Private credit markets have grown substantially over the past decade, reaching $812 billion in AuM during 2019 according to Preqin, a provider of data and analysis for alternative investments.

With banks reducing their lending to small and mid-tier corporates since the global financial crisis, private debt has been used more widely to meet this financing requirement. Preqin estimates that the number of private debt fund managers active in this space has more than doubled over the past five years to close to 1,800 and the pool of available capital climbed to almost $300 billion at the end of 2019 (Preqin, ‘2020 Global Private Debt Report’, page 10).

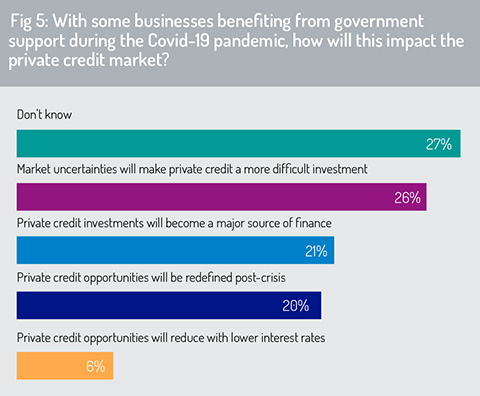

Although respondents recognise the growing importance of private debt as a source of finance, particularly for small and mid-sized firms that may struggle to access funding through bank channels, the survey data indicates a mixture of uncertainty and caution around the outlook for private credit markets (fig 5). Just over a quarter of respondents believe that current market uncertainties will “make private credit a more difficult investment”.

This is particularly in case of a spike in corporate defaults if economic recovery cannot be sustained during H2 2020 and into 2021. Douglas Grant, director of direct lending specialist Conister Finance, says: “We are facing a significant double-dip recession that could last well into late 2021 and the economy will be hurt by both SMEs closing and mass redundancies for a significant part of the workforce.”

The City UK, an industry-led body representing UK financial services, identifies a recent resurgence in ‘zombie companies’ where “businesses are servicing debt from remaining cash flows with little or no capital for investment. UK businesses may build up £100 billion ($130 billion) of debt by next March which they would be unable to repay, with 780,000 SMEs in danger of insolvency,” it says.

This is an alarming prospect. Whether or not this is an accurate estimate, it reinforces the importance of cautious credit risk management for direct lenders and buyers of publicly traded corporate debt in the months ahead as emergency support measures are reined in.

Money market funds

The onset of the coronavirus pandemic drove strong inflows into MMF. The European Fund and Asset Management Association (Efama) reports that money market funds attracted €829 billion ($975 billion) in net new investment during Q1 2020, more than three times the amount recorded in Q4 2019 (€259 billion). The largest component of these fund sales was in the US (€638 billion) and China (€183 billion).

“Savers in the US and China, which are two countries where MMFs play a big role as a vehicle to park cash, have increased their savings in MMFs, most likely as a precautionary move against the backdrop of the Covid-19 crisis,” says Bernard Delbecque, senior director, economics and research at Efama. These net inflows pushed assets under management in MMFs up 13.7% to near €7 trillion ($8.2 trillion).

However, investors started to reduce their holdings in MMFs as we moved into June and July, eager to capitalise on a recovery in risk assets and the backstop that the Fed has set in place for corporate debt through its asset purchase programme. Some have also taken the opportunity to pay down bank credit lines established at the height of the Covid crisis.

Lipper reports that US money market funds experienced 11 weeks of consecutive net inflows (totalling $1.1 trillion) through to mid-May. However, subsequently it had five successive weeks of net redemptions (amounting to $98.2 billion) – with withdrawals most prominent from Government MMFs (-$26.6 billion) and Institutional US Treasury MMFs (-$11.7 billion) – as investors took money out of more conservative investments and bought into higher-yielding assets.

