Volatility rose in October with the second wave of Covid-19. Sean Thompson reviews manager searches during a difficult month for markets.

October was when hopes for a V-shaped recovery were dashed, with headlines largely dominated by the resurgence of Covid-19 in Europe. The US presidential elections were also a marker. Not surprisingly, financial markets spent much of the month in wait-and-see mode before finally sputtering after widespread lockdown restrictions were announced in Europe.

Positive gains in US and European equities at the beginning of October were completely erased in the last week. In fact, European equities delivered negative returns of over 5% in the month, underperforming most major regions. Asian stock markets were stronger, with positive Chinese economic data helping lift emerging markets. In fixed income, global investment grade credit and emerging market debt were broadly flat, while US and European high yield produced positive returns in the month. European government debt achieved overall returns of around 1%.

There was much volatility and uncertainty. Against this backdrop, investors continued to carry out search activity in CAMRADATA Live, either to seek out new managers or monitor existing investments using peer group analysis to compare and rank asset manager performance.

There was much volatility and uncertainty. Against this backdrop, investors continued to carry out search activity in CAMRADATA Live, either to seek out new managers or monitor existing investments using peer group analysis to compare and rank asset manager performance.

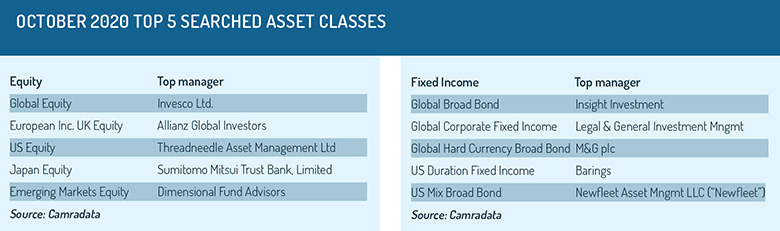

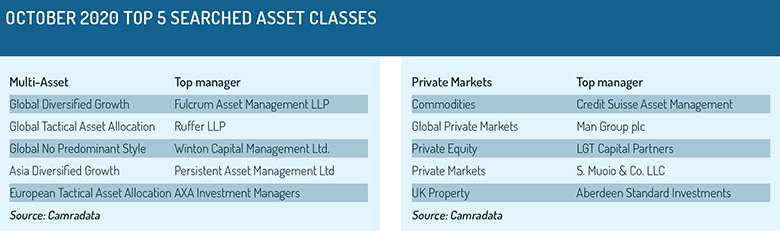

The manager with the most searches in each of the top searched asset classes was Invesco Ltd, including Global Equity. Insight Investment ranked top for Global Broad Bond; Fulcrum Asset Management LLP for Global Diversified Growth; and Credit Suisse Asset Management for Commodities.

Markets are likely to remain volatile until new cases of Covid-19 stabilise and the US political landscape settles.

Markets are likely to remain volatile until new cases of Covid-19 stabilise and the US political landscape settles.

Although there may be a lack of clarity about the short term, longer-term prospects for businesses and markets are not necessarily clouded by the same uncertainty. And if the battle with Covid-19 is largely won in 2021, we can expect many businesses to see their earnings grow again.

In the meantime, central banks look set to maintain support using extremely low interest rates, and governments seem committed to continue spending. If they do, then November may be a tough month, but perhaps we could afford ourselves some festive cheer in December with the expectations of a better year ahead!

Sean Thompson is managing director of CAMRADATA, the owner of Funds Europe. All figures are for three months to September 30, 2020 unless otherwise stated.

© 2020 fund europe