We asked fund manager Mondrian to use CAMRADATA LIVE and explain how the firm’s global fixed income strategy is differentiated and how it provides diversification benefits when used alongside an equities portfolio. Case study written by David Butcher.

When portfolio manager Matt Day talks about diversification, he’s not just thinking about the way global sovereign bonds behave against domestic bonds, or high yield and investment grade corporate credit. He’s also thinking about equities.

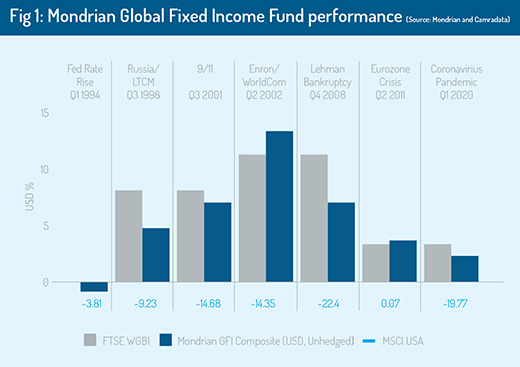

“If you look back at historic periods of market stress, such as when the pandemic first hit, you often see global bonds displaying a lot more calm than equities. That first quarter of 2020 is a case in point. As governments were scrambling to respond to Covid-19, global shares fell some 19%. Global bonds went up by over 3%.”

He thinks that considering periods such as the first quarter of 2020 is critically important – particularly because he believes a bond managers’ returns in such a period are a critical measure of the underlying risk inherent in a bond portfolio and the risks taken to achieve returns.

Over three years – and indeed longer periods – the numbers speak for themselves: three-year annualised returns of 3.80% (relative to the benchmark at 2.75%) for the Mondrian Global Fixed Income Unhedged Composite to the end of March 2022, for example (USD, gross of fees, benchmark is FTSE WGBI). Yet strong performance in a choppy three-year period is only part of the story.

Look back across the full 30 years of the strategy sitting behind the Mondrian Global Fixed Income Fund and you see a repeated pattern. Mondrian’s fixed income team have often offered uncorrelated returns to equities and performed well against the fixed income benchmark (see Fig 1).

Matt Day attributes this success to the team’s measured approach to risk: “We imbed an allowance for risk in the value metrics that we use. In our market – and looking at our fund peer group – we do this in a distinct way. So, we like to think we’re differentiated.”

It’s all founded on an investment process tested over three decades that starts with analysis of prospective real yields, which incorporates Mondrian’s own inflation forecasts and its assessment of each market’s fundamental sovereign credit risks.

This method of assessing value sovereign credit risk includes an approach that draws in macro, ESG, fiscal and external factors, to give the team a rounded view of every potential sovereign investment. This helps the portfolio to avoid getting sucked in to weaker sovereigns when not compensated to take on the risk. Overweight positions to countries such as Mexico and China can and are currently taken, but only because the yields compensate for the inherent risks, in Mondrian’s view.

Conversely, underweights to the US, Eurozone and, biggest of all, the UK demonstrate the interplay of inflation forecasting and sovereign risk allowance in the team’s assessment process.

Non-corporate forms of credit can also be added, using Mondrian’s credit value metrics such as SNCF and Kommunalbanken. These are high-quality credits. They are designed to boost diversification and enhance returns.

Currency positioning can also offer diversification and value. The euro hedged share class of the Fund, for example, currently features modest positions in the currencies of Poland, Norway, and Peru – and is significantly underweight the euro.

Tracking error1 = 0.6711

Such an approach means the fund has a relatively low tracking error of 0.67

As Matt Day comments, “Tracking error will vary over time. But at times we do see lower tracking error versus peers. It’s something we talk to clients about at length because they’re buying into a fixed income strategy; they don’t want active risk that is highly correlated with equity markets.”

Information ratio1 of 1.68

The team delivers such a reasonably high information ratio because they have a prudent attitude to risk.

IRs compare the returns of a portfolio and its benchmark relative to the volatility of those returns. It’s an empirical measure of portfolio manager skill. In some respects, this is also a good way of thinking about how the team approaches portfolio management. In other words, if they can generate attractive levels of income and smooth a client’s journey through volatile markets, then they’ve done their job.

Along with the investment process, the opportunity set is clearly defined. “There’s a consistency of process over several decades that has been employed without the use of complex derivatives,” says Day.

“Moreover, it allows us to avoid basis risk associated with many derivatives, which often becomes elevated at times of financial market stress.”

1 Annualised over three years, to the end of December 2021. Source: Camradata

*If you are a CAMRADATA client and would like to give our readers an ‘elevator pitch’, contact Amy Richardson ([email protected]) or David Wright ([email protected]) for details.

© 2022 funds europe