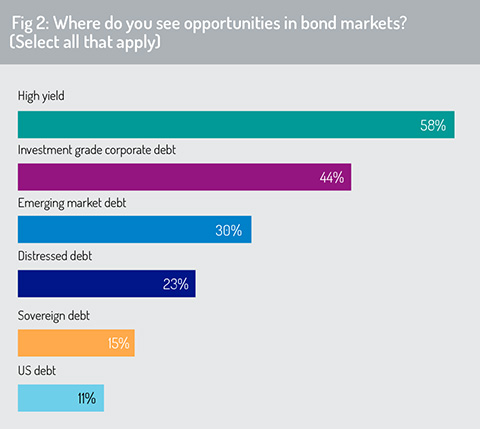

In fixed income markets, the survey finds strongest opportunities in high yield (58%) and investment grade corporate debt (44%, fig 2). Credit spreads have narrowed from their widest point at the onset of the Covid crisis and credit markets will potentially offer attractive opportunities during the remainder of 2020 and into 2021.

To add stability to corporate bond markets, the US Federal Reserve extended its asset purchase programme on June 15 to enable purchases of corporate bonds and bond ETFs through its secondary market corporate credit facility (SMCCF). This, as we have noted, is part of a wider programme of emergency facilities introduced by the US central bank in response to the pandemic.

Under this programme, the Fed has included purchases of ‘fallen angels’ that were previously investment grade but have subsequently been downgraded by the ratings agencies.

In applying this facility, the Fed applies an ‘indexing approach’ to guide its corporate bond purchases, aiming to create a portfolio of corporate bonds on its balance sheet that mirrors a diversified market index of US corporate bonds which meet the SMCCF’s requirements (in terms of rating, maturity and other factors).

With this backstop in place, the survey predicts that investors will be drawn to corporate bond markets in seeking yield opportunities as the crisis unwinds. While companies may face constraints in paying attractive dividends and staging share buy-backs – a significant driver of shareholder value in developed equities markets in recent years – they will typically continue to service their debt.

That is, of course, unless we see a spike in corporate defaults – and bond investors must keep a watchful eye on credit risk as governments wind down their emergency support measures.

Beyond the above, respondents identify opportunities in emerging market debt (30%) and distressed debt (23%). Monetary easing in a number of emerging markets has provided a stimulus to emerging market debt. EM central banks delivered, on average, around 150 bps in total interest rate cuts between the start of March and the start of August 2020, according to Hemant Baijal, head of the global debt team at Invesco. While we are now at the lower boundary of possible rate cuts in some countries, others (including India, Indonesia and Mexico) offer potential for further monetary relaxation.

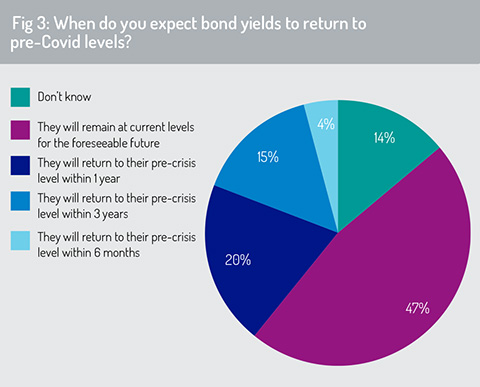

Building on these points, the survey finds that respondents do not expect bond yields to return to pre-crisis levels “for some time in the future” (fig 3). Close to half of respondents say that yields will not return to pre-crisis levels within three years. By comparison, just 4% say bond yields will revert to pre-crisis levels within six months and 20% say that bond yields will do so within one year.

We should remember, however, that government bond yields even prior to the pandemic had been pushed to low levels in historical terms. During 2019, ten-year US Treasury yields witnessed their largest decline in more than eight years, driven particularly by investors moving to ‘risk off’ amid concerns about deteriorating economic data and ongoing US-China trade tensions. Yield curve inversion during the middle part of 2019, with ten-year US treasury yields dropping below two-year yields, highlighted investor concerns about possible recession. In the eurozone, German ten-year bund yields remained in negative territory throughout much of H2 2018 and this has persisted into 2019 and 2020.

