Diversified growth funds saw poor performance and considerable outflows to add to a string of redemptions going back months, writes Sean Thompson.

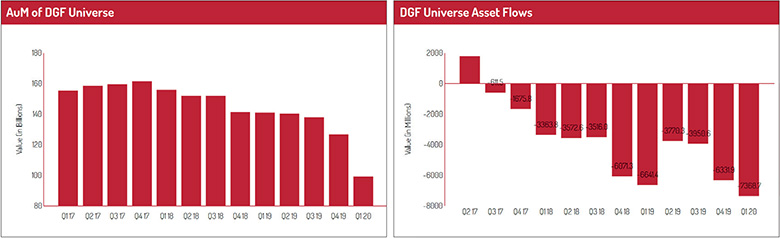

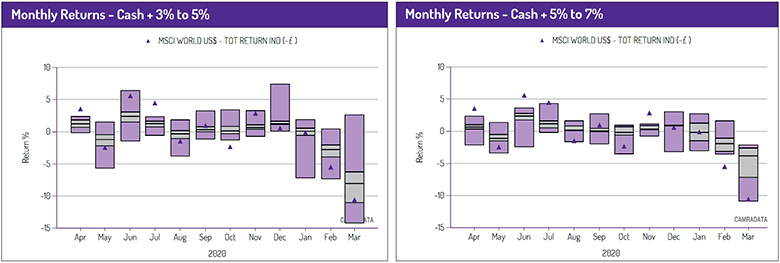

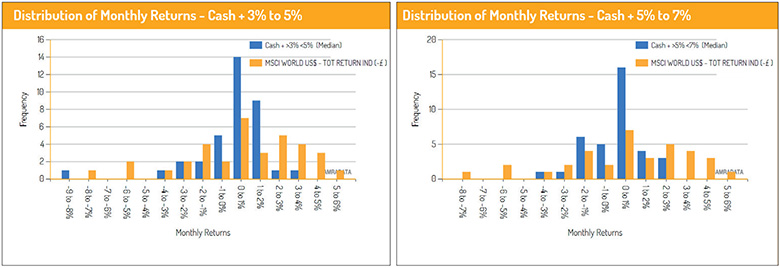

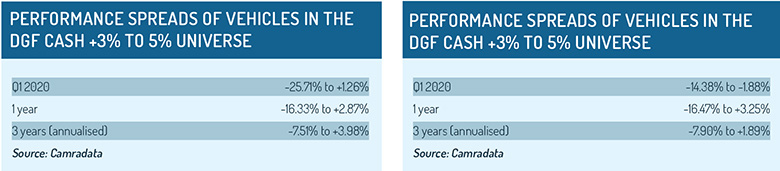

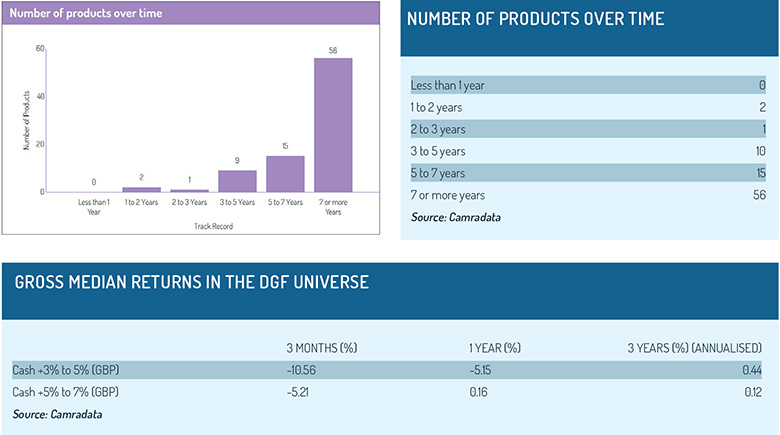

The DGF sector saw its 11th consecutive quarter of outflows in Q1 2020, not to mention its biggest quarterly outflow of the past three years, according to the Camradata investment research report for the period. Added to that, the sector experienced the worst quarterly performance to date. The cash +3% to 5% median performance showed a loss of 10.56% in Q1 and a 5.15% loss in the 12 months to March 31. This was in line with other asset classes’ losses as a result of Covid-19, but some asset managers, such as AQR Capital Management and William Blair International, did see inflows.

The glory days of 2016 and 2017 seem a long way off, though it will be interesting to see if Q2 brings a reversal of fortunes.

Sean Thompson is managing director of CAMRADATA, owner of Funds Europe. All figures are for three months to March 31.

© 2020 funds europe