Cost pressures from regulation is one of the most difficult challenges for asset management firms. Supporting the increasing demands of regulation comes at a time of unprecedented pressure to reduce fees. It’s a difficult balance to get right – and it’s no wonder outsourcing of some regulatory and compliance functions is a growth business.

In the UK, the FCA’s Value for Money review found that price competition was “weak in a number of areas” of the industry.

Despite a large number of firms operating in the market, there had been high profits over a number of years, suggesting a lack of competition.

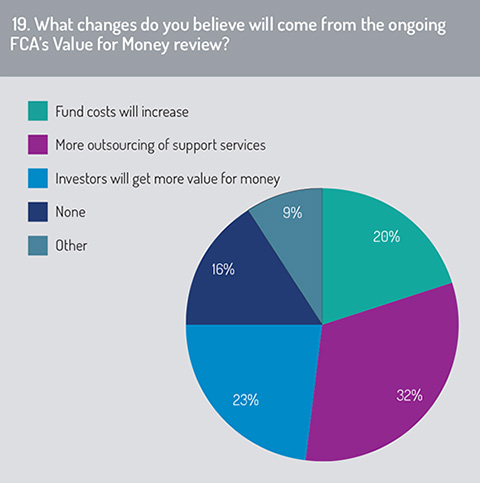

Our survey respondents (fig 19) expect the market review by the FCA will lead to higher fund costs and more outsourcing. However, underlying investors could see more value, too.

ESG and transparency

Transparency in the asset management industry could be better. This is highlighted by views in the Funds Europe/CACEIS survey where 21% of respondents felt the industry was not transparent enough, though 58% felt the industry was “getting better” (fig 17).

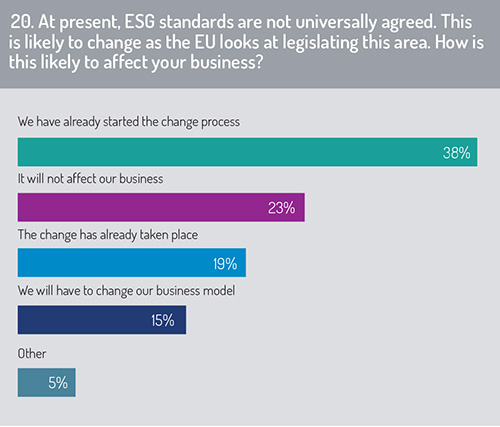

One area where investors wish to see more transparency is within ESG, another topic broached by our survey (fig 20).

In separate research (by fund manager Franklin Templeton), many institutional investors said they were seeking improved ESG transparency and data standardisation. This was seen as important for more meaningful adoption.

In separate research (by fund manager Franklin Templeton), many institutional investors said they were seeking improved ESG transparency and data standardisation. This was seen as important for more meaningful adoption.

The research found a lack of acceptable policy frameworks as the main challenge to introducing ESG and a lack of quality data to support decisions.

Janine Guillot, chief executive of The Sustainability Accounting Standards Board (SASB), said: “A collective effort across all market participants – asset owners, asset managers, data providers, standards-setters and policymakers – is needed to ensure investors have the tools and capabilities necessary to achieve their financial goals.”

We asked our respondents if they saw any improvement in ESG standardisation as the EU moves towards legislating in this area. Most said they had already started to change. Some said the change had already taken place.

But ESG standardisation is likely to attract more debate. The EU’s recent taxonomy is expected to help.

Until the taxonomy – which will cover bonds as well as shares – starts coming into force over the next couple of years, the only independent check on firms’ claims on how sustainable their funds really are will continue to come from ratings agencies, which have over the past decade cashed in on growing demand for ESG scores.

But, while around $3 trillion (€2.7 trillion) of institutional assets globally now track ESG scores, ratings agencies’ role in certifying the green credentials of firms has been criticised for a lack of correlation between the methodologies used to create the ESG scores.

Once the taxonomy becomes mandatory, the principal role of checking the green claims of fund houses is likely to move from ratings agencies to national regulators and will gain more teeth in the process. Retail financial products that reach the highest green standards – likely to include investments in clean energy and renewable technologies, for example – will be awarded an eco-label.

Ama Seery, sustainability specialist at Janus Henderson, which manages $374.8 billion in assets, says that the taxonomy is a “welcome first step”, but should have gone further to include not just environmental factors but also social and governance issues.

© 2020 funds europe