We should remember, however, that government bond yields even prior to the pandemic had been pushed to low levels in historical terms. During 2019, ten-year US Treasury yields witnessed their largest decline in more than eight years, driven particularly by investors moving to ‘risk off’ amid concerns about deteriorating economic data and ongoing US-China trade tensions. Yield curve inversion during the middle part of 2019, with ten-year US treasury yields dropping below two-year yields, highlighted investor concerns about possible recession. In the eurozone, German ten-year bund yields remained in negative territory throughout much of H2 2018 and this has persisted into 2019 and 2020.

Reflecting on the outlook for fixed income assets, Punter Southall Wealth CIO Thomas Becket says: “Traditional areas of fixed income are probably going to return very little in the short to medium term. Investors will need to be very selective with government bonds and corporate debt now offering very little yield. There is likely to be more interest in asset-backed securities, high-yield credit and maybe the financial sector could also come increasingly into favour.”

According to Calastone’s managing director and head of global markets, Edward Glyn, Calastone witnessed record outflows [in H1 2020] from fixed income funds across its global transaction network owing to concerns over credit quality in sovereign and corporate debt markets. “In Q3 2020, we started to see flows to bond funds trickle in as the markets were calmed by central bank stimuli,” he says. “However, this hasn’t got close to making up for the crushing blow these funds faced earlier in the year.”

Multi-asset strategies

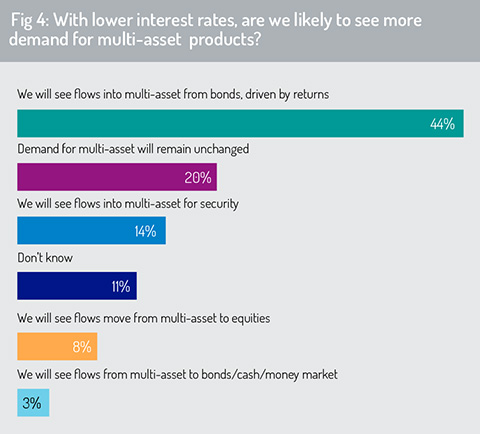

As noted in fig 1, the survey predicts that fund flows are likely to increase into multi-asset strategies in pursuit of return opportunities in this low interest rate environment (fig 1, fig 4). Some 44% of respondents said that multi-asset strategies will experience positive net flows, particularly from investors seeking to reallocate a share of their government bond holdings in search of stronger returns.

There have been exacting questions asked of multi-asset strategies over the past two to three years, with persistent net outflows providing a warning of declining investor enthusiasm for the product. However, data from the CAMRADATA universe of multi-asset funds indicates that many such funds are broadly delivering to their mandate.

There have been exacting questions asked of multi-asset strategies over the past two to three years, with persistent net outflows providing a warning of declining investor enthusiasm for the product. However, data from the CAMRADATA universe of multi-asset funds indicates that many such funds are broadly delivering to their mandate.

Taking the CAMRADATA Diversified Growth Fund (DGF) universe as an example, many funds in this universe hit their target returns over a 12- and 36-month time frame to December 31, 2019. DGF funds with an objective of cash plus 3% to 5% generated median return of 12.06% over the year and annualised median return of 5.06% over the past three years.

Funds targeting cash plus less than 3% delivered median return of 10.86% over the past year and 5.31% annualised return over the past three years.

However, as noted, this has failed to contain the outflow of funds from DGF products. The CAMRADATA DGF universe experienced net redemptions of £10.16 billion during Q4 2019, the largest in any single quarter since 2017 and the ninth successive quarter in which it has witnessed net outflows. With this contraction, total assets under management (AuM) in the DGF universe fell to £150 billion, approximately £34.4 billion below its high point at the end of 2017.

© 2020 funds europe