The impact of coronavirus was eventually priced in. Perhaps the reason it took so long was because computer-led strategies were distorting prices. Alex Rolandi investigates.

At the end of February, UK prime minister Boris Johnson said he’d hold a meeting about coronavirus, but that it could wait till after the weekend. Markets were quicker to react to the outbreak, but then seemed to go into denial.

When news of the virus first made major headlines, stock markets reacted negatively, then rallied to record highs. Fund managers applauded unprecedented levels of resilience as the bull market prevailed – for a while.

Equities appeared to have brushed off concerns over contagion. Then Apple, whose supply chain is well-rooted in China, revealed its revenue would fall short in the second quarter. Markets shuddered at the warning sign.

In the same week, Danish shipping giant Maersk issued its own earnings alert. “As factories in China are closed for longer than usual in connection with the Chinese New Year and as a result of the Covid-19, we expect a weak start to the year,” the firm stated on February 20.

The Asian powerhouse’s economic influence was becoming apparent. When global share prices plummeted just a few days later, it seemed markets were finally waking up to the impact of the virus and how important China is at a global level.

Some investors are asking why it took so long.

The effect coronavirus would have on the Chinese economy and world markets had been misjudged, according to Tom Becket, chief investment officer at London-based Psigma Investment Management.

“If you’d have predicted what was going to happen with regards to this ongoing virus situation, and the response to it within business, and the likely impact on the Chinese and global economies, you would’ve been surprised to then wake up two weeks later and find that global stock markets were mostly – with the exception of things really linked to China – higher than they were beforehand,” he tells Funds Europe.

No signs of caring

After the initial ripple effects following the outbreak, weeks passed with markets showing no signs of caring. “Looking at some of the market moves in recent months, you could have expected the opposite to happen based on what’s been going on in the economy and the macro-environment,” says Becket. “And personally, I think there are other influences at work.”

The fund manager believes that market behaviour is being driven by algorithms. “I don’t know whether it’s artificial intelligence or strategies built around algorithmic processes, but computer-based trading strategies are having a growing and historically different influence on markets.”

So, is the “egregious evaluation” of certain parts of the market caused by computer-led investments? “I think 100% it’s compounding it.”

The investment industry is operating in a different paradigm now, Becket says. In the past, markets were predominantly driven by humans making investment decisions. “We were real buyers.”

But in September last year, Bloomberg reported that passive equity strategies had surpassed their active stock-picker counterparts for the first time in history. Passive strategies are machine-driven and rules-based, just like smart beta and, at least predominantly, quants.

Coded rhythms

This fundamental shift towards computer-driven investments is having a profound effect on valuations.

According to Mike Horan, head of trading at BNY Mellon subsidiary Pershing, the proliferation of execution algorithms will further drive trading activity into the larger capitalised liquid stocks of the world’s largest companies – especially when combined with the need to cut the costs of trading.

“These stocks are perfectly suited to an algorithmic trading environment, as they are characterised by a wealth of willing buyers and sellers, and in large sizes,” he says. “This will be at the expense of the smaller, less liquid companies because, and especially in the UK, the smaller companies are traded in the old-fashioned quote-driven market and wholly not suited to execution algorithms.”

He adds: “This dynamic will be further compounded as the investing public will continue to be pushed into defensive, passive investments, characterised by increased ownership of blue-chip companies in personal wealth portfolios and pensions investments.”

For Becket at Psigma, the use of algorithmic trading is creating a positive feedback loop. “Money is increasingly chasing what’s done well,” he says. “Algorithm-based strategies are essentially elevating valuations in certain areas of global stock markets.

“Now, so much of the money invested in markets – up to 90% through high-frequency trading, CTA [commodity trading adviser] modelling funds, and trend-following funds, many of which are quantitative-driven strategies as well – is chasing the same themes and same factors in markets, the same momentum, growth opportunities, dividend yield strategies over low bond yields. It’s driving all the money into the same space.”

For quant specialist Arup Datta, who heads Mackenzie Investments’ global equity quantitative team, the resilience of markets – especially the Chinese stock market – and the speed of recovery after the first share price slide were both surprising and concerning.

