The wide gap in returns – or rather, ‘negative’ returns – for investors in China recently highlights the volatility there and globally. Sean Thompson reveals what CAMRADATA Live tells us about the realities of investing in China.

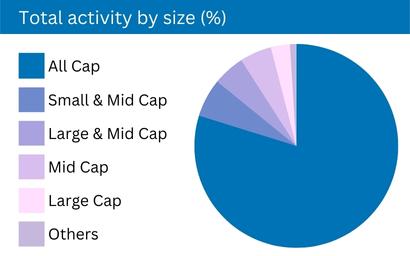

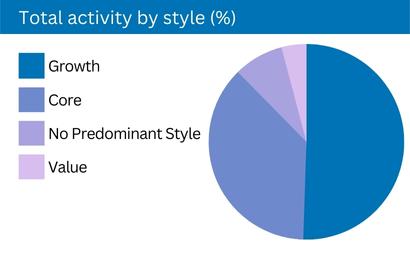

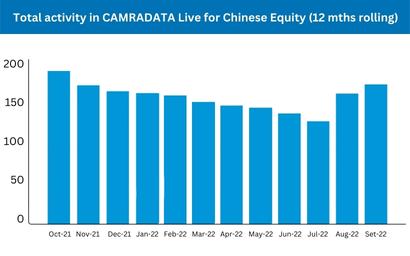

Although China’s economic growth has slowed in 2022, some of the market risks seem to have begun to reduce over time. In CAMRADATA Live, search activity for Chinese Equity by institutional investors has been increasing since July. Most searches have focused on vehicles investing in companies of any size and/or those defined by style as either Core or Growth.

There are more than 50 Chinese Equity vehicles in CAMRADATA Live, of which 85% are in USD. These 50-plus vehicles are managed by nearly 30 asset managers listed in CAMRADATA Live, with some managers offering more than one type of style (Core, Growth, Value, etc.).

At the time of writing, not all asset managers had updated their returns to the end of September 2022; however, those that had showed there had been quite a diverse range of returns in Q3 2022. Of the 33 that had updated their returns, all had produced negative returns in the quarter. The best-performing vehicle delivered a negative return of -7.29%; the worst, -26.85%.

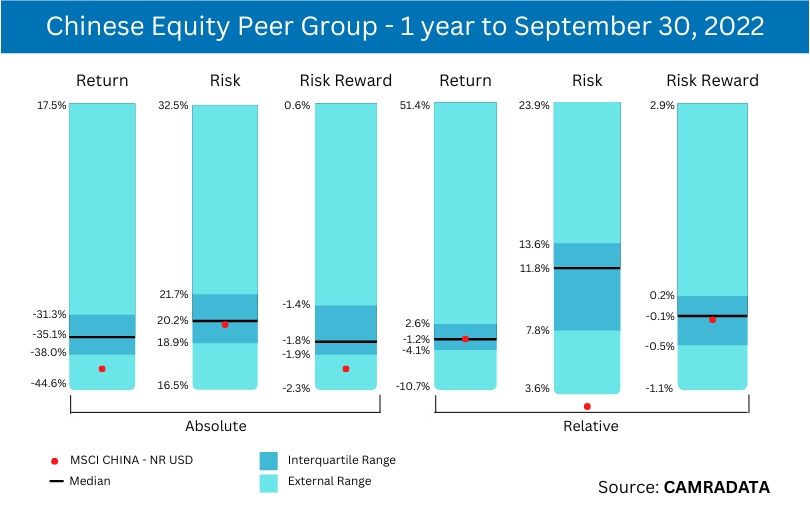

Looking at the 12 months to September 30, 2022, it also shows that all of these vehicles except one had produced negative returns. Performances for this period ranged from +17.48% to -44.60%. This is quite a dispersion in returns and highlights what a challenging period it has been for the China equity market.

CAMRADATA’S proprietary IQ scores show the top manager, with an IQ score of 0.91 over the one-year period in the Chinese Equity (USD) universe, was Fidelity International with its vehicle FF China Focus Fund. ClariVest was second, with the ClariVest All-China product.

To download the full IQ reports for this and other asset classes, please log in to CAMRADATA Live.

Looking ahead… China’s economic growth is expected to be halved in 2022 when compared to 2021. Many factors have affected economic growth in China, including the country’s ongoing real estate downturn, the government’s ‘zero-Covid’ policy, and increased regulation affecting certain sectors.

Looking ahead… China’s economic growth is expected to be halved in 2022 when compared to 2021. Many factors have affected economic growth in China, including the country’s ongoing real estate downturn, the government’s ‘zero-Covid’ policy, and increased regulation affecting certain sectors.

However, after a turbulent few years, we might be hopeful that markets are now looking at a period of relative stability.

Perhaps with a reopening of China, resurgent policy support, lower inflation and a better growth environment, some observers could even argue that asset managers will make the most of this turning point and recover some (if not all) of the losses that investors have had to endure.

Copyright MSCI 2022. All Rights Reserved. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. This information is provided on an ‘as is’ basis, and the user of this information assumes the entire risk of any use made of this information. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) relating to any use of this information.

© 2022 funds europe