A closer look at what enables moats to weather financial storms.

Warren Buffett was using moats as a metaphor for the economic benefits that companies enjoy when they have built up sustainable advantages that protect their long-term profits and market share from competitors. The wider the moat, or competitive advantage, the better-positioned such companies are to fend off “attacks” – competition – from rival businesses and weather economic downturns.

Companies with wide moats are typically characterised by many, if not all, of the following attributes: intangible assets including brand recognition and patents, network effects that boost the value of a product or service as the user base grows, cost advantages that enable the cheaper production or purchase of goods that undercut potential competition, efficient scale that discourages other would-be competitors from entering the space in which the company in question operates and switching costs which lock customers into a company’s unique ecosystem and make it expensive to move.

The ability of such companies to thrive under challenging circumstances and generate impressive long-term capital appreciation in the process was demonstrated recently in the period spanning 2018 and much of 2019, which saw notable rallies in the overall market as well as significant pullbacks that were better endured by companies with wide moats.

In August of 2018, the overall market notched a milestone as it officially became the longest bull run in history, after an already very strong first three quarters in 2018. VanEck’s US moat strategy managed to keep pace with the strong market, participating in this record-breaking bull run. Although the bull run was impressive and helped drive strong returns throughout the market, it was largely driven by FAANG (Facebook, Apple, Amazon, Netflix, Google) stocks, as well as other technology equities, which the US moat strategy was underweight during most of the year because of these stocks’ elevated evaluations. When markets began selling off in the fourth quarter of 2018, with the FAANG stocks collectively losing roughly 20% of their value, VanEck’s UCITS ETF did not suffer as much, because of this aforementioned underweighting.

In other words, the underweighting of the US moat strategy during this turbulent period in the market was largely attributable to its unique methodology. The Morningstar Wide Moat Focus Index has historically generated impressive relative returns that are not driven by sector or factor-based allocations, but because of its strong stock selection process.

The index begins by screening from the 1,500 global stocks covered by Morningstar’s equity research team of more than 100 analysts, whose research is relied upon by 200 asset managers and 75,000 financial advisers. The roughly 140 companies demonstrating the strongest “wide moat” characteristics are isolated, and then screened again for attractive valuations, which is the market price divided by the fair value price.

Morningstar’s focus on attractive valuations is intended to result in further underexposure to many of the high-flying stocks (such as FAANG companies) that typically come back to earth when markets sell off during financial “storms”. The result is the 40 to 80 companies within the Morningstar Wide Moat Focus Index, comprised of potential high-quality companies with wide, durable moats at attractive valuations at the time they are added to the index.

Morningstar’s focus on attractive valuations is intended to result in further underexposure to many of the high-flying stocks (such as FAANG companies) that typically come back to earth when markets sell off during financial “storms”. The result is the 40 to 80 companies within the Morningstar Wide Moat Focus Index, comprised of potential high-quality companies with wide, durable moats at attractive valuations at the time they are added to the index.

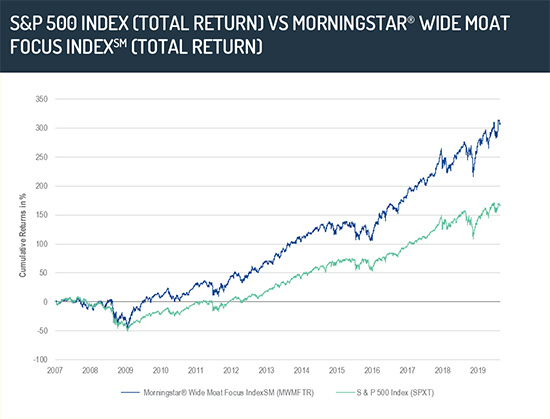

This focus on expert analyst-driven stock selection has continued to bear fruit and outperformance, even in the context of broader gains in the market. Although the S&P 500 posted strong performance during September of 2019, the performance of VanEck’s US moat strategy during the same period of time was approximately double that of the broader US market. While the S&P 500 index has generated a total return of 167.2% since February 14, 2007, the Morningstar Wide Moat Focus Index has generated a return of 308.9%, more than 141 percentage points beyond that of the S&P 500 (as of September 30, 2019). This outperformance was driven almost entirely by stock selection within nearly every market sector. By identifying fairly valued companies with durable economic moats, VanEck’s US moat strategy can help investors navigate treacherous economic waters.

Important Disclosures;

This publication is for marketing and informational purposes only. Morningstar® Wide Moat Focus IndexSM is a trade mark of Morningstar inc. and has been licensed for use for certain purposes by VanEck.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

©2019 funds europe