In an inflationary, volatile environment, institutions have shown a notable interest in infrastructure assets, finds CAMRADATA.

Infrastructure is a form of ‘real asset’, meaning the physical assets we see in everyday life, like bridges and roads. Institutional investors can be attracted to infrastructure due to its non-cyclical performance and because some investments offer stable and predictable free cash flows. Plus, infrastructure is well known for its potential to hedge against inflation.

It is therefore not surprising to learn there has been an interesting amount of search activity in CAMRADATA Live across infrastructure strategies by institutional investors in the last 12 months. These searches have been in global infrastructure equity/debt; the equity segments of European, North American and global developed markets; and in debt segments for emerging markets and for the European including UK infrastructure categories.

However, the most searched asset class by investors among these categories is global infrastructure equity.

Infrastructure investments are used within portfolios often because they have low correlation with other assets and can offer long-term consistent returns, despite how economic conditions may vary.

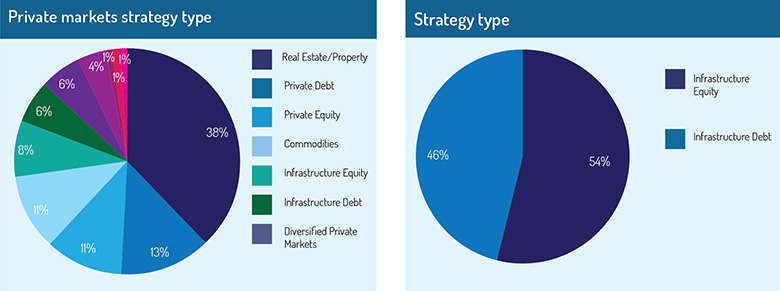

Infrastructure makes up 13.4% of private market funds on CAMRADATA Live. Within the infrastructure category, there are four main currencies. EUR has the largest proportion and makes up (43%); this is followed by USD (34%), GBP (17%) and CAD (6%).

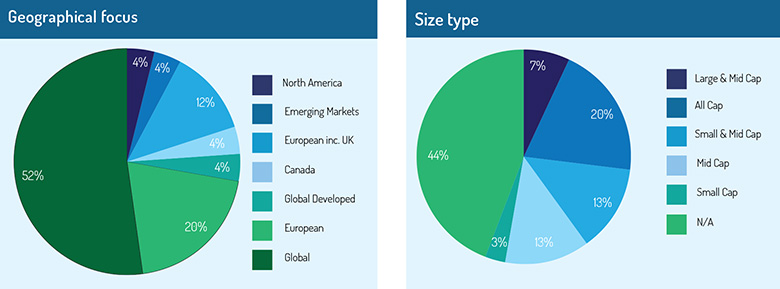

The geographical approach of infrastructure funds is predominantly global (52%). After this, it is European (20%), European inc. UK (12%), and North America, emerging markets, Canada and global developed making up 4% each.

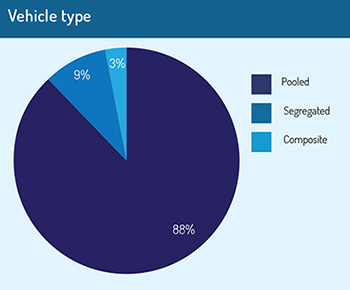

Infrastructure strategies on CAMRADATA Live are split between equity (54%) and debt (46%) and the vehicles are broken down into three types: pooled (88%), segregated (9%) and composite (3%).

Infrastructure strategies on CAMRADATA Live are split between equity (54%) and debt (46%) and the vehicles are broken down into three types: pooled (88%), segregated (9%) and composite (3%).

CAMRADATA Live provides institutional investors with vital information on how asset managers are managing these types of strategies. It is important to fully understand how infrastructure strategies are managed and what knowledge and expertise each asset manager has when deciding whether to invest in this asset class and with whom. For instance, infrastructure debt is an asset class that has the potential to provide stable returns and cash flows over a long-term horizon, with a low relative level of default that is due to the fundamental essentiality of real assets. However, care needs to be taken in selecting the right investment as not all transactions labelled as “infrastructure” exhibit the same stability of future cash flows.

Infrastructure assets provide essential services that support economic growth. As well as providing diversification, infrastructure also has characteristics that can benefit institutional by reducing portfolio volatility.

The combination of these qualities are likely to lead to more interest in infrastructure assets for the foreseeable future. To learn more about infrastructure strategies and the asset managers who manage them, log in to CAMRADATA Live or request your free access at www.camradata.com.

*All figures are as of March 31, 2022 unless otherwise stated.

© 2022 funds europe