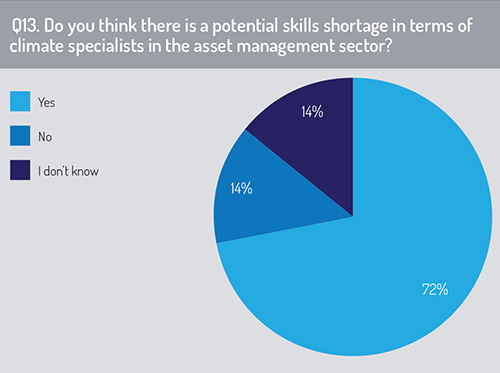

People will also play a critical role, especially those with expertise and/or experience in climate-related work. As Q13 suggests, the industry could be facing a potential skills shortage, as cited by 72% of respondents.

More than a fifth of respondents (21%) have prioritised the development of an educational framework to upskill key employees across all functional areas. Similar numbers cited the hiring of portfolio managers and analysts with specific expertise on climate risk (17%) and building expertise at board and senior management level (16%).

More than a fifth of respondents (21%) have prioritised the development of an educational framework to upskill key employees across all functional areas. Similar numbers cited the hiring of portfolio managers and analysts with specific expertise on climate risk (17%) and building expertise at board and senior management level (16%).

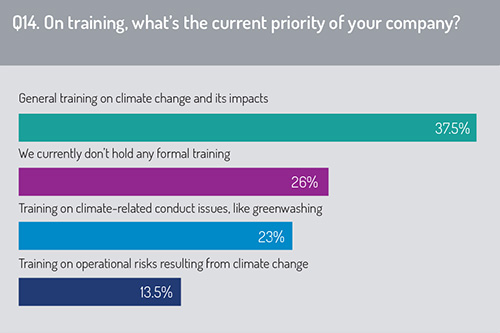

So given that climate specialists will likely come with a premium, it is surprising that firms are not doing more to improve the climate capabilities internally. Our survey (Q14) shows that more than a quarter (26%) do not currently offer any formal training around climate. And while more than a third (37.5%) offer general training on climate change and its impacts, only 13.5% provide training on the operational risks resulting from climate change.

So given that climate specialists will likely come with a premium, it is surprising that firms are not doing more to improve the climate capabilities internally. Our survey (Q14) shows that more than a quarter (26%) do not currently offer any formal training around climate. And while more than a third (37.5%) offer general training on climate change and its impacts, only 13.5% provide training on the operational risks resulting from climate change.

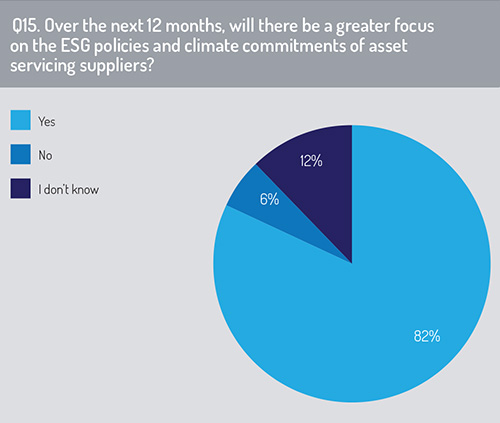

Our survey also suggests that asset managers are looking to apply climate credentials to their service providers (Q15). For example, 82% of respondents said there will be a greater focus on the ESG policies of their asset servicing providers and that they will look to align themselves with counterparties that share their views on climate.

Our survey also suggests that asset managers are looking to apply climate credentials to their service providers (Q15). For example, 82% of respondents said there will be a greater focus on the ESG policies of their asset servicing providers and that they will look to align themselves with counterparties that share their views on climate.

Read the full report

2: Creating a climate risk framework

3: Importance of investment risk overlooked

4: Internal governance still developing

5: Education and skills are key

6: Data availability challenge misplaced

10: Recommendations and regulation

© 2022 funds europe