Funds Europe sweeps through the third-party fund administration world, with asset figures and opinion pieces from industry writers.

Even if its purchase of BBH had been successful, it looks like State Street would not be ahead of its main asset servicing rival BNY Mellon.

State Street’s total assets under custody and administration (AuC/A) at December 31, 2022, was $36.7 trillion, compared with BNY Mellon’s $44.3 trillion (see Table 3).

When State Street announced its intended acquisition of BBH in September 2021, the firm’s reported AuC/A was $42.6 trillion. The Boston-based custodian and asset manager intended to increase that to $48.2 trillion, thanks to BBH’s $5.6 trillion of client assets.

According to figures in our survey, State Street today lags BNY Mellon by more than the $5.6 trillion uptick that BBH would have provided at the time.

According to figures in our survey, State Street today lags BNY Mellon by more than the $5.6 trillion uptick that BBH would have provided at the time.

It is, of course, academic now that the deal has fallen through – but in order to become the world’s number-one asset servicer by AuC/A, State Street would clearly have needed the BBH portion of assets to have performed well enough to get the increase it needed.

The failed acquisition, which ended after State Street faced regulatory hurdles, has not been the only notable asset servicing deal of recent times. On October 17, 2022, Caceis said it would buy the European asset servicing arm of Royal Bank of Canada (RBC), and a memorandum of understanding was signed.

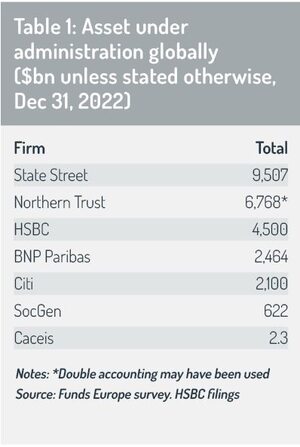

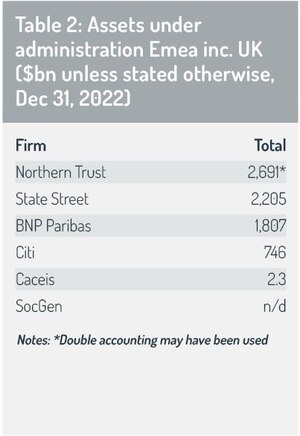

The French bank has Parisian rivals, namely BNP Paribas and Societe Generale. Its business is heavily European, and Caceis still continues to report, for now at least, its global and Emea AuC/A figures as the same: $4.4 trillion.

The French bank has Parisian rivals, namely BNP Paribas and Societe Generale. Its business is heavily European, and Caceis still continues to report, for now at least, its global and Emea AuC/A figures as the same: $4.4 trillion.

But Joe Saliba, the deputy CEO at Caceis, said in January that the deal would see the firm become a leading group in Europe with a “global reach”.

A thousand staff from RBC Investor Services’ operational centre in Malaysia will transfer to Caceis. Saliba added that as well as becoming Europe’s number-one fund administration player, with some €3.5 trillion in AuA, Caceis will rank in terms of custody “among the top-three providers, looking after around €4.8 trillion in assets”.

A thousand staff from RBC Investor Services’ operational centre in Malaysia will transfer to Caceis. Saliba added that as well as becoming Europe’s number-one fund administration player, with some €3.5 trillion in AuA, Caceis will rank in terms of custody “among the top-three providers, looking after around €4.8 trillion in assets”.

Mixed year

Deals – successful and unsuccessful – have made for an exciting year in asset servicing. But it’s also been a mixed year, with market sentiment and interest rates at play.

According to HSBC, which runs HSBC Securities Services, the bank’s asset servicing arm, banks globally have seen strong net interest income as central banks increased rates.

However, at December 2022, HSBC held $9.1 trillion of AuC, a reduction of 15% compared with December 31, 2021.

However, at December 2022, HSBC held $9.1 trillion of AuC, a reduction of 15% compared with December 31, 2021.

The impact of currency translation differences in Europe and Asia, and adverse market movements, were mainly blamed. AuA of $4.5 trillion was 9% lower than the year before. The same reasons were given, but the firm did see inflows from new customers in Europe.

BNY Mellon’s $44.3 trillion had seen a 5% decrease, reflecting lower market values and a stronger US dollar. But net new business was also won.

© 2023 funds europe