Emerging markets investors will hope to see a boost to asset classes as the Covid-19 vaccine roll-out spreads across the globe, says CAMRADATA.

The economic recovery that is expected for 2021 may give hope for emerging markets investors. The rapid rollout of Covid-19 vaccines means nations with developing economies are now able to vaccinate at a faster rate and this, hopefully, should have a positive impact on the sector.

In CAMRADATA Live, the top asset classes by investor research activity in the last three months to 31 December last year shows that emerging markets equities were fourth in the ranking. The investors were primarily pension funds at 90% and insurance companies at around 10%.

Looking at the top five asset managers’ selected products, Aberdeen Standard Investments came top for this particular asset class. However, in the past year, the top-performing firm for emerging markets equities has been Artisan with its Artisan Developing World vehicle. This gave an absolute return of 83.46% with a standard deviation of 22.73%.

The firm that has performed best in the past three months is RWC Partners. Its RWC Global Emerging Markets Fund delivered 36.97% gross return.

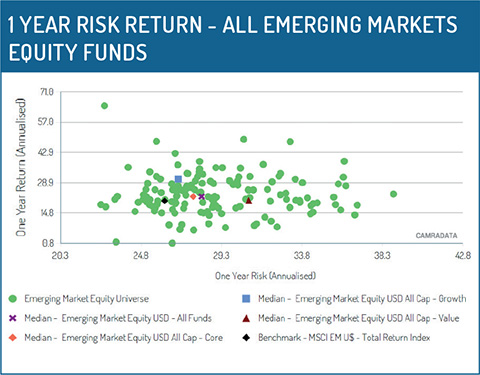

The graph indicates the correlation of one-year risk to return for all emerging market equity vehicles within the universe. We see that there are vehicles that have taken less risk and yet achieved higher returns in comparison to the benchmark. Some of the riskier vehicles, meanwhile, have produced lower returns.

The median for EME USD – All Funds, though, shows that in general, the vehicles that have taken more risk have achieved slightly higher returns in comparison to the benchmark. The spread of the correlation between risk and return for a vehicle illustrates the importance of carrying out manager research when selecting an asset manager within this asset class.

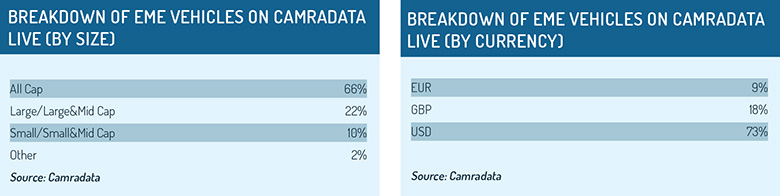

In CAMRADATA Live, there are around 275 vehicles within Emerging Market Equities, two-thirds of them All Cap and the rest broken down into other sizes. Within these vehicles, 73% have their base currency as USD. These funds are sorted mainly into three styles, with more than half of them being core, growth and value (growth 19% and value at 14%).

Could 2021 be a big year for emerging markets? The level of global trade and the exchange rate between the USD and other currencies will, as always, be contributing factors.

Could 2021 be a big year for emerging markets? The level of global trade and the exchange rate between the USD and other currencies will, as always, be contributing factors.

If global trade increases, this results in higher exports and domestic currencies becoming stronger. If USD weakens, commodities tend to become cheaper, resulting again in higher exports.

However, this is very much dependent on external global factors that may play a part during these times of uncertainty.

All figures are for one month to December 31, 2020 unless otherwise stated.

© 2021 funds europe