There have been good reasons for investors to invest in high yield in recent years, but upset in the equity markets shows that these bonds have fairly high correlations with equities. Ankul Daga, investment strategist at Vanguard Europe, explains.

If you were watching equity markets quietly crumble over recent months, it probably occurred to you that the right response to troublesome times is a good long-term strategy.

Sometimes it is possible to time the market, but it is nightmarishly difficult. As Britain’s Queen put it, speaking to economists about the global financial crisis (GFC): “Why did no one see it coming?”

In recent years, many investors have been tempted to reduce their allocation to government and investment grade bonds. There were two reasons for this. One was the higher yields offered by lower-rated bonds. The other was the risk of holding duration at a time when interest rates appear set to rise.

Let’s look in a bit more detail at each of those propositions.

At a generic level, global high-yield bonds yield around 8%. Hard currency-denominated emerging market bonds offer around 5.5%, slightly more than UK equity income. By contrast, global investment grade yields are around 2.9% and global treasuries below 1.5%, though this latter figure is suppressed by the exceptionally low yields of Japan and Germany.

There have been good arguments behind the move to high yield. Although economic growth has been low, it has been positive. Quantitative easing has kept inflation mild but alive, while capital spending has been minimal.

These are not exciting conditions, but they have kept companies in good financial shape and helped to sustain financial markets. This in turn has been good for high-yield bonds, whose liabilities are fixed, as can be seen by current low default rates. As bank lending has contracted in the wake of the GFC and interest rates have fallen, better-quality borrowers have come to the market, as have less speculative, longer-term investors.

Relatively high correlations

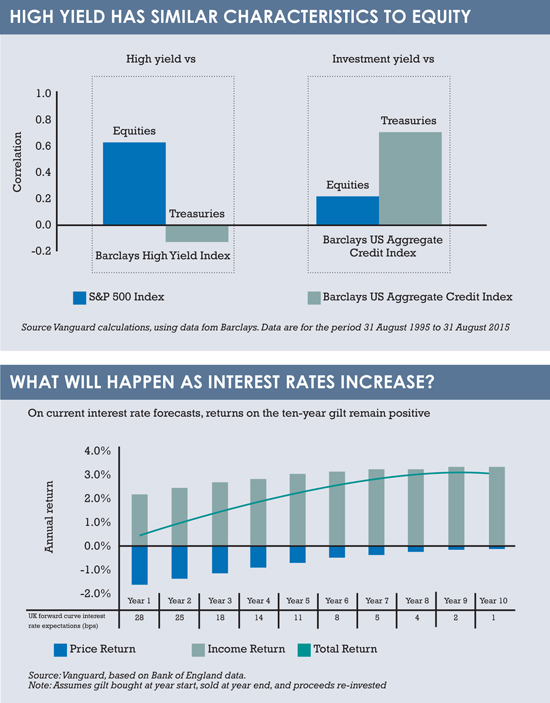

What the upset in equity markets has shown, though, is that there is good reason that high-yield bonds are not rated investment grade. If we look at risk and return correlations between high-yield and equities, we see that over the longer term they are relatively high, 0.6 in the 20 years to the end of August 2015. By contrast, the correlation between high-yield bonds and government bonds is not only low but negative, -0.1 over the same period.

What this is telling us, in plain terms, is that high-yield bonds behave much more like equities than like bonds. They tend to improve in value when the economy is growing and company creditworthiness is improving, as we have seen in the years since the GFC. Equally, they tend to buckle during periods of stress, as we have seen more recently.

The point is that high-yield bonds are not a magic formula. They do not generally offer both higher returns and resilience in a crisis. In terms of strategic asset allocation, choosing one is to forgo the other.

The same but opposite point can be made in respect of an allocation to government bonds. Many investors have wound down their holdings in this area, frustrated by low yields and uneasy about rising interest rates.

The same but opposite point can be made in respect of an allocation to government bonds. Many investors have wound down their holdings in this area, frustrated by low yields and uneasy about rising interest rates.

Again, let’s look at the evidence. Yields are certainly low relative to history, but going on market expectations for the next ten years, we can see that future yields are forecast to rise only slightly from present levels. In other words, we should not overly focus on the direction of rates but also consider the pace of likely increase.

As at the end of June, the forward curve showed the yield on the ten-year gilt rising 0.28% over 12 months and a further 0.23% in the following 12 months. Increases then taper off, as the table at the bottom of the page shows. This means a capital loss in each year, starting at 1.7% and tapering down in line with the slowing rate of increase in yields.

But gilts will still pay a coupon and this is likely to be greater than the capital loss in any one 12-month period. Our total return is therefore positive over the entire 10-year period. Interestingly, as yields rise and the rate of increase slows, so our total return will also increase.

Gilts may not pay much, but they do pay something. They also offer effective insurance when equity and high yield markets show signs of stress.

I would respectfully suggest that the correct answer to the Queen is that we may not see things coming, but we are ready when they do.