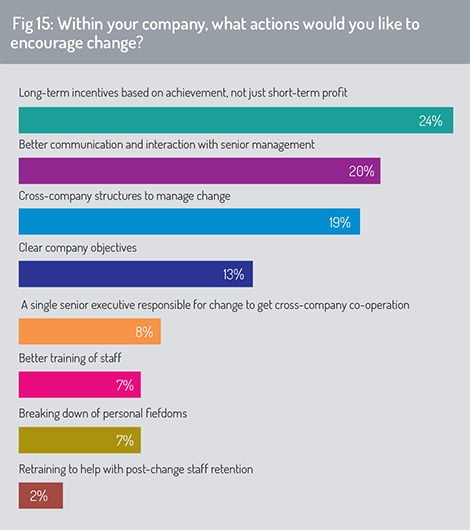

The final questions in the survey asked respondents to identify which factors are most important, at business and industry level, in supporting effective change management.

Figure 15 revealed a preference for far-sightedness. Nearly a quarter (24%) of respondents said the action they would most like to encourage change was “long-term incentives based on achievement, not just short-term profit”. Clearly, there is a view that employees should be encouraged to plan far into the future and not work to a cycle of quarterly financial results. The second-most popular response to this question was “better communication and interaction with senior management”, which supports the earlier point about teamwork being crucial in achieving effective transformation (20%). In third place, with 19% of responses, was “cross-company structures to manage change”. Once more, the importance of co-ordination within and without organisations was emphasised.

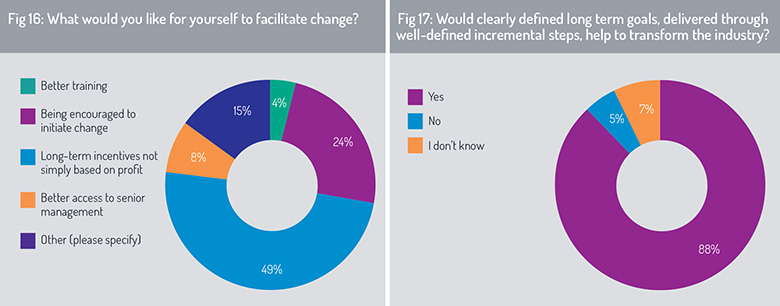

In the next question, respondents were asked to consider which factors they would value personally to facilitate change. Echoing the previous finding, nearly half (49%) of respondents said “long-term incentives not simply based on profit” would be most helpful. This factor beat other options such as “better training” and “better access to senior management”. Respondents who selected the “other” category were asked to state what they had in mind. Their suggestions included “more IT/new technology awareness in senior management” and “recognition that everyone across the organisation can help with change”.

The final question in the survey proposed a way forward that could gain the support of most of our respondents (Fig 17). We asked, “Would clearly defined long-term goals, delivered through well-defined incremental steps, help to transform the industry?” An overwhelming 88% answered “yes”. This finding offers some comfort – in an industry that is often plagued with disagreement and fragmentation, there are things we can (mostly) agree on.

Respondents who answered “yes” were invited to submit their own suggestions for achieving effective change in the funds industry. An edited list of their proposals can be found below.

Conclusion

This survey has revealed that the funds industry faces significant challenges in relation to its usage and deployment of technology. Respondents repeatedly made the point that fund companies are not well placed to manage the technological transformation that is necessary. The hurdles include siloed organisation structures in which different departments do not communicate well; a lack of understanding of complex technical issues by senior managers; and unhelpful incentives that encourage employees to focus on short-term gains at the expense of long-term performance. There is good news, though. Our respondents felt that solutions to this malaise were available. Broadly, the remedy to the problem will involve better industry standards, a focus on long-term planning, and more collaboration both within organisations and at an industry level. The problems are ominous, but with teamwork and determination, the funds industry can thrive.

An edited list of anonymous quotes from respondents gathered from question 17.

“The funds industry is culturally incapable of changing on its own. It is 20-30 years behind the transformation in other industries. The sector is overripe for the entry of a major disruptor, which will force funds companies to change in response. A few will successfully adapt. The remaining majority will be dead.”

“Drivers for change need to be clear and commercial for all parties. Market expectation is that new technology means lower fees eventually. Significant investment by asset servicers to support change leads to a downward pressure on revenues. Where’s the incentive?”

“[We need] a small number of industry leading firms to collaborate. Less talk more action!”

“Goals are key and can transport a vision. We dare more when defining long-term goals but would need to manage drift over time to ensure the goal remains relevant or needs adjustment.”

“Who is the change for, is it really needed, if so why, and who benefits from it?”

“More standardisation in the fund industry would help in creating synergies and reducing costs and step up the use of new technology. This, of course, is if the regulation tsunami slows down.”

“[Change requires] use of standardised non-competitive technology together with clear cross-functional co-operation to implement change, driven by the correct senior person with clout to push things through to conclusion.”

“People need to feel they are been assessed not only by their immediate performance but by their contribution to the completion of important structures and steps defined by organisational long-term goals.”

“The industry needs to redefine itself and start creating true value.”

©2019 funds europe