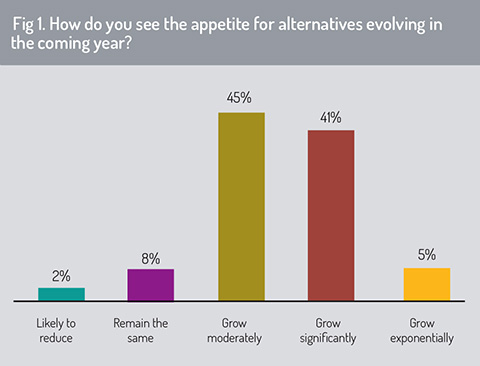

The survey began by asking for respondents’ views on the likely growth trajectory of the all-important alternatives sector over the coming year. The results (fig 1) show that confidence has increased considerably since last year’s survey, which was carried out at the start of the pandemic.

Fully 91% of respondents to this year’s survey expect the alternatives sector to grow over the coming year, with 41% expecting it to grow significantly and 5% anticipating exponential growth. This contrasts sharply with last year, when only 68% of respondents expected growth and a significant minority of 12% predicted that the sector would contract.

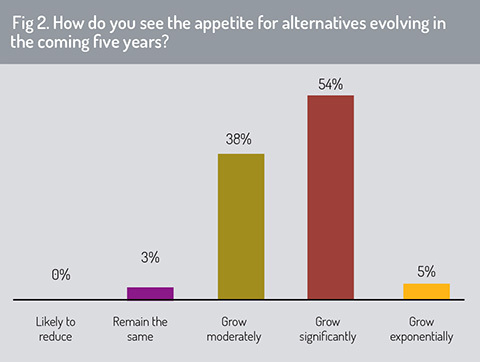

Predictions for longer-term growth (fig 2) are even more optimistic. A whopping 97% of respondents to this year’s survey expect growth over the next five years. Of these, almost 60% expect significant or exponential growth – with no one expecting the sector to contract.

Predictions for longer-term growth (fig 2) are even more optimistic. A whopping 97% of respondents to this year’s survey expect growth over the next five years. Of these, almost 60% expect significant or exponential growth – with no one expecting the sector to contract.

Even last year, five-year predictions were buoyant, with 83% of respondents expecting growth. This acknowledges both the increasing importance of alternative investments and the established role in that market of Jersey, which offers both flexibility and stability as alternative managers face the inexorable challenges that rapid growth brings.

“The key trend globally remains the increasingly strong allocation by investors to alternatives,” says Refson. “There is no sign of investor appetite slowing down, and private equity is the main beneficiary. Inevitably, this wall of capital creates challenges in finding quality investments to deliver sustainable returns and this competition for top-tier assets leads to pressure on valuations and prices.”

Asset class breakdown

Asset class breakdown

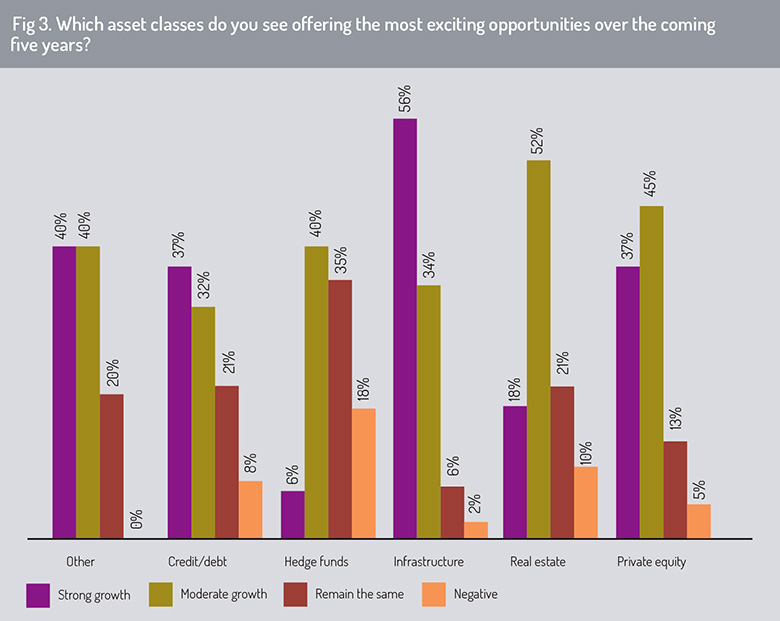

Survey respondents expect growth across the board in the alternatives sector. However, when it comes to which asset classes respondents expect to grow most rapidly, the clear winner is infrastructure. Ninety per cent of respondents expect the infrastructure sector to grow, with 56% predicting strong growth and only 2% anticipating a contraction (fig 3).

The percentages predicting growth are also high for the private equity (82%), real estate (70%) and credit/debt (69%) sectors. However, a majority (52%) expects only moderate growth in real estate, with only 18% predicting strong growth and 10% envisaging a contraction.

Certainly, private equity has shown strong historic growth. “The assets under management of private equity grew by 153% by value over the past five years, and the number of individual funds doubled over the same period,” says Refson.

The sector where growth expectations are most muted is hedge funds. Six percent of respondents expect strong growth in hedge funds, and 18% anticipate a contraction – the highest negative number for any sector.

Eighty percent of respondents also expect growth outwith the main alternatives sectors. Digital assets, structured products and ESG investment – including sustainable infrastructure – were the main additional segments that respondents mentioned.

© 2021 funds europe