How can an investor in an alternative strategy know the valuation they are given is correct? Daniel Johnson, of Wells Fargo Global Fund Services, and Eric Lazear, of FQS Capital Partners, offer advice on due diligence.

Traditionally, for most investors, the main concern when investing in a hedge or private equity fund was whether the manager could generate a sufficient level of return for an acceptable level of investment risk.

But operational matters have increased in importance and operational due diligence has now evolved to the point that many investors will reconsider an investment on operational grounds alone, regardless of the return profile.

Operational risk can take many forms, but valuation is a good place for investors’ initial focus: are the holdings of the fund accurately valued, and is there a process in place to ensure that they are accurately valued at each dealing period?

Valuation risk is particularly critical for more complex strategies, such as structured credit, where the risk of pricing irregularities is significantly higher. However, it is also important to review and understand pricing policies and procedures for strategies that trade listed securities. For example, it is useful to know whether the manager marks their equity longs at the bid, mid or close and, if it is the mid, if the manager determines the impact on the portfolio if priced at the bid.It is also important to understand if adjustments are made for large positions, less liquid holdings, or for securities that trade less frequently.

How the holdings of a fund are valued is important for many reasons: it drives the net asset value (NAV); it sets the price for subscriptions and redemptions; and it determines the level of performance fees.

While this point may be obvious for most investors, many investors are often unsure of what detailed valuation related questions to ask the manager and, equally as important, the administrator who is responsible for producing the NAV.

VALUATION RISK

Unlike reviews of performance, it is essential that any review of valuation risk include all parties involved in valuing the assets of the fund. This will often include speaking to the administrator about their role in the process and what the involvement of the investment manager has in determining the final prices.

The good news is that if operational due diligence is performed correctly and thoroughly, it is possible to identify how much valuation risk funds potentially have. This enables investors to make an informed decision on whether that level of risk is acceptable to them.

The good news is that if operational due diligence is performed correctly and thoroughly, it is possible to identify how much valuation risk funds potentially have. This enables investors to make an informed decision on whether that level of risk is acceptable to them.

However, when reviewing the valuation process it is often too easy to adopt a checkbox approach. It is essential for investors to understand that the questions one should ask must change depending on the strategy of the fund and the assets it trades.

The questions asked of a distressed debt manager are different from those that should be directed to a long/short equity manager who only trades listed securities.

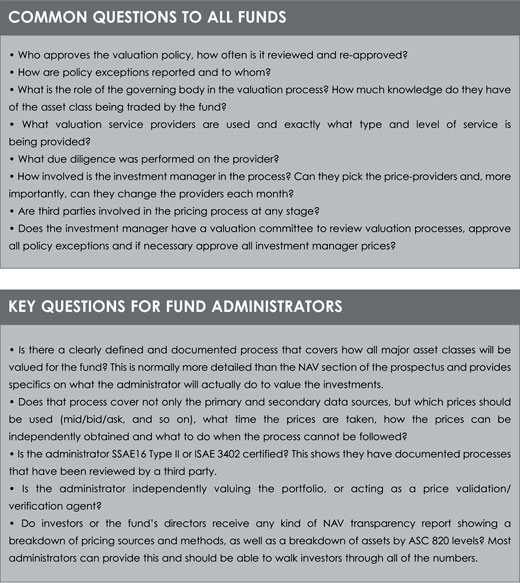

But there are also some common questions that should be asked of all funds and questions for fund administrators covering key areas (see boxes).

These questions are just some examples to help investors more fully understand the valuation process for funds they are considering investing in.

Daniel Johnson is vice president, valuation services at Wells Fargo Global Fund Services and Eric Lazear is head of operational due diligence at FQS Capital Partners (US)

©2013 funds europe