Lipper reports that US money market funds experienced 11 weeks of consecutive net inflows (totalling $1.1 trillion) through to mid-May. However, subsequently it had five successive weeks of net redemptions (amounting to $98.2 billion) – with withdrawals most prominent from Government MMFs (-$26.6 billion) and Institutional US Treasury MMFs (-$11.7 billion) – as investors took money out of more conservative investments and bought into higher-yielding assets.

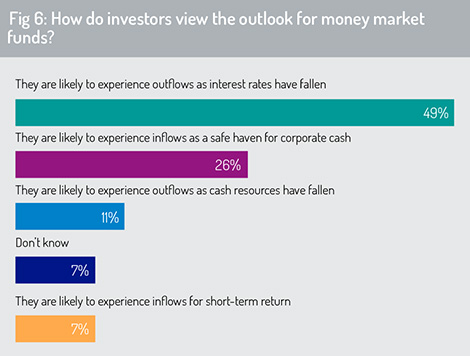

The survey predicts that this trend will continue, with 49% of respondents saying that investors will reduce their exposure to money market funds, following interest rate reductions by central banks in the early phase of the pandemic (fig 6). This is almost twice the number that believe that MMF will rise in popularity as a safe haven for corporate cash (26%).

Commenting on these trends, Calastone’s chief revenue officer, Ed Lopez, says: “The massive inflows into money market funds earlier this year really shows how important they are in difficult times, but as yields fall, fund managers must think carefully about how these funds can remain an attractive investment in today’s low interest environment. In our own research, we have found that there are systemic dysfunctionalities with the way they operate today. Firms must consider next year how they can keep costs low to keep these funds attractive to investors, taking into account the ever-increasing need for real-time information flow and automated funds processing.”

Gold

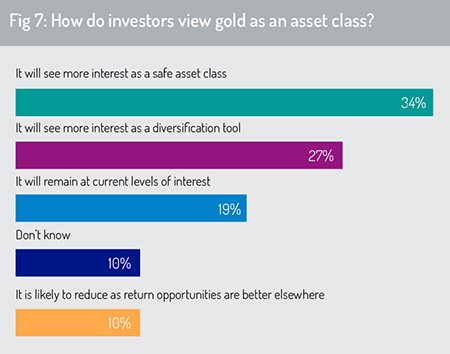

The survey predicts that investors’ appetite for gold as a ‘safe asset class’ will continue to strengthen (34%), with 27% indicating there will be greater demand for gold as a source of portfolio diversification (fig 7). Only 10% say that there will be net divestment (outflows) from gold in search of better return opportunities in other asset classes.

These findings align with evidence from precious metals markets during the first half of 2020. The economic and health uncertainty around the Covid-19 pandemic has driven ‘flight-to-quality’ flows, with gold being a primary beneficiary. Investors have poured money into gold during 2020, continuing the strong momentum of 2019.

The World Gold Council (WGC) indicates that gold delivered a year-to-date return of 16.8% during H1 2020, thereby “outperforming all other major asset classes” (WGC, ‘Gold Mid-year Outlook 2020’, page 1). In early August, the gold price reached a new high on breaking $2,000 per ounce.

The World Gold Council (WGC) indicates that gold delivered a year-to-date return of 16.8% during H1 2020, thereby “outperforming all other major asset classes” (WGC, ‘Gold Mid-year Outlook 2020’, page 1). In early August, the gold price reached a new high on breaking $2,000 per ounce.

This has also resulted in record inflows into gold-backed ETFs. Global net inflows of $39.5 billion during H1 surpassed the previous record for annual inflows of $23 billion in 2016, according to WGC data. North American funds accounted for 80% of global net inflows in June (adding $4.6 billion in AuM, up 4.3%). European funds added $745 million, increasing AuM by 0.8%.

WGC head of research Juan Carlos Artigas said that “gold ETF investment demand shattered records this year as investors sought safety from the economic turmoil created by Covid-19. To put this in context, inflows during the first half of 2020 significantly exceeded multi-decade record levels of net gold purchased by central banks in 2018 and 2019.”

© 2020 funds europe