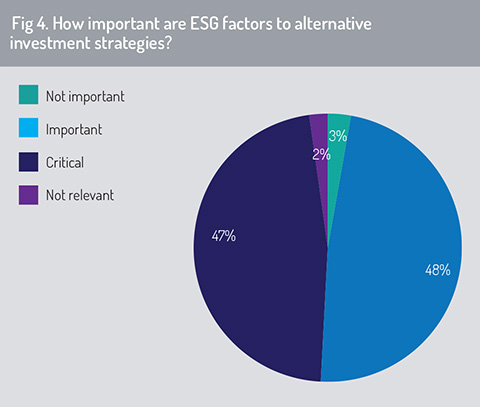

Perhaps the single most important message from this year’s Jersey survey is that ESG has now extended beyond mainstream investing and is firmly embedded in the alternatives sector (fig 4). Ninety-five percent of respondents now consider ESG factors to be important for alternative investment strategies, with 47% deeming them to be critically important. This near-unanimity represents a massive leap in opinion from last year, when 26% of respondents remained sceptical about the importance of ESG factors for alternative investment strategies.

“The survey response says it all – only 5% of respondents feel that ESG factors are not important or not relevant to alternative investment strategies,” says Leanne Wallser, group partner at Walkers.

“The survey response says it all – only 5% of respondents feel that ESG factors are not important or not relevant to alternative investment strategies,” says Leanne Wallser, group partner at Walkers.

“It would be interesting to wind the clock back two years to see what the response rate would have been then. My strong feeling is that the numbers would have been quite different.”

Jersey Finance’s head of funds, Elliot Refson, sees in the growing importance of ESG factors in the alternatives market a huge future opportunity for Jersey.

“We see continued regulatory and investor pressure on alternatives to build trust and transparency in all aspects of their operation,” he says. “Over the past year or so, we have also seen the area of ESG come to the fore. From a Jersey perspective, this translates into strong growth in the funds sector.”

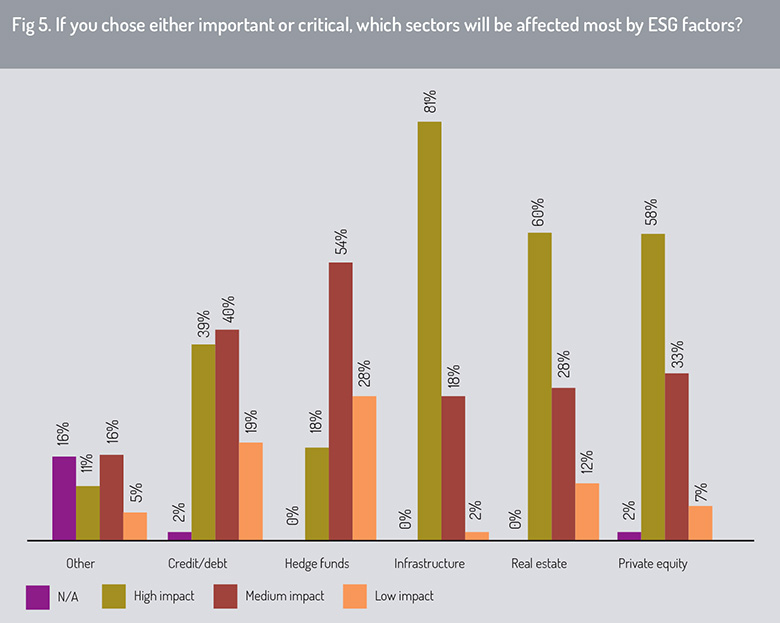

The picture with regard to which alternative asset classes respondents believe will be most affected by ESG factors (fig 5) is an interesting one. In general, those sectors that are predicted to grow the fastest are also the ones where the impact of ESG factors is expected to be the greatest by the 95% of respondents who believe ESG factors are important.

Chief among them is infrastructure, where 81% of respondents expect a high impact. Eighty percent plus of respondents also expect a high or medium impact from ESG factors in real estate and private equity. This is emblematic of the way that the influence of ESG is spreading. Companies are increasingly expected to take ESG factors into account at all stages of their growth, while sustainable construction is an important theme in the real estate sector.

“Unsurprisingly, given the emphasis on infrastructure spending and the push for public and private sector stimulus funding to #BuildBackBetter, 81% of respondents felt that infrastructure spending would be affected by ESG factors,” says Wallser.