“Things move much faster these days. It’s definitely possible that quants could create a positive feedback loop in the markets,” he says. “I will not rule that out, but I am not one of those quants.”

Datta says human intervention would prevent stocks being bought for his strategy that looked good to the machine, but which common sense said to avoid. Many quant managers would say the same – that human checks and balances are applied daily. Datta, who travels to China regularly on business, notes that many quants are plying their trade there. “I don’t know how good they are, but I know there are a lot,” he adds.

According to Boyan Filev, head of quantitative equity alpha strategies at Aberdeen Standard Investments (ASI), a lot more hedge funds appear to be using artificial intelligence methodologies. The AI expert says he doesn’t necessarily believe that algorithms have been driving higher share price valuations, but he acknowledges the growing amounts of passive money in the investment landscape. “People blindly put money into indices like MSCI or FTSE without quite understanding whether it’s a good time to invest, what the fundamentals are, or what the price of the asset they’re buying is,” he says.

The data going into quant funds is crucial. Filev says the more data being fed into a strategy, the more likely a better outcome is. “The risks depend on how the strategy has been calibrated. Things change over time, whether they be interest rates, employment, or any other macro-variables – things can change dramatically,” he adds.

“The last ten years are very different to the ten years before them. If you start modelling on macro-economic variables which might be dependent on the environment, then there is danger there, and you might not be able to predict what happens in the next ten years.”

The coronavirus outbreak presented a big unknown for everybody, fundamental and quant alike. “I cannot imagine anybody built their process factoring in something like this,” Datta says.

For Becket, though, a concern is that quants and other algorithm-led funds often trade on market direction. “A lot of them are momentum-chasing strategies, which gets you back into that positive feedback loop situation,” he says.

Market elevation

Concerns over the coronavirus were initially underplayed, even as infection numbers and the death toll continued to rise, says Becket. “Big swathes of China, and by implication global supply chains, have been shut down and with no signs of reopening any time soon, so I think we’re probably in the early stages of this situation.”

Entire Chinese cities were placed on lockdown in a bid to contain the contagion. Towards the end of February, the chief executive of Maersk, Søren Skou, estimated that Chinese factories were operating at around 50% to 60% of capacity. Since the lunar new year, the company cancelled more than 50 sailings to and from Asia due to the virus. Following an initial blow to earnings, Skou predicted that there would be a sharp rebound once the epidemic peaked.

Becket has very little confidence that the situation is under control. “I’ve been surprised by how willing people have been to look through the economic impact when you juxtapose it against the Sars situation back in 2003,” he says.

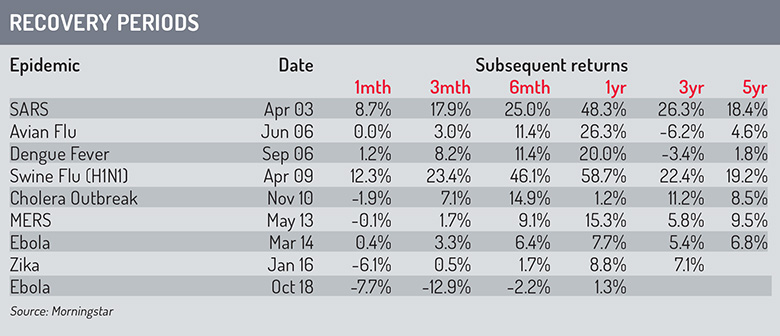

Morningstar data from other epidemics indicates that global equity markets tend to recover by the six-month mark (see table below).

During the Sars outbreak, the S&P 500 fell 14% over two months from mid-January to mid-March, with the technology and communications sector taking the hardest hit, according to analysis by Citi. Meanwhile Hong Kong’s Hang Seng didn’t recover until late April, when new infections finally peaked.

Back then, China wasn’t half the economic powerhouse it is now – which makes it all the more strange that equity markets rallied for so long before sinking again later in February. “This is already a worse situation than Sars, and one where they have less control,” argues Becket.

