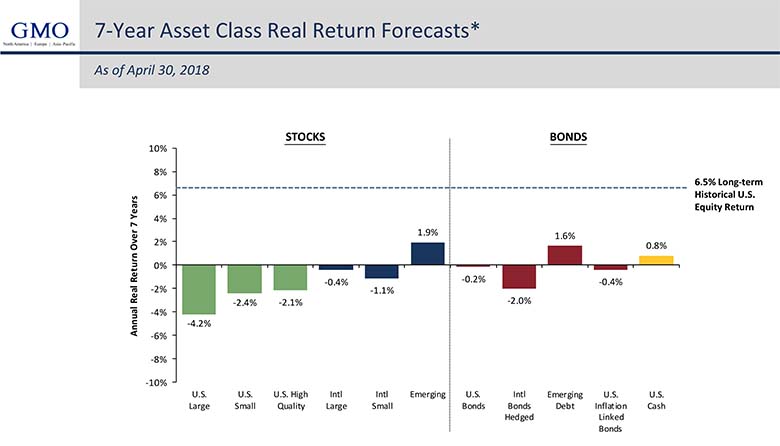

Not one asset class will make a 2% return on investment in the next seven years and many will experience losses, investment manager GMO forecast.

According to GMO’s ‘7 Year Asset Class Real Return Forecasts’ the sharpest dive is expected from US large-caps which are predicted to make losses of 4.2% (see table).

The Boston-based firm, which has offices in London and Amsterdam and manages $71 billion (€60 billion), makes its forecasts on the premise that assets will gradually return to a fair valuation over a seven-year period.

Tommy Garvey, member of GMO’s asset allocation team, said that viewed through this lens, both equities and bonds looked generally expensive.

Only three asset classes were predicted to make returns of which emerging market stocks were the strongest at 1.9% followed by emerging debt with forecast returns of 1.6% and US cash at 0.8%.

Garvey said: “We do take some comfort from the significant disparity across equity markets ranging from exceedingly expensive in the US, to perhaps a little worse than fair for emerging value.”

This translates to high conviction asset allocations in GMO portfolios with a strong preference for emerging equity over developed equity and, within the developed markets, a strong preference for non-US equity over US equity, Garvey said.

GMO finds quality the most attractive factor within the US, while outside the US it maintains a bias towards value stocks, which is particularly pronounced in emerging markets.

©2018 funds europe