Many of Europe’s biggest ETF providers are French, but they may need to develop their bond ranges to topple BlackRock’s iShares at the pan-European level. Peter Taberner reports.

Paris-based Amundi is the largest European-headquartered ETF provider, a status reinforced by the acquisition of Lyxor that was finalised in January this year.

While Amundi provides the scale and strategic guile to expand, the merger has brought Lyxor’s track record in thematic investing into play.

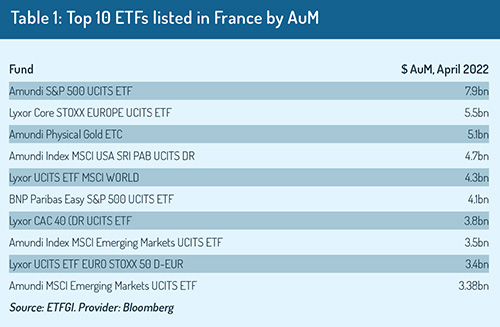

Together, Amundi and Lyxor dominate France’s ETF scene – as Table 1 (over the page), of the largest France-listed funds in April 2022, shows.

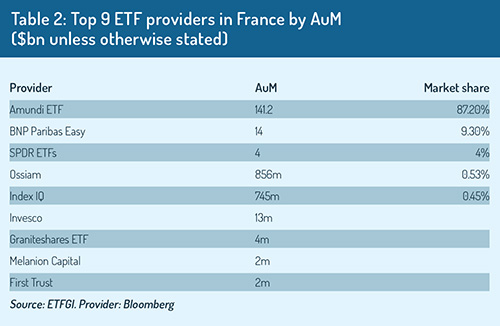

Amundi boasts $141 billion (€134 billion) of ETF assets under management (AuM) and nearly 90% of market share.

According to Gaëtan Delculée, its global head of sales of ETFs and indexing, the Amundi ETF range provides investors with access to one of the largest and most comprehensive line-ups of Ucits ETF products available.

Amundi’s more than 300 products include thematic investing, ESG, emerging markets and fixed income, Delculée says.

Lyxor, meanwhile, created the first ETF to be launched in France – the Lyxor CAC 40 – back in 2001. This was also the first ETF to be introduced by a European ETF issuer.

BNP Paribas Asset Management, based in Paris, offers 100 ETFs and index funds for French and international investors, including through its BNP Paribas Easy brand. Overall, the group has €35.4 billion of ETF AuM.

The firm launched the BNP Paribas Easy CAC 40 ESG ETF into the French market in March last year and was the first French market index fund to track this ESG index, which comprises 40 companies, most of them French, listed on the Paris stock exchange.

“Our range of ESG index solutions covers a wide range of equity and bond markets, geographical areas and themes, allowing us to offer new solutions to investors committed to a responsible approach,” says Bertrand Alfandari, head of development of ETFs and index funds at BNP Paribas AM.

He adds that BNP Paribas was among the first firms to launch ETFs on low carbon themes back in 2008, and the ‘circular economy’ and green real estate in 2019. It was also a groundbreaker with respect to sustainable infrastructure and ‘blue economy’ – meaning the sustainable use of ocean resources – ETFs in 2020.

Yet despite the progress of the France-based giants of the ETF market, they still have some way to go before they can compete at the pan-European level with BlackRock.

Undisputed leader

According to Morningstar, iShares (BlackRock’s ETF franchise) remains the undisputed market leader across the European ETF market, with a colossal 44% of market share.

To highlight its dominance across Europe, BlackRock’s market share is equivalent to that of its six largest competitors combined.

The ETF market is a pan-European affair, with almost all ETFs for sale domiciled in Ireland and Luxembourg and many funds – which may have multiple listings across European exchanges – moving towards a centralised clearing system to gain operational efficiencies and maintain ETFs’ ‘low-cost’ reputation.

The ETF market is a pan-European affair, with almost all ETFs for sale domiciled in Ireland and Luxembourg and many funds – which may have multiple listings across European exchanges – moving towards a centralised clearing system to gain operational efficiencies and maintain ETFs’ ‘low-cost’ reputation.

