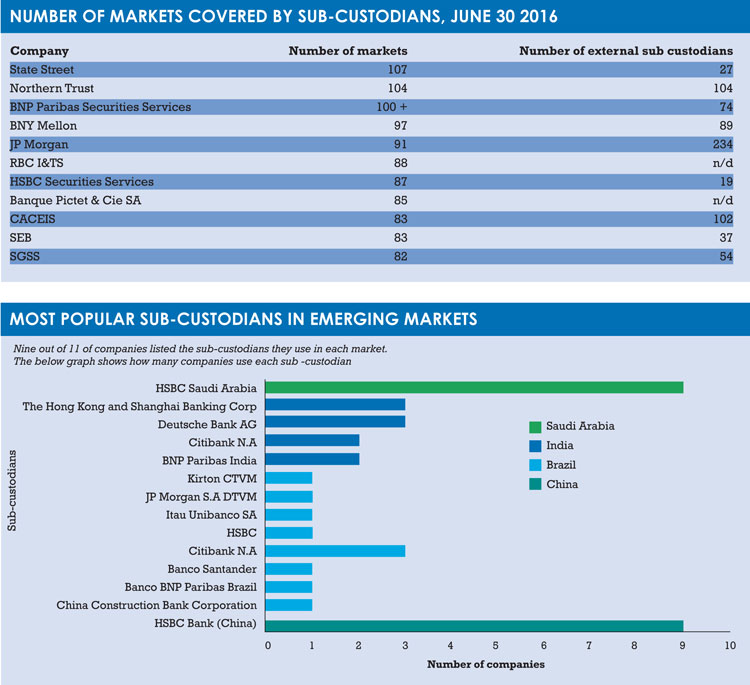

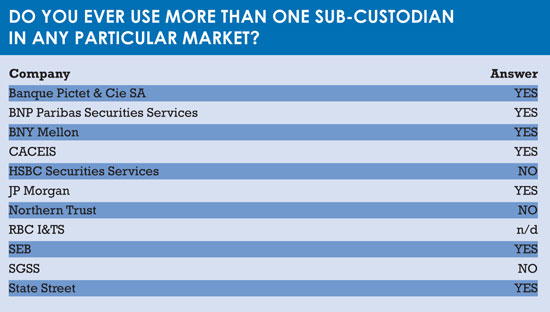

Custodians are also trying to address the cost of enhanced due diligence by reducing the number of sub-custodians they appoint. Funds Europe’s annual custody survey shows that a number of custodians employ only one sub-custodian per country, save for some exceptional countries such as China or the US.

At the same time, however, custodians are also appointing shadow or contingent sub-custodians, which is another cost to consider.

According to Tom Casteleyn, head of product management for custody, cash and foreign exchange (FX) at BNY Mellon, it is a trade-off between the efficiency of having only one provider and the risk mitigation of using more providers.

“Even if that contingent provider is only half-enacted or not enacted at all, I think it is important to have them in place. But you have to assess it on a country-by-country basis. These arrangements have always existed but now these contingencies are becoming more commonplace and with more structured and formal arrangements,” Casteleyn says.

Whether the custodian is able to pass these extra costs on to their fund managers or must absorb them as part of the cost of business, it is a case-by-case debate, he adds.

“For example, if you look at something like the depositary bank role under the AIFMD, those extra responsibilities are increasing the risk and the costs to the depositary – so that has to be compensated in some way.”

HAVING THEIR SAY

In addition to who pays the price of enhanced due diligence, there is also the question of just how much say a fund manager should have in the appointment of sub-custodians.

Fund managers should appoint a custodian with a network aligned to the investment objectives of the fund, says Xanthopoulos at Alpha Lux. “When looking at the underlying sub-custody network, fund managers should assess what optionality there is in certain countries,” he says.

But while global custodians accept the need for greater scrutiny of their selection criteria, few seem willing to let fund managers have a direct say in the appointment process.

The sub-custody network is an integral part of the global custody offering so it is important that it is transparent to fund managers how global custodians select sub-custodians, the criteria involved and the periodic due diligence, says Casteleyn at BNY Mellon.

But he adds: “In general, there is no challenge when a fund manager reviews our sub-custodians. Either [the selected sub-custodian] is a recognised leader or there is a limited choice in a certain market, and we are confident in our selection criteria. Only in some very rare cases could there be legitimate reasons why an alternative sub-custodian would be required.”

But he adds: “In general, there is no challenge when a fund manager reviews our sub-custodians. Either [the selected sub-custodian] is a recognised leader or there is a limited choice in a certain market, and we are confident in our selection criteria. Only in some very rare cases could there be legitimate reasons why an alternative sub-custodian would be required.”

At SGSS, Guérin agrees that it is unlikely that fund managers will take their scrutiny of the sub-custody network further by demanding to appoint their own sub-custodians. This is because of the cost and risk involved.

“We have seen it on some very rare occasions, in markets like China or where they may have an existing relationship with a sub-custodian but we would still need to do our due diligence.”

There is also the fact that AIFMD and Ucits V make the depositary bank liable for any lost assets, even if the fund manager appointed the sub-custodian.

WORK FOR CONSULTANTS

Yet fund managers are using consultants in their tighter focus on custody relationships, says Simone Vroegop, Emea head of consultant relations at State Street. “For example, there has been an increase in requests from consultants to provide regular input to monitor a custodian’s performance. This is no longer limited to pure custody services, but also includes value-added ones.

“Consultants are also increasingly requesting access to online information delivery tools, which their clients can use to monitor their custodian almost on a daily basis, if they wish.”

Benchmarking exercises of pricing and service levels are more common.

Sometimes consultants run these exercises, but also in-house procurement teams might do it, especially where the focus is more price-based than content-driven, says Vroegop.

Custodian ratings have existed for some time but, she says, fund managers seldom use them. The majority prefer to make their decisions based on other elements, such as credit ratings, financial strength, counterparty liabilities and track record.

“On the back of regulatory pressure, consultants are also being hired to make impact assessments of regulation on fund manager operating and service models.

“During the pitching process, this can lead many fund managers to select a provider who can best deliver on FX depositary tasks or regulatory reporting,” says Vroegop.

“Overall, the role of a consultant has changed from being the issuer of a ‘request for pitch’ (RFP) and the provider of a long or shortlist, to a partner at the table who helps to co-create a solution for the client jointly with the custodian, without necessarily issuing an RFP.”

©2016 funds europe