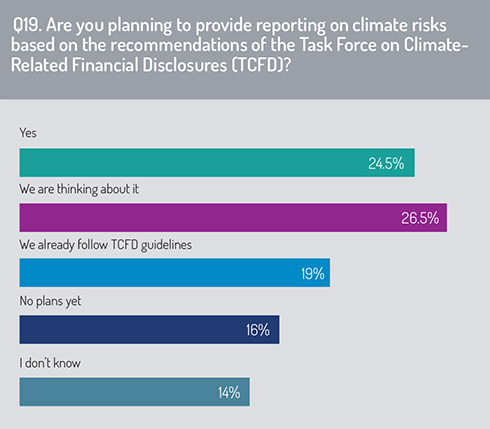

The survey asks if firms are planning to provide reporting based on TCFD recommendations (Q19). Only one in five (19%) are already providing this reporting, while just under a quarter (24.5%) definitely plan to. In total this accounts to less than half (43%), which is a disappointing total, even if 26.5% of respondents are still yet to make up their mind.

The TCFD is a useful framework that will help companies develop a robust and reliable foundation for their climate risk strategy. It is becoming more widely accepted by companies, although it will take time to increase adoption and this adoption rate will be dependent on the regulatory reporting burden, through directives likes the SFDR, and the ability to integrate with other disclosure initiatives.

The TCFD is a useful framework that will help companies develop a robust and reliable foundation for their climate risk strategy. It is becoming more widely accepted by companies, although it will take time to increase adoption and this adoption rate will be dependent on the regulatory reporting burden, through directives likes the SFDR, and the ability to integrate with other disclosure initiatives.

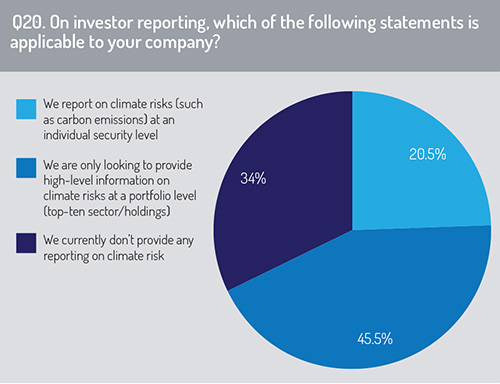

It is also worrying that more than a third (34%) do not provide any investor reporting on climate risk (Q20) while only 20.5% are able to provide this reporting at an individual security level rather than on a portfolio basis.

In the last two years, asset managers have been hit with a raft of sustainability reporting requirements – some of them mandatory, others voluntary. In general, there is wide support for the principle behind reporting, such as the need to give investors some metrics to compare funds, and to limit the perception of greenwashing. There are also growing demands for Article 8 and Article 9 funds to walk the talk, which will require good standards of data.

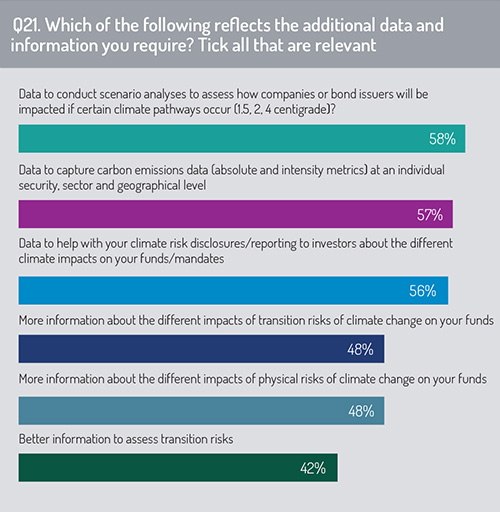

The survey highlights not just the fact that there is a data challenge but also where this challenge is most acute. When asked what data and information firms most require (Q21), the most popular answer was ‘data to analyse the impact of climate change on companies or bond issuers’ in order to conduct scenario analysis (58%).

The survey highlights not just the fact that there is a data challenge but also where this challenge is most acute. When asked what data and information firms most require (Q21), the most popular answer was ‘data to analyse the impact of climate change on companies or bond issuers’ in order to conduct scenario analysis (58%).

A similar number of respondents cited data to capture carbon emissions (57%) and data to help with climate risk disclosure reporting. Other data required by firms relate to the impact of transition risks and physical risks on funds.

What is notable is that even the least popular answer – information to assess transition risks – was still highlighted by 42% of respondents. This reveals the scale of the data challenge facing firms, especially when you refer back to the data-based barriers highlighted in Q18.

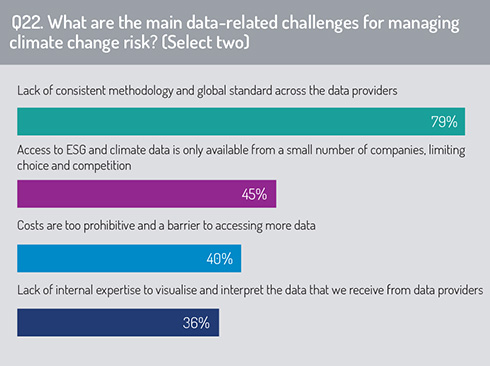

The data challenge has been exacerbated by the absence of global standards or consistent methodology for sustainability data. So it is not surprising that when asked to name their main data-related challenges for managing climate risks (Q22), 79% of respondents cited the lack of consistent methodology and global standards across data providers.

The data challenge has been exacerbated by the absence of global standards or consistent methodology for sustainability data. So it is not surprising that when asked to name their main data-related challenges for managing climate risks (Q22), 79% of respondents cited the lack of consistent methodology and global standards across data providers.

There are other challenges – the limited choice of companies providing ESG and climate data and the prohibitive costs were cited by 45% and 40% respectively, while 36% cited a lack of internal expertise to properly interpret the data, supporting the concerns about a potential skills shortage, highlighted in Q13.

However, there is a broad acceptance among many fund managers that the data challenge is an extremely complex one, given the sheer breadth of factors involved in sustainability plus the fact that so many of these factors are qualitative, not quantitative, in nature.

However, there is a broad acceptance among many fund managers that the data challenge is an extremely complex one, given the sheer breadth of factors involved in sustainability plus the fact that so many of these factors are qualitative, not quantitative, in nature.

So while there is recognition of the need to improve the provision and quality of data around climate change, there is also an acceptance that this will take some time. In the meantime, asset managers should still get involved and take action in getting their hands on what data is available to drive expanded reporting and governance requirements.

Read the full report

2: Creating a climate risk framework

3: Importance of investment risk overlooked

4: Internal governance still developing

5: Education and skills are key

6: Data availability challenge misplaced

7: Reporting issues

10: Recommendations and regulation

© 2022 funds europe