Jose Garcia Zarate, associate director of passive strategies at Morningstar, says that leaving aside iShares, the battle between providers – particularly the likes of Lyxor and Germany’s Xtrackers – has for many years centred around who would claim second place in AuM league tables, rather than who would topple BackRock.

The main battleground has been on equity exposures, with French ETF providers such as Amundi, Lyxor and BNPP AM trying to gain market share by highlighting expertise in areas such as ESG and thematic investing.

“The area that remains almost exclusively a domain of iShares is fixed income. This is because iShares quickly established a firm grip on bond market ETF exposures, offering a wide range of ETFs for all geographies, and so far, investors have been reluctant to switch to other providers,” Zarate says.

“French ETF providers are aware that they must step up their efforts on fixed income. It is a key focus for product development and growth for them.”

However, while it’s true that France can boast major players in the ETF market, the country’s enthusiasm for ETF products has at times been muted.

In a survey of 2,550 financial advisers in 2016, Natixis Asset Managers found that 84% of those in France warned that investors may not be fully aware of the risks associated with a supposed over-reliance on passive investments. Similarly, 76% of French respondents believed that investors had a false sense of security regarding their investments.

To assess the French ETF landscape further, it’s important to consider how brands are pivoting in France and which creative packages are on offer. Alfandari at BNP Paribas AM says that all of its ETFs and index funds are listed on several stock exchanges in Europe, such as Euronext Paris, Xetra and Borsa Italiana.

“We do not have a product range exclusively for French investors, but have a product development strategy that is European in nature that focuses on the needs of our clients everywhere in Europe,” he adds.

The firm has one of the largest ranges of funds labelled SRI – a nationally recognised and audited guarantee of sustainable investment quality in France, providing guidance for investors interested in environmenta l, energy transition or social issues.

“In terms of clients, the French market is very much driven by professional investors more than in the UK or in Germany, and as asset managers, we are advocates of greater education around the characteristics of ETFs and index funds,” Alfandari says.

“In terms of clients, the French market is very much driven by professional investors more than in the UK or in Germany, and as asset managers, we are advocates of greater education around the characteristics of ETFs and index funds,” Alfandari says.

Delculée says Amundi’s proximity and unique understanding of the French market makes the firm a trusted and preferred partner for many investors. “Our key strength is the ability to accompany them in the ESG climate transition, as investors are increasingly reorienting their portfolios to meet ESG criteria,” he adds.

Invesco, a US-headquartered fund manager with a large presence in the ETF market, does not have a major presence in France, but all of its 100-plus ETFs and similar exchange-traded products are registered in France and promoted to French clients

Thibaud de Cherisey, head of Emea ETF distribution at Invesco, says the firm has had a historical presence in France for nearly four decades and launched its the first ETF in 2008. It has increased its footprint in France through the PowerShares brand and since the acquisition of Source in 2017.

“Invesco’s ETF business in Europe has grown strongly over the past years with nearly $70 billion AuM as at mid-June.

Fund distribution

According to market players, the French ETF market is dominated by institutional investors, from pension funds to family offices, with the retail investor presence minimal. Yet according to Morningstar, it is difficult to access statistics that would clarify which type of institutional investor dominates the market space.

Currently there is an increase in direct advertising campaigns, and more cooperation with fund platform providers. The latter is crucial, as in the early days of the ETF market, many fund platforms simply rejected the distribution of ETFs, in some cases because the platforms themselves were not geared towards dealing with the stock-like nature of ETF trading.

At Invesco, de Cherisey says in the past few years, ETF adoption from private banks has accelerated. In a trend that looks set to continue, these banks are increasingly using ETFs in their client portfolios, with a specific focus on thematic ETFs.

Another driver of ETF growth in France is the unit-linked insurance business. Numerous unit-linked insurance platforms are said to be increasingly selecting ETFs.

De Cherisey adds that Invesco recently signed an agreement with Active Asset Allocation, a French fintech company that has set up an ETF distribution platform aimed at French insurers.

Amundi’s Delculée has observed similar patterns emerging. However, he says: “We are noticing over the past few years a steady growth of the retail segment, manly via ETF-based solutions, life insurers or online platforms. Amundi ETFs, for example, are referenced in nearly 160 life insurance wrappers, which is today the French preferred saving vehicle.”

© 2022 funds europe