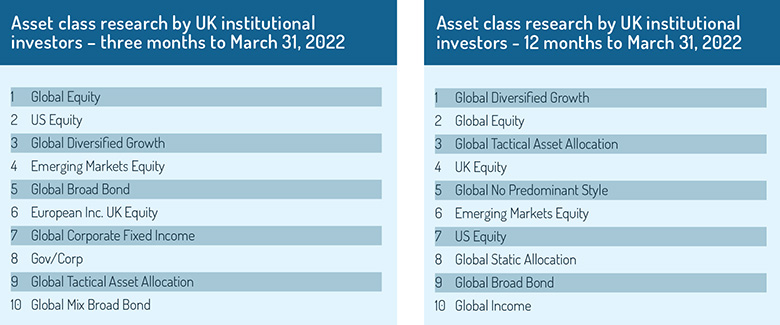

Global Diversified Growth funds were heavily searched by UK institutions last year and remain a top-three asset class in searches, CAMRADATA finds.

UK institutional investors have shown significant interest in Global Diversified Growth funds in recent months. Data from CAMRADATA Live shows this asset class to be the most researched by UK institutions in the 12 months to March 31, 2022.

Similarly, the data shows that this asset class was the third-most searched in the first quarter of 2022.

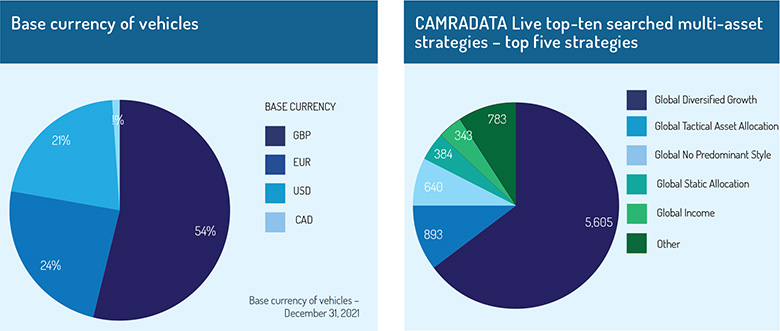

There are more than 200 Global Diversified Growth funds in the database. The currencies of these vehicles are GBP (54%), EUR (24%), USD (21%) and CAD (1%).

There are more than 200 Global Diversified Growth funds in the database. The currencies of these vehicles are GBP (54%), EUR (24%), USD (21%) and CAD (1%).

The firm that performed best in the three months to December 2021 was Franklin Templeton Investments. Its Franklin Multi-Asset Diversified Moderate Composite delivered 6.03% gross return with a volatility of 6.52%.

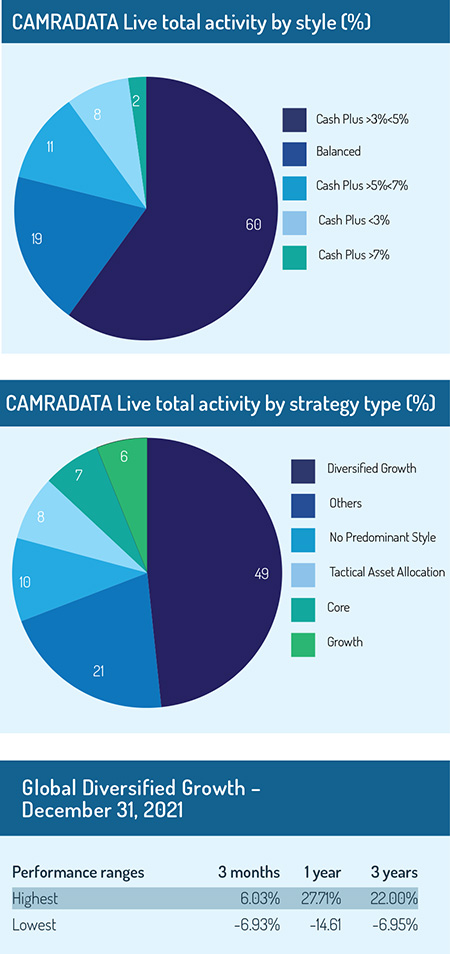

Predominately 60% of the total activity by style was Cash Plus > 3% < 5% and 49% of strategy type activity was Diversified Growth. The performance for the year to December 31, 2021, ranged between 27.71% and -14.61%. For the three years to December 31, 2021, performances ranged between 22% and -6.95% with annualised standard deviation of these funds ranging from 2.65% to 17.23%.

CAMRADATA’S IQ scores show that the best-performing manager in the Global Diversified Growth (GBP) universe for the three years to December 31, 2021 was Troy Asset Management Limited with its product Trojan Fund. This vehicle achieved an excess return of 11.04% over the benchmark, whilst taking excess risk of 5.41% to achieve it. The firm won the CAMRADATA IQ 2022 award for the Diversified Growth Funds – Cash +3% to 5% (GBP) universe.

In comparison, the best-performing manager in this asset class for the year to December 2021 was J.P Morgan Asset Management with its product JPM Diversified Growth Fund. This vehicle achieved an excess return of 14.47% over the benchmark, while taking excess risk of 3.79% to achieve it.

Factors such as high inflation rates, the pandemic and the war in Ukraine will remain key issues when it comes to economic uncertainties in the year ahead and the possibility of continued volatility in the financial markets.

* All figure are 12 months to March 31 2022 unless otherwise stated.

© 2022 funds europe