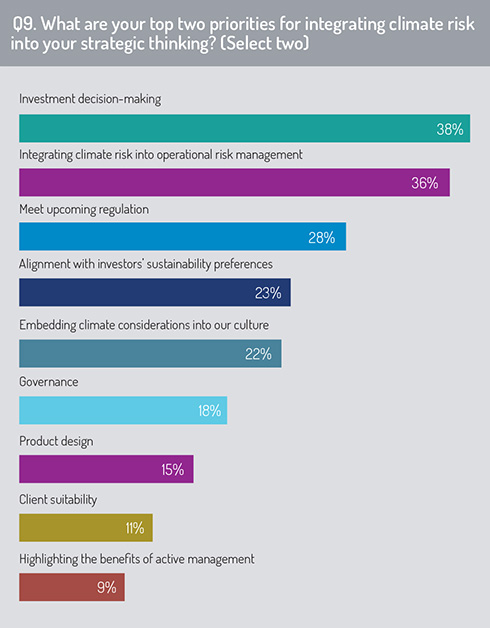

It is also useful to compare the priorities for integrating climate risk into firms’ strategic thinking (Q9) with the drivers for climate change (Q4). The two clearest answers for Q9 are investment decision-making (38%), and integrating operational risk management (36%), which suggests that awareness of risks still has some way to go.

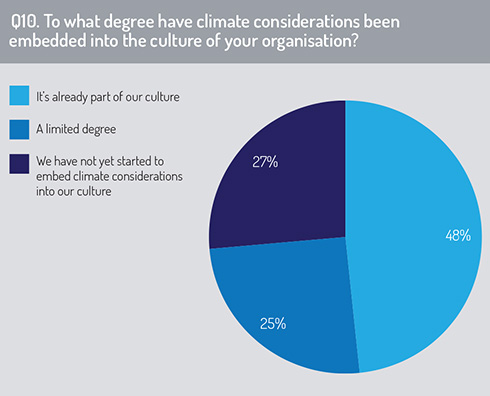

The survey results suggest that governance around climate risks is still developing. For example, when asked to what degree climate considerations have been embedded into the culture of the organisation (Q10), almost half (48%) could say that it is already embedded. Of the remaining 52%, about half (25%) say that they have been implemented to a limited degree while the rest (27%) have not yet started this process.

The survey results suggest that governance around climate risks is still developing. For example, when asked to what degree climate considerations have been embedded into the culture of the organisation (Q10), almost half (48%) could say that it is already embedded. Of the remaining 52%, about half (25%) say that they have been implemented to a limited degree while the rest (27%) have not yet started this process.

The importance of embedding climate considerations throughout the organisation cannot be overstated. Not only will it sharpen product design, it will also enhance risk management and improved internal governance.

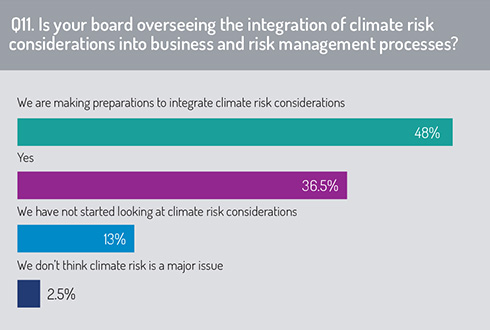

Ultimately, cultural and organisational changes come from the top. Consequently, our survey also asked about the involvement of senior management in ensuring that climate risk considerations are integrated into business and risk management processes (Q11). While just over a third (36.5%) could say that the board is overseeing this process, a much larger number (48%) is still in the preparatory stages for integrating climate risk considerations.

Ultimately, cultural and organisational changes come from the top. Consequently, our survey also asked about the involvement of senior management in ensuring that climate risk considerations are integrated into business and risk management processes (Q11). While just over a third (36.5%) could say that the board is overseeing this process, a much larger number (48%) is still in the preparatory stages for integrating climate risk considerations.

When it comes to the priorities on internal governance for climate risk (Q12), the most important is the integration of ESG data into portfolio selection (50%), followed by establishing management information of climate risk (28%). Once more this underlines the importance of data in firms’ climate risk strategies and operations.

When it comes to the priorities on internal governance for climate risk (Q12), the most important is the integration of ESG data into portfolio selection (50%), followed by establishing management information of climate risk (28%). Once more this underlines the importance of data in firms’ climate risk strategies and operations.

Read the full report

2: Creating a climate risk framework

3: Importance of investment risk overlooked

4: Internal governance still developing

5: Education and skills are key

6: Data availability challenge misplaced

10: Recommendations and regulation

© 2022 funds europe