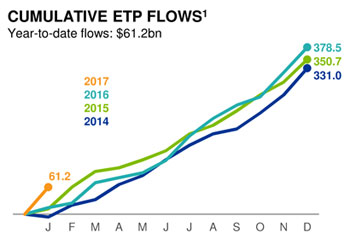

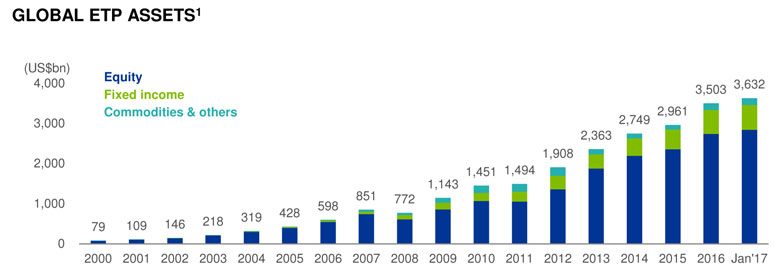

Flows into ETFs and other exchange-traded products (ETPs) globally reached a nine-year high of $61.2 billion (€57.5 billion) in January, according to a report published today by US investment house BlackRock.

January’s flows were only slightly below the pre-financial crash high of $64.7 billion recorded in September 2008, which was the second best monthly figure on record.

The new figures, which also show the best January flows on record, were – according to BlackRock – boosted by global reflation (a combination of rising wages and inflation) which particularly fuelled flows to US and Japanese equity funds.

Of the total, US equities drew in $19.3 billion. Rising optimism about tax reform and economic stimulus boosted small-caps and mid-caps, which gathered $4.3 billion and $4.1 billion respectively, and over $1 billion a piece went into real estate, technology and financial equity sector funds.

Of the total, US equities drew in $19.3 billion. Rising optimism about tax reform and economic stimulus boosted small-caps and mid-caps, which gathered $4.3 billion and $4.1 billion respectively, and over $1 billion a piece went into real estate, technology and financial equity sector funds.

Fixed income gathered $16.6 billion mostly in shorter maturities and in investment grade corporates as flows remained resilient to rising rates.

Japanese equities in January brought in record monthly flows of $10.7 billion, boosted by a weaker yen, rising inflation and better earnings expectations.

Flows into European ETP flows in January amounted to $10.2 billion.

Emerging market equities gathered $2.5 billion amid a rebound in economic activity and a more measured US dollar in January – despite long-term expectations of dollar strengthening due to rising interest rates.

©2017 funds europe