“China now represents around 40% of global growth, it is much more integrated into global supply chains than it was 20 years ago. More to the point, China is much more of a services-based economy than it was back then, and replacing services-led demand is much more difficult than replacing exports-led demand. I’m surprised by how relaxed people are about the situation, and that goes back to the point that the things driving markets are not necessarily the same as 15 or 20 years ago.”

In Datta’s estimation, if what happened to Apple becomes more widespread across multinationals, the effect will be much more severe in world markets.

Gold rush

Investor confidence can be a fragile thing. The fact that gold has been trading at a seven-year high shows how optimism has dwindled, despite the relative overall buoyancy of global markets in the weeks following the coronavirus outbreak.

According to ASI’s Filev, there has been concern within the firm at how high valuations have been. “It’s very hard to predict the market – people have been saying the markets will crash, and despite that, markets had recently been going up and up. It’s a dangerous game to play,” he says. “There’s a higher probability that something will happen, and when it does, it’s likely to be a bigger correction than normal based on historical periods.”

Data from research firm EPFR showed that year-to-date inflows into bond funds passed the $155 billion (€141 billion) mark during the third week of February. According to the firm’s research director, Cameron Brandt, mutual fund investors were “reluctant” to chase the returns being delivered by equity markets.

Those investors that did buy into the rally by US and other equity markets generally favoured broad, diversified exposure. In the US, the focus was on the tech sector. Both global equity and technology sector funds ranked among the top 15 fund groups attracting the biggest amount of inflows year-to-date.

In Asia it was a different story. Korea equity funds posted record redemptions in the week ending February 19, while China equities had net outflows for the second time in three weeks, and Japanese equity funds faced an ongoing investor exodus over coronavirus fears.

On February 24, the industry woke up to plummeting share prices worldwide as Covid-19 reached other countries. The impact on supply chains looked like it was taking its toll.

According to Becket, value ultimately wins out. “You come to a point where this becomes unjustifiable and something breaks, meaning you get a reversion of markets and you start to see the more expensive stuff underperform and the cheaper stuff outperform,” he says, referring back to the positive feedback loop created by algorithmic trading.

When algorithm strategies start to underperform, markets are disrupted. “You will see a reversion which will be very painful for lots of people,” says Becket. He recalls the end of 2018. “It was a disastrous time for global asset markets, with some markets down 20% in a quarter. The stuff that really outperformed then was the really cheap value stuff, whereas the highly valued perceived growth parts of the market performed really badly. And you can see that again quite easily now.”

Not if, but when

Across the board, the consensus is that share prices of many companies had been elevated for too long. It wasn’t a case of if there would be a crash, but when. Over ten years on from the start of the last financial crisis, there is a huge dependence on quantitative easing.

Looking to the long term, Mackenzie’s Datta says he is worried about market valuations and the US deficit – though he doesn’t think these issues will totally manifest themselves within six months. Problems likely lie beyond the half-year point. However, if the coronavirus becomes a six-month issue, then the markets will correct.

Having been through the dot-com bubble, the quant investor says it’s hard to predict when a crash will happen. “During the TMT [technology, media, telecoms] bubble, stocks kept going up every day and you never knew what would stop them. Then, one fine day in March, the bubble burst.”

The quant investor fared the dot-com bubble and 2008/09 financial crisis well, he says, because he added an extra value tilt to strategies at just the right time.

Datta is holding tight for now. It’s about “extra time, rather than half-time”, he says, using a football analogy.

As share prices began to nosedive in the fourth week of February, suddenly it seemed markets had realised that coronavirus was not under control, or not as much as thought. The impact of Covid-19 was finally being priced in.

Once again, caution has become a theme permeating the industry as more and more multinationals have begun to issue profit warnings and, at the time of writing in late February, stocks worldwide continued to slide. The FTSE All World index has already lost around $5 trillion in value since its peak in January.

Looking forward, only one thing is certain: 2020 is set to be another year of volatility, and it’s only just beginning.

© 2020 funds europe