A concentration on low volatility in the absolute return sector leads to low diversification and mediocre returns. This is at odds with the funds’ own investment case, says Barry Norris of Argonaut Capital.

The argument for investing in absolute return should be relatively simple: a consistent delivery of attractive returns, combined with a risk profile offering diversification from traditional long-only funds.

However, much of the investor attention surrounding absolute return strategies overly focuses on those funds displaying low volatility characteristics, which we argue by itself has no portfolio diversification benefits. We are concerned the emphasis on low volatility in isolation often leads too many funds to deliver only mediocre ‘cash-plus’ returns – without the actual safety of cash.

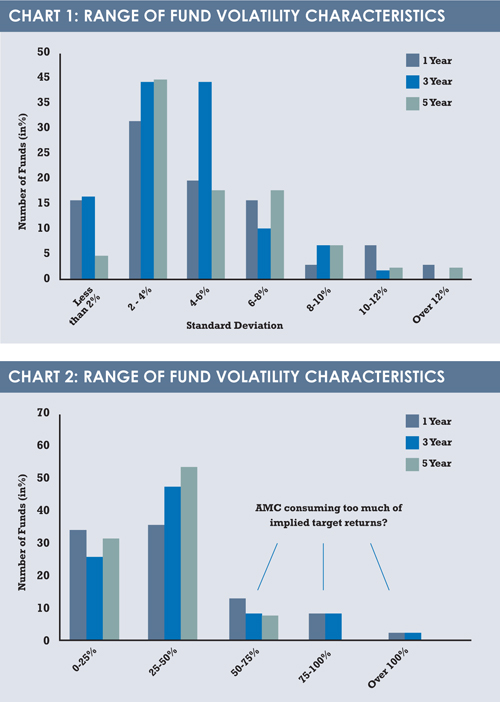

With approximately half of the sector displaying a standard deviation of less than 4%, are these cash-plus returns worth the extra bother?

Cash is the ultimate low-volatility investment. Unlike low-volatility funds, cash never delivers a negative absolute return – except in the unlikely event of the bank becoming insolvent. Therefore the risk/return analysis of cash as an asset class is always consistently strong, due simply to the absence of risk.

By far the biggest limitation of cash-plus low-volatility funds is the absence of clear diversification benefits. An investor may believe they are achieving diversification by selecting a range of low-volatility funds, only to find all of the strategies selected are highly correlated to the stock market and/or each other. The investor could likely replicate the same return profile by splitting assets between cash and the market index, which would probably be cheaper to replicate after fees.

Chart 1 shows the range of fund volatility characteristics (standard deviation) in the Targeted Absolute Return sector.

LOW-VOLATILITY FUNDS: WORTH PAYING FOR?

While cash does not charge an annual management fee, or performance fee, this is not the case with the universe of low-volatility funds. In fact, it is questionable whether it is appropriate for many low-volatility funds to even apply the commonplace annual management charge (AMC).

For example, if a fund has a standard deviation of 2%, is it really appropriate for it to apply 75bp AMC? Even in a year where the fund manager has demonstrated skill in converting risk into return, with the delivery of an admirable Sharpe ratio of one, the AMC would likely consume nearly 40% of the targeted return.

Chart 2 shows AMC versus volatility in the IA Targeted Absolute Return sector, with AMC as a percentage of standard devation. Our analysis reveals approximately a quarter of funds have an AMC of at least half of the standard deviation. Even in a good year, this suggests fees will eat away at least half of the implied return.

Chart 2 shows AMC versus volatility in the IA Targeted Absolute Return sector, with AMC as a percentage of standard devation. Our analysis reveals approximately a quarter of funds have an AMC of at least half of the standard deviation. Even in a good year, this suggests fees will eat away at least half of the implied return.

LOW CORRELATION AND DELIVERING RETURNS

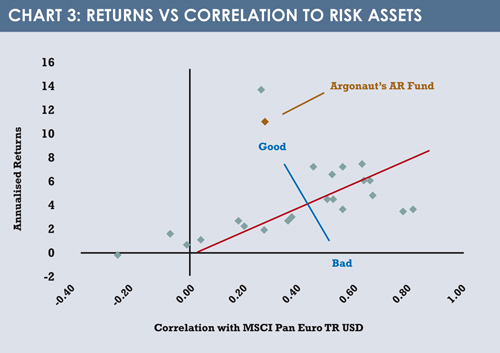

The most attractive risk characteristic of an absolute return fund in our view is not low volatility, but achieving low correlation to risk assets and delivering returns in all market environments. After all, the least difficult skill in investing is providing a positive return at the same time as the market and everyone else.

It is clearly more difficult to deliver positive returns at different times to the market and peers, while still displaying an attractive return profile overall – given the tendency of stock markets to deliver positive returns over market cycles. This requires investment in a non-correlated asset – which for us at Argonaut is a short book of equities – and demonstrating skill in generating alpha on both the short and long side of the book. It also requires a net exposure to never get too aggressive.

Our analysis of the IA Targeted Absolute Return sector – see chart 3, which shows annualised fund return versus correlation with MSCI Pan Euro since 2009 – found only three funds had a negative correlation to the European stock market. However, the overall return record of these funds is poor. By contrast, over half of the funds in the sector had a correlation of more than 0.5 with the European stock market – which suggests limited diversification benefits. The sweet spot is in the combination of an attractive return profile and a low correlation to the European stock market.

The IA Targeted Absolute Return sector is filled with a variety of different fund types: such as multi-asset strategies, or long/short bond or equity vehicles. While this clearly results in different risk and return profiles, the framework for analysing the attractiveness of these strategies is the same. Investors must take a closer look at this heterogeneously to identify those funds that can truly offer diversification, as well as still provide value for money.

Barry Norris is founder and chief investment officer at Argonaut Capital and manager of the Argonaut Absolute Return Fund

©2015 funds europe