The outlier is again the hedge funds sector. Respondents do expect ESG factors to have an impact on hedge funds, but the majority – 82% – believe the impact will only be moderate or low. The trend, however, is for respondents to put more weight on the impact of ESG on hedge funds. Fifty-four percent of this year’s respondents expected a medium impact compared to 42% last year, while 18% expected a high impact compared to 16% last year.

The outlier is again the hedge funds sector. Respondents do expect ESG factors to have an impact on hedge funds, but the majority – 82% – believe the impact will only be moderate or low. The trend, however, is for respondents to put more weight on the impact of ESG on hedge funds. Fifty-four percent of this year’s respondents expected a medium impact compared to 42% last year, while 18% expected a high impact compared to 16% last year.

“As expected, high impact is anticipated for private equity and real estate but what is also relevant is that, even for the sector felt least likely to be impacted by ESG considerations – hedge funds – the cumulative response was that 72% of respondents felt there would be a high or medium impact,” says Wallser.

Demand for alternatives

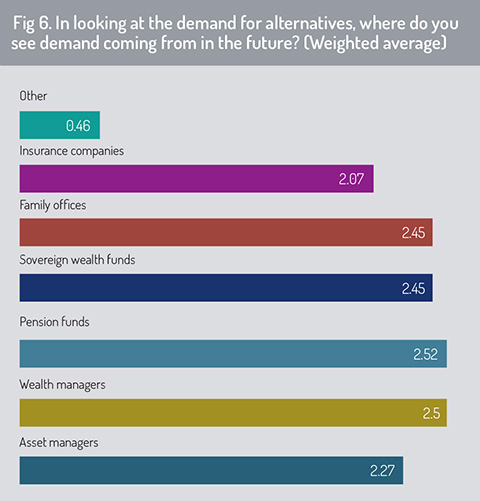

Respondents expect the greatest demand for alternatives (fig 6) to come from pension funds and wealth managers. Sovereign wealth funds and family offices are close behind. Demand from asset managers is expected to be somewhat lower, with insurance companies predicted to use alternatives the least.

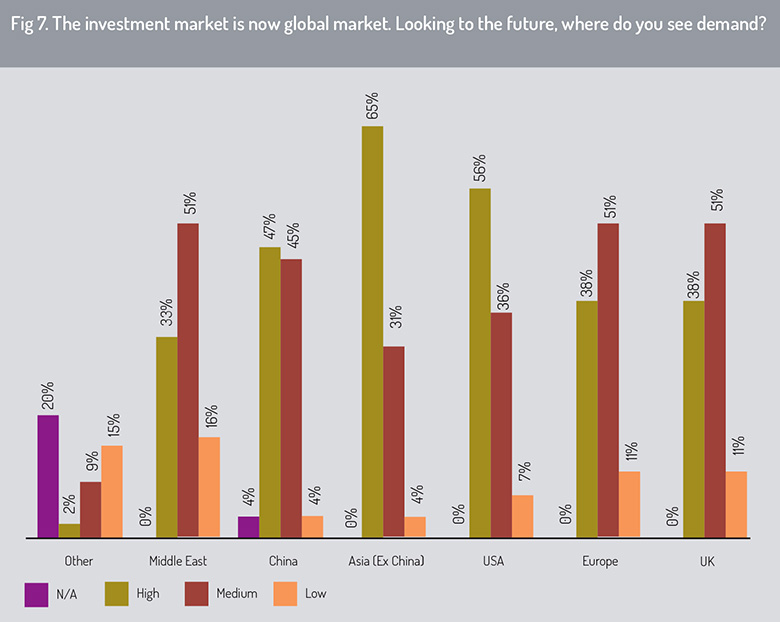

In terms of geography (fig 7), the emerging markets of Asia are expected to be one of the main drivers of demand for alternatives. Ninety-six percent of respondents expect high or medium demand from Asia ex China, with 65% predicting high demand from these markets compared with 52% last year, while 92% expect high or medium demand from China.

This means that Asia ex China has now overtaken the USA as the source of the highest expected demand for alternatives. Fifty-six percent of respondents expect high future demand from the USA, compared with 59% last year, while the percentage of respondents who expect low demand from the USA has risen from 2% last year to 7% this year.

Figures for the UK and Europe have not shifted much from last year. Just over half of respondents expect medium demand from the UK and Europe, with 38% anticipating high demand in each case. The Middle East presents a mixed picture, with a sizeable minority of 16% expecting only low demand and 33% anticipating high demand.

© 2021 funds europe