The fund management sector looks set to swoop on the topic of social inequality once markets emerge from Covid-19.

By now you may have read ample articles (like this) that say not only is ESG (environmental, social, governance) investing not dead, but that Covid-19 will reinforce it and, importantly, give more impetus to the ‘social’ dimension.

“Whereas climate change put environmental issues front and centre, the pandemic has elevated urgency on social issues,” says Thomas Kuh (pictured below), head of ESG at Truvalue Labs in San Francisco. “Covid-19 has exposed serious, systems-level problems like inequalities of income and wealth that need to be addressed,” he says.

After analysing data on information flows between January and April, Truvalue found ESG issues such as access and affordability were prominent in the context of the pandemic.

After analysing data on information flows between January and April, Truvalue found ESG issues such as access and affordability were prominent in the context of the pandemic.

Maarten Bloemen of Franklin Templeton Investments’ global equity group, echoes the finding, saying: “The coronavirus has brought a spotlight on several issues in the ‘S’ category of ESG, including social stability, employment, infrastructure, data security and keeping employees and customers safe – whether they are physically interacting or not.”

The above were speaking in a recent article from our ESG report:

Will fund managers and corporates respond materially to the issues of social inequality?

“We believe how companies behave and respond during this time can and will have long-term implications for employee, consumer and community relationships, and will be a key differentiator in the months and even years to come,” says Jonathan Bailey, head of ESG investing at Neuberger Berman.

Analysts at Fidelity International have already predicted that Covid-19 could accelerate acts of social responsibility by companies.

And what about governments?

“The bailouts that are taking place and will continue because of Covid are only just starting, and what it means is that governments – and by extension the people at large who pay for governments’ budgets – can be at the heart of economies like never before,” says Matt Christensen of Axa Investment Managers.

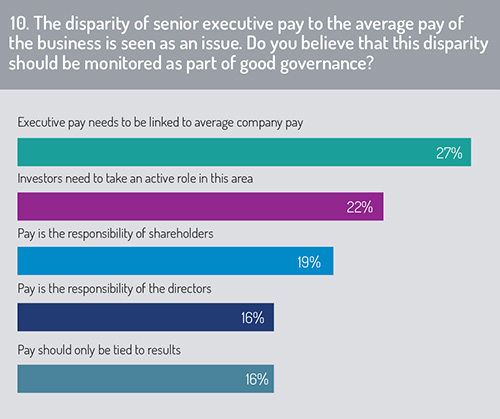

But as with all matters in ESG, fund management companies cannot make demands for corporate behaviour without addressing their own. On the subject of income inequality, recent research by Funds Europe and Caceis and published in our Governance Report 2020 indicated many fund professionals believe CEO pay should be linked to average company pay.