The legal and accountancy professions are historically male-dominated, although there are many women working in these professional sectors today and increasingly gaining seniority. We may extrapolate that fund boards and fund management firms generally will see more women board members with these professional backgrounds in future.

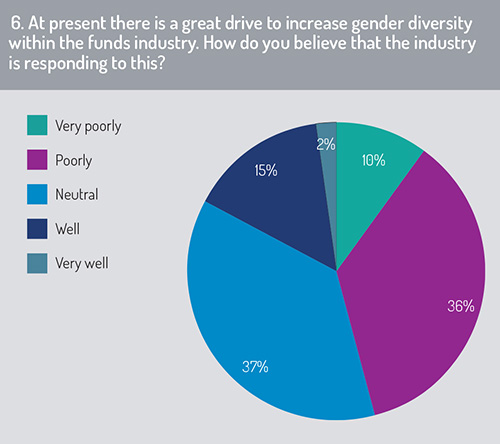

With this in mind, how did our respondents feel about the asset management industry’s handling of diversity (fig 6)? ESG investing could see asset management firms pushing for gender diversity at corporations in which they invest. What happens when asset management holds a mirror up to itself?

Neutral to poor is how many participants in our survey see the industry’s response to gender diversity within their organisations. Just 15% think the industry is doing well on this issue.

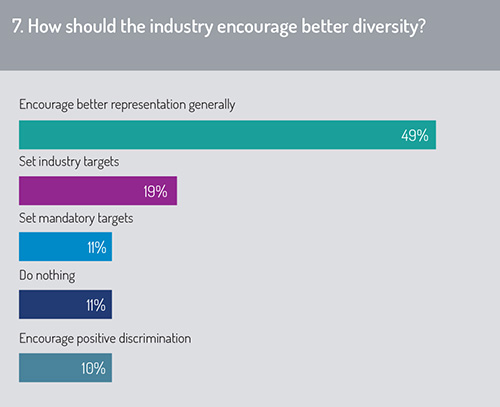

On average, the 177 respondents felt that the industry should do more to encourage diversity generally (fig 7). Only 11% said “Do nothing” when asked about what could be done. The rest would argue some form of encouragement should be given, for example setting mandatory targets. Ten per cent even voted for positive discrimination.

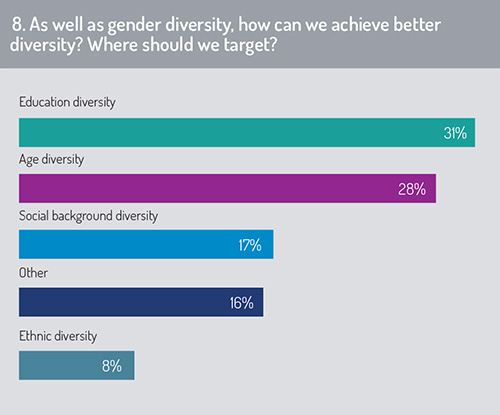

And beyond gender diversity, what other sort of ‘inclusion’ would respondents like to see (fig 8)?

And beyond gender diversity, what other sort of ‘inclusion’ would respondents like to see (fig 8)?

Educational diversity triumphed, with 32% opting for this from the options our survey presented to them. This result chimes with the diversity debate taking place among fund professionals.

Last year, for example, Chris Cummings, who heads the UK’s Investment Association (IA), called for wider recruitment by asset management firms across the class spectrum, and as part of this it was recommended that firms expand the talent pool by broadening their outreach to schools, adult education colleges and to universities outside the range of standard elite institutions.

The IA feels firms should end their bias in recruitment by moving away from only considering degree qualifications and look at other qualifications and life experiences that “paint a fuller picture of applicants’ qualities and capabilities”.

Additionally, a survey last year by CFA UK also showed that socio-economic inclusion, of which education is a part, is at the forefront of investment professionals’ minds. Seven in ten of those surveyed said the industry should employ people from a wider socio-economic background.

Additionally, a survey last year by CFA UK also showed that socio-economic inclusion, of which education is a part, is at the forefront of investment professionals’ minds. Seven in ten of those surveyed said the industry should employ people from a wider socio-economic background.

So, if educational diversity scored highest and social-background diversity came third in the Funds Europe/CACEIS survey with 17% of the score, what came second?

‘Age diversity’ was the second preferred inclusion factor for asset management firms. This got 28% of the vote – just behind education.

Respondents to our question about which diversity topics were most important were allowed to vote for one choice only and a good number of comments to the survey said they would have voted for all the options – and more, such as disability.

The results clearly show fund professionals would like to see higher standards of diversity and a wide breadth of inclusion groups in the asset management industry.

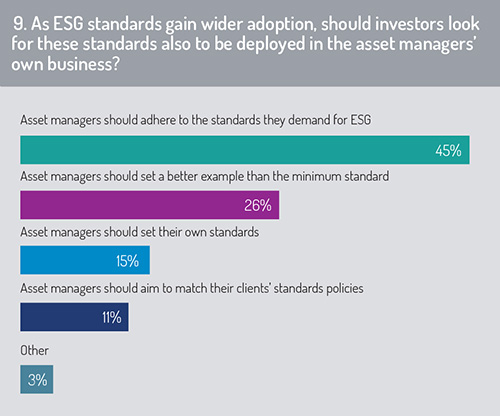

Further, in ESG generally, fund professionals feel the asset management industry should itself raise the bar for the rest of the corporate world.

Further, in ESG generally, fund professionals feel the asset management industry should itself raise the bar for the rest of the corporate world.

We asked: As ESG standards gain wider adoption, should investors look for these standards also to be deployed in the asset managers’ own business (fig 9)?

Forty-five per cent said asset managers should adhere to the ESG standards they set for other companies – but nearly a quarter said firms should do more themselves than meet any other minimum standards.

A total of 26% said managers should set their own standards or at least match their clients’ standard policies.

© 2020 funds europe