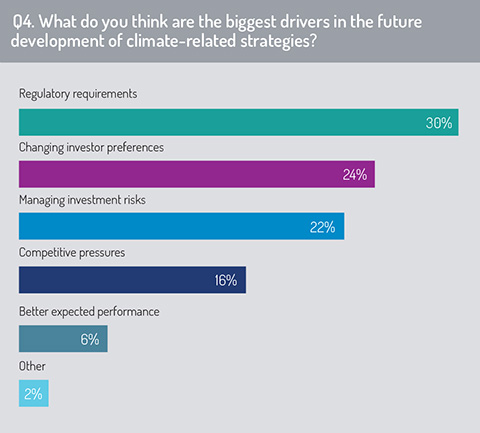

When asked for the main drivers of future development of climate-related strategies (Q4), it is not surprising that ‘regulatory requirements’ was the most cited factor (30%), followed by changing investor preferences (24%). Managing investment risks and better expected performance only accounted for 22% and 6% respectively.

This suggests that too few fund managers are treating climate as a climate-related financial risk, much like an operational or traditional investment risk. This is a cause for concern given the risks that will be faced by companies and bond issuers to the physical and transition risks of climate change.

This suggests that too few fund managers are treating climate as a climate-related financial risk, much like an operational or traditional investment risk. This is a cause for concern given the risks that will be faced by companies and bond issuers to the physical and transition risks of climate change.

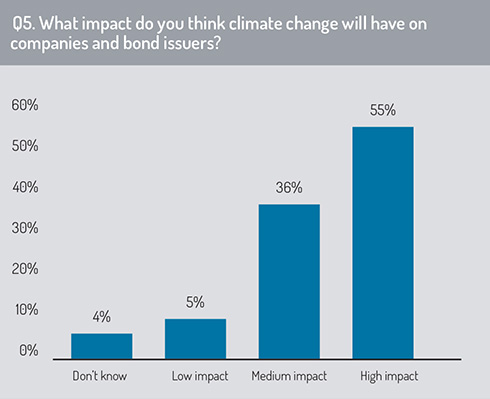

It is also concerning that more than a third (36%) of respondents believe climate change will only have a medium impact on companies and bond issuers (Q5). In fact, climate factors will have a high impact when you take into account both physical and transition risks.

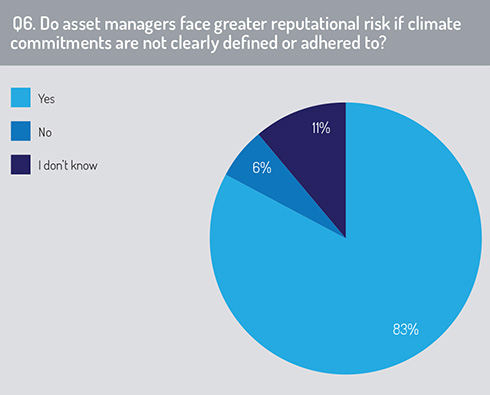

In contrast, there is much greater interest in reputational risk (Q6) where an overwhelming 83% stated that asset managers face greater reputational risk if their climate commitments are not clearly defined or adhered to.

In contrast, there is much greater interest in reputational risk (Q6) where an overwhelming 83% stated that asset managers face greater reputational risk if their climate commitments are not clearly defined or adhered to.

The reputational risk associated with climate change commitments is likely to be seen during this year’s AGM season. The UK’s Investment Association (IA) has warned that climate change, along with diversity, will be a shareholder priority. Consequently, the IA states that asset managers will be looking for companies to take “immediate action” on climate risks.

Andrew Ninian, director of stewardship and corporate governance at the Investment Association, said: “Climate change and the transition to net zero is not an issue which can be left for future management teams or boards. Investors wish to see the actions the current leadership will be taking, and investment managers will be watching closely this AGM season to ensure they are doing just that.”

Andrew Ninian, director of stewardship and corporate governance at the Investment Association, said: “Climate change and the transition to net zero is not an issue which can be left for future management teams or boards. Investors wish to see the actions the current leadership will be taking, and investment managers will be watching closely this AGM season to ensure they are doing just that.”

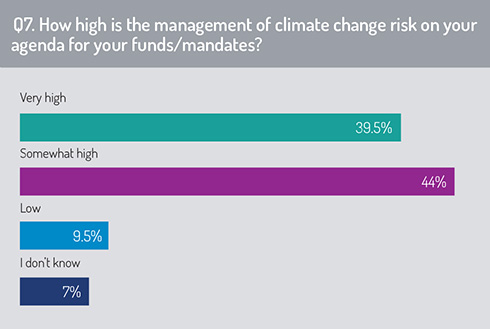

This has been recognised by asset managers, given that the management of climate change risk is high or somewhat high on the agenda for funds and mandates of 83.5% of respondents (Q7).

Yet, despite their importance, only 19% of respondents mentioned that they have the reporting in place to provide full disclosure on climate risks (Q8). More than a third (34%) of respondents stated that they are in the process of putting such a framework in place.

Yet, despite their importance, only 19% of respondents mentioned that they have the reporting in place to provide full disclosure on climate risks (Q8). More than a third (34%) of respondents stated that they are in the process of putting such a framework in place.

Read the full report

2: Creating a climate risk framework

3: Importance of investment risk overlooked

4: Internal governance still developing

5: Education and skills are key

6: Data availability challenge misplaced

10: Recommendations and regulation

© 2022 funds europe