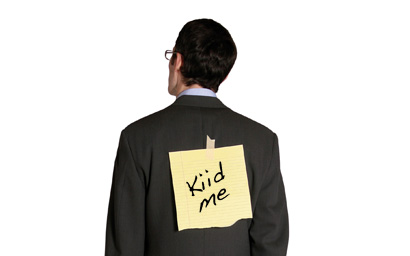

The deadline for fund managers to produce Key Investor Information Documents looms large. Angele Spiteri Paris writes about the challenges and how this exercise compares with the one that spawned the simplified prospectus

Some think the Kiid (Key Investor Information Document) is just a rehash of information already found in the simplified prospectus which, in most cases, failed to achieve its goal. But, although producing the Kiid will be more challenging than expected, others feel the document will improve the comparability of investments and will provide investors with uncomplicated information they could not get anywhere else.

The creation of these documents presents specific and acute challenges that will cost the fund industry a significant chunk of change, without the guarantee that their existence will ultimately lead to the investor education goal regulators dream about.

As outlined in the Ucits IV regulation, as of 1 July, 2011, all investment companies selling funds within European Union member states must produce a Kiid for each of their products, written in the local language of each country in which the fund is sold. Each Kiid must be updated regularly to ensure accuracy.

Some claim that the Kiid’s predessor, the simplified prospectus, is the perfect example of a documentation exercise gone wrong. The aim was to provide potential investors with a document that shrank the multi-page prospectus into something more palatable. The result, however, was something very different.

Nicolas Gonzalez, head of product development at Société Générale Securities Services (SGSS) says: “The simplified prospectus was complex and very difficult to understand. It contained too much material that was not organised.”

Killian Buckley, a member of consulting, corporate advisory at Kinetic Partners, says: “The aim of the simplified prospectus was to provide investor protection, but there was a certain amount of latitude around what could be included in it.”

As a result, he says most simplified prospectuses ended up being made up of “a large number of disclaimers”, which did little, if anything, to improve investor knowledge.

Noel Fessey, Schroders’s head of fund services, says: “Some firms worried that a two-side simplified prospectus would not comply with regulation and would create unnecessary legal risk. In their view, it was safer to err towards full disclosure and that’s how some of them came to produce 30-page simplified prospectuses.”

Fessey adds that Schroders was confident that its two-side interpretation of the simplified prospectus was in keeping with the spirit of the rules and that the additional legal risk was negligible. “With more confidence on the part of the industry and more practical guidance from regulators, most of what is in the Kiid could have been achieved under the simplified prospectus regime, the notable exception being the synthetic risk and reward indicator,” he says.

Instead, Schroders and its contemporaries have had to go through producing simplified prospectuses for all their products and now have to spend around double the money to produce the relevant Kiids.

For Schroders’s part, Fessey says: “We would have preferred to keep our two-side simplified prospectus but the Kiid is now inevitable. We’re happy to do it to gain a standardised document that will help investors better to understand our funds. We’re also pleased that we won’t have to add special finishes to the document to satisfy local regulatory preferences.” However, he is a pragmatist. “The Kiid may be harmonised but marketing rules are not, and we must still take account of significant national differences

across Europe”.

Abbey Shasore, chief executive officer at Factbook, a firm that offers reporting solutions, says: “Yes, we could have skipped the simplified prospectus altogether. The Kiid is a logical step; we were always going to this point.”

It is just that asset managers could have saved some energy and resource in the process.

Philippe Denis, global head of research and development at BNP Paribas Securities Services, believes the Kiid bodes something better than the simplified prospectus did. He says: “Of the text included in the Kiid, 50% will be related to disclaimers but the other 50% will be more valuable information than any that can be found in the simplified prospectus.”

Style over content

Industry commentators expect the Kiid to be more of a success because of the structured approach Europe has taken.

The aim is for the document to be similar, no matter which asset manager produced it. Fessey says: “Around four years ago, during the Kiid consultation processes, the industry said that if the Kiid must be imposed its content should be prescribed to the greatest possible extent. We didn’t want to see it fail like the simplified prospectus. We wanted the new document to be harmonised throughout Europe, and that is what the new rules aim to do.”

Shasore says: “By encouraging standardisation around the Kiid, Esma [now Cesr] will ensure comparability of product.”

And, ultimately, this comparability is one of the goals Kiid is trying to achieve.

Gonzalez says: “The Kiid should be a short, harmonised document written in plain language that will allow all the information about a product to be standardised.”

Gary Wheeler, head of sales and account management at Financial Express, a data firm that has discussed Kiid production with asset managers, says: “The structured approach is a positive thing for investors because it will allow them to consider products across the board on a like-for-like basis.”

Although Shasore agrees that the prescriptive approach to the compilation of the Kiid is positive, he questions its restrictiveness. “I’m not convinced that restricting the information to two pages will provide investors with sufficient information, especially considering that they have to use plain language,” he says.

Mind the language

Many claim that the instruction to use plain language is to be one of the greatest challenges of Kiid production for asset managers. After all, what qualifies as “plain”? And who decides?

The first hurdle will be getting all the players involved to agree. Buckley says: “The fund manager, marketing and compliance have to come to a consensus on this.” He says regulators may have a “watching” brief and look at a sample of Kiids being produced to ensure the language is sufficiently straightforward. “It’s about instilling the culture that Kiids need to be simple.”

Shasore adds: “The plain language requirement is one of the fuzzier areas of the regulation and represents one of the main challenges. It’s going to be a real issue and conveying all the attributes of a product in such a structured document is going to be extremely difficult.”

According to Denis, the UK’s Financial Services Authority is the only European regulator that has made a distinction around the language to be used. “The FSA has taken a very pragmatic approach, saying that any word used in the Kiid has to be in the Oxford dictionary,” he says.

Denis agrees with Buckley’s comment that there will be a lot of discussion. “There will be lots of work and a lot of review by asset managers on the language used. This is work that is already being done,” says Denis.

Fessey explains that at this time last year the industry had expected Cesr (now Esma) to produce an official European glossary of financial terms, which fund promoters could use in their Kiids. It did not happen and rightly so, he says: “Cesr didn’t do it for good reason. It would have been very difficult to prepare a glossary that everyone could agree on.”

Cesr instead opted to produce a plain language guide but Fessey’s view is that plain language in the financial industry is much easier to describe in principle than it is to write in practice. Nevertheless, he agrees that Cesr is right to insist that the industry should describe its products in terms that investors can understand. Fessey believes that it will only become clear whether the industry has passed the plain language test once the Kiid has been in use for a while.

©2011 funds europe