Fund search activity suggests UK Property is piquing investor interest, among broader strategies such as Global Equity, writes Tom Ashford.

UK Property emerged as one of the top-five most searched asset classes in the first quarter of the year – a period in which there was a substantial increase in institutional investor search activity on CAMRADATA Live.

In Q1 2019, there were over 8,000 asset manager searches carried out, together with 11,750 performance exports on asset manager vehicles downloaded. Investors were also running off a large number of Infosheets, Peer Group Reports and Ranking Reports (aka IQ Score Reports) from CAMRADATA’s online asset manager research database.

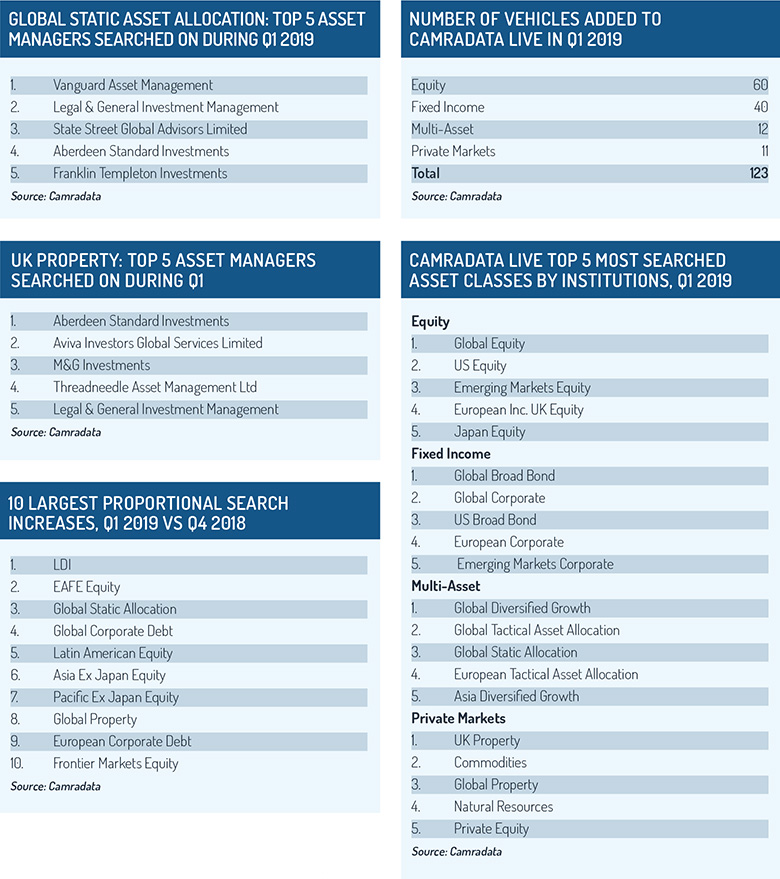

The most searched strategies during the first quarter within their own asset class universes were: Global Equity, Global Broad Bond, Global Diversified Growth and UK Property.

However, it was also interesting to see how many different strategies were being looked at during this period. Japan Equity was one of the top-five strategies searched, with Sumitomo Mitsui Trust Bank Limited being the most searched manager in this area. The stats showed that Ashmore Group was the most searched manager in Emerging Markets Corporate (Fixed Income), while Vanguard Asset Management had the highest amount of activity in Global Static Asset Allocation (Multi-Asset).

In UK Property, Aberdeen Standard Investment was the most searched manager.

All of these strategies made it in the top five of most-searched strategies within their asset class in Q1 2019.

LDI saw the largest increase in proportion of search activity compared to the previous quarter, followed by EAFE Equity and Global Static Allocation.

There were 123 vehicles added to CAMRADATA Live during Q1 2019. PGIM Fixed Income led the way by adding 12 new products.

©2019 funds europe