Diversified growth funds and hedging strategies will have protected UK pension schemes in the recent period of volatility and low returns, says Danny Vassiliades of Punter Southall.

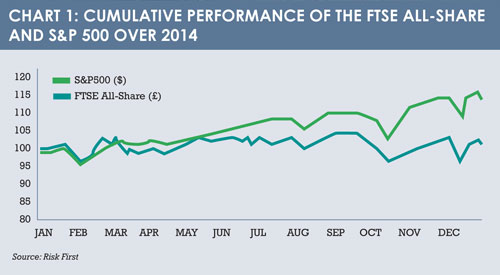

For the first time since 2011, the return on the FTSE All-Share last year was less than 10%. Indeed, 2014 yielded a meagre 1.2% for investors in the index. If we compare this to our neighbours across the Atlantic, those investors who are solely concentrated on the UK equity markets will have felt like they missed some of the equity bull-run ‘after party’ as the S&P 500 pumped out a return in excess of 13% over the same period.

Some of this poor performance can be explained by the drop in crude oil prices at the end of the year, which should, nevertheless, help the rest of the UK economy.

Given the volatility experiences in the latter stages of 2014 and the concerns over deflation and near-recession in the Eurozone, the ‘flight to safety’ by many investors has resulted in a compression of risk-free yields in the UK.

Furthermore, despite the current position of the interest rate curve, it would be naïve to believe that rates cannot reduce further.

Difficult as it is to predict how yields will progress over the next year, and thanks to the shock many experienced at the end of 2014, many pension funds are likely to be reviewing their matching strategy and considering how much unrewarded economic risk they are willing to take.

As we can see from Chart 1, the second half of 2014 was characterised by two periods of sharp drawdown and increased volatility.

Moving into 2015, we are likely to see a divergence in monetary policy and specific event risk, such as the UK elections in May, driving market characteristics. This will result in equity ‘beta’ looking very different across the developed market opportunity set. Investors will need to either think more about spreading their bets to ensure they don’t get caught out by specific problems in any one market or look to delegate a part of their portfolio to an asset manager who can be agile around the growth opportunity set in an attempt to generate the investors’ required return characteristics.

Moving into 2015, we are likely to see a divergence in monetary policy and specific event risk, such as the UK elections in May, driving market characteristics. This will result in equity ‘beta’ looking very different across the developed market opportunity set. Investors will need to either think more about spreading their bets to ensure they don’t get caught out by specific problems in any one market or look to delegate a part of their portfolio to an asset manager who can be agile around the growth opportunity set in an attempt to generate the investors’ required return characteristics.

FLIGHT TO SAFETY

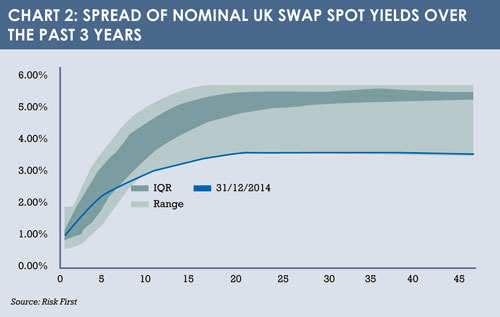

Given the volatility in the latter stages of 2014 and the concerns for 2015, in particular deflation and near-recession in the Eurozone, we saw a ‘flight to safety’ resulting in a compression of risk-free yields in the UK

Chart 2 shows the range of positions of the UK swap spot curve over the past three years in dark green, with the position of the curve as at December 31, 2014 shown with a dark blue line. The combination of the yield curve being at historic lows and muted domestic equity returns will have made for uncomfortable reading for many UK pension schemes.

Those schemes with an appropriate hedging strategy and a diversified growth portfolio will have fared better than most.

Despite the current position of the interest rate curve, it would be naïve to think that yields have gone as low as they are going to. There is much uncertainty in predicting how these yields are going to progress over 2015 but, given the aforementioned shock that will have been experienced by some pension funds at the end of 2014, matching strategies are likely to be reviewed and funds will consider the level of unrewarded economic risk they are willing to take.

Despite the current position of the interest rate curve, it would be naïve to think that yields have gone as low as they are going to. There is much uncertainty in predicting how these yields are going to progress over 2015 but, given the aforementioned shock that will have been experienced by some pension funds at the end of 2014, matching strategies are likely to be reviewed and funds will consider the level of unrewarded economic risk they are willing to take.

MARKET UNCERTAINTY

As 2015 continues, we are likely to see a divergence in monetary policy and specific event risk driving market characteristics. Elections create uncertainty, and markets hate uncertainty; until the UK decides its next government, gilt yields may hold, but there is a chance they could fall even further. Because equity beta is going to look remarkably different across the developed market opportunity set, investors need to consider spreading their bets to hedge risk. The other option, as mentioned, is to delegate a part of their portfolio to an asset manager with the ability and resources to react nimbly to markets and still deliver the types of returns that investors have stipulated.

DIVERSIFIED GROWTH FUNDS

Another result of the returning volatility within equity and commodity markets is the rising popularity of diversified growth funds. The combination of the spread of nominal UK swap spot yields being at historic lows and muted domestic equity returns will have made uncomfortable reading for many UK pension schemes, but – as mentioned – those appropriately hedged and with diversified growth portfolios will have done better than others.

Medium and higher-risk diversified growth funds are usually used as replacements for equity with the added benefit of diversification and lower volatility. Lower-risk funds are an interesting alternative to corporate bond funds. Within return-seeking portfolios, trustees need to ensure that they remain well diversified; over-exposure to any one market runs the risk of poor returns, particularly in these times of economic uncertainty.

Danny Vassiliades is head of investment consulting at Punter Southall

©2015